Wall Street still treats utilities like income relics. Big mistake.

The same wires and substations that power your home now feed NVIDIA’s data centers—and our portfolios. These “boring” utilities are morphing into AI toll collectors, handing us up to 10.4% dividends while vanilla investors chase momentum stocks.

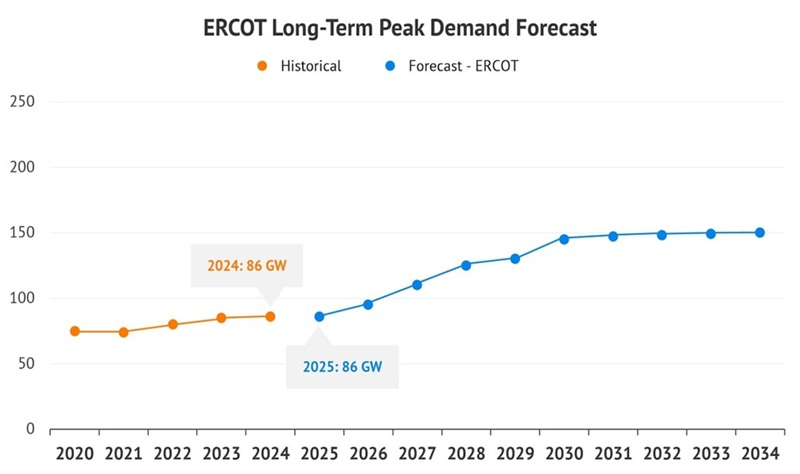

Take Texas, for example. The grid is strained. The population is popping. New residents, factories and AI campuses are all plugging into the state’s aging grid at once. The math is no longer “mathing” and it’s about to get worse. ERCOT projects power demand will jump 62% by 2030—yikes!

And Oncor, the state’s largest utility, believes that is way too conservative.… Read more

Recent Comments