When we buy dividend stocks, we’re looking for more than just the dividend. Price gains are preferred as well.

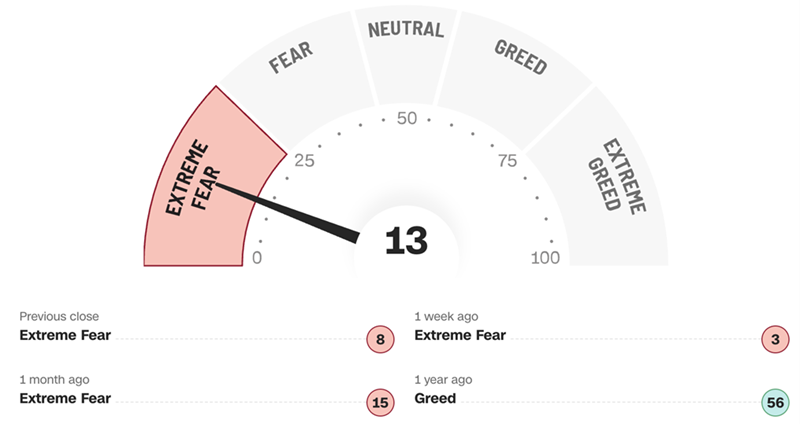

Greedy? Nah. Not if we time our buys right. It is possible to have our payouts and watch our stocks go up, too.

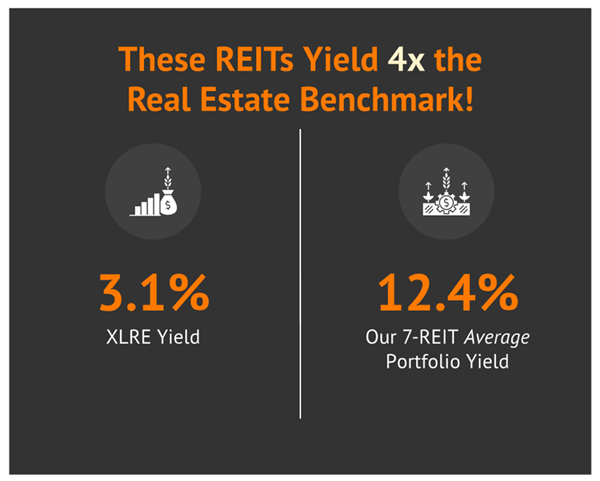

Two months ago, we recommended Annaly Capital (NLY) in these pages. Annaly dished a safe 12.9% dividend, well-funded by income. And the mortgage REIT (mREIT) had upside potential to boot.

Vanilla investors were worried about a recession, missing a time-tested maxim of income investing: As rates fall, REITs rise. This “rate-REIT seesaw” was about to tip and catapult Annaly’s price higher.… Read more

Recent Comments