We’ve got a frankly, bizarre dynamic setting up in stocks right now.

Global stocks are clobbering their American cousins this year. But here’s the disconnect: This is happening even though US stocks are hitting all-time highs seemingly every day.

On the surface, it sounds like both of these can’t be true. But as we’ll see below, this setup makes total sense. We’ll also look at how we can play it for both offense—price upside, in other words—and defense (in the form of 8%+ dividends), too.

USA, USA, US … Wait a Minute …

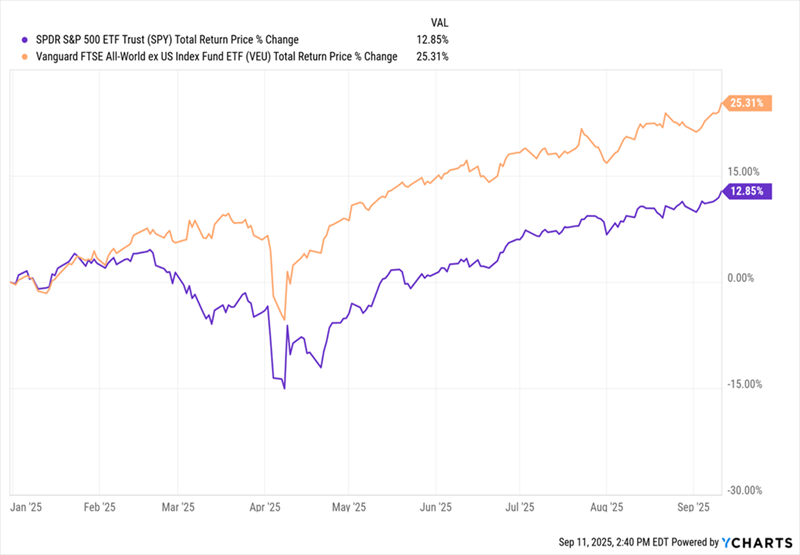

Here we’re looking at the S&P 500, as measured by the SPDR S&P 500 ETF (SPY), in purple, compared to the Vanguard FTSE All-World Ex-US Index Fund (VEU), a good benchmark for global stocks (minus the US, as the name says), in orange.… Read more

Recent Comments