Imagine getting $100 per month in passive income for every $10,000 you invest. That amounts to a $35,000 annual dividend stream with less than $300,000 saved.

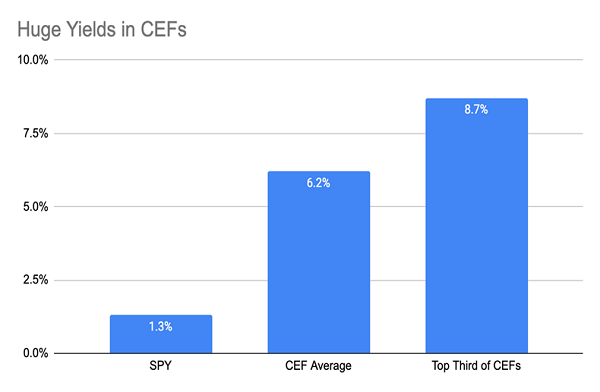

It’s not impossible. In fact, investors do it all the time with my favorite high-yield investments—closed-end funds (CEFs). While the average yield on CEFs is currently 6.2%, a third of these funds yield upwards of 7%, and 17 boast payouts of 10% and higher.

Source: CEF Insider

CEFs’ payouts are particularly impressive considering the SPDR S&P 500 ETF Trust (SPY), an index fund tracking the S&P 500, yields a paltry 1.3% today—the lowest yield for the stock market in 20 years.… Read more

Recent Comments