It’s a party on Wall Street! While the suits fawn over the hot “Trump trade” stocks, we dividend investors are going to dumpster dive.

Hey, we have no shame. We’re talking about yields from 7.8% to 13.4%, paid monthly!

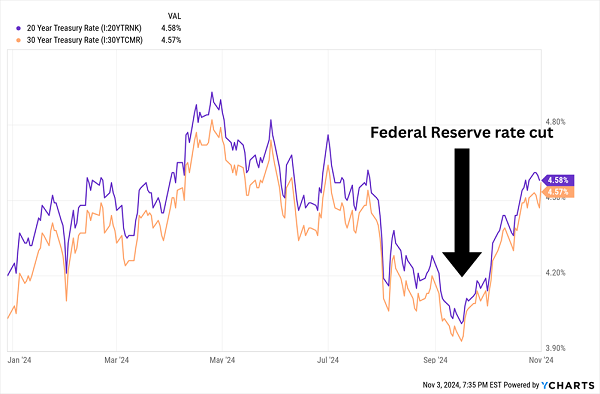

Why the bargains? Bonds have been bloodied since the Federal Reserve cut rates.

Wait, what? Let’s remember the Fed guides short-term rates. Long-term rates , on the other hand, march to the beat of their own drum:

20- and 30-Year Treasuries Above 4.5% Again

We could dip into bond exchange-traded funds (ETFs)—they’ll have the same tailwind at their back. But I prefer CEFs over bland ETFs for three very simple reasons:

- They yield more.

Recent Comments