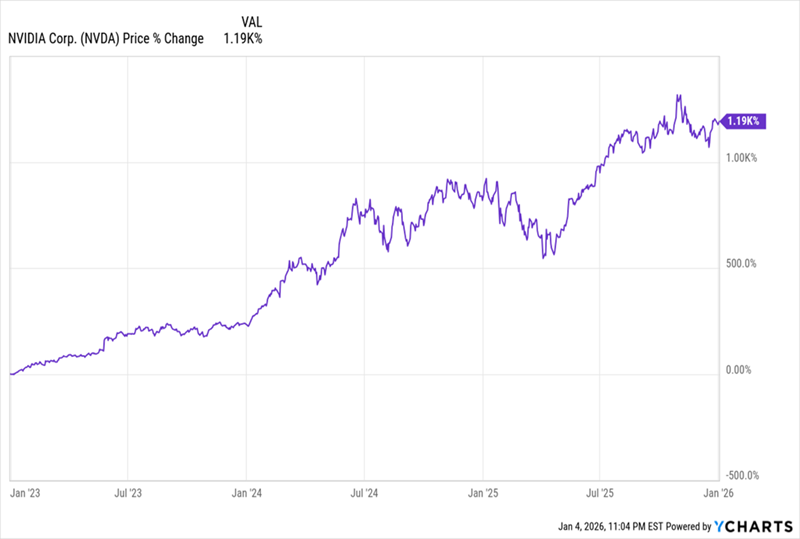

The run that AI poster child NVIDIA (NVDA) has been on these last few years is truly incredible. That’s not news, of course. But what matters now is whether investors are overpaying for that growth—in both NVIDIA and AI as a whole.

NVIDIA’s Monstrous Run

Once a chipmaker known for appealing mainly to gamers, NVIDIA started to climb in 2023, thanks to a new technology only a few people really understood at the time: generative AI.

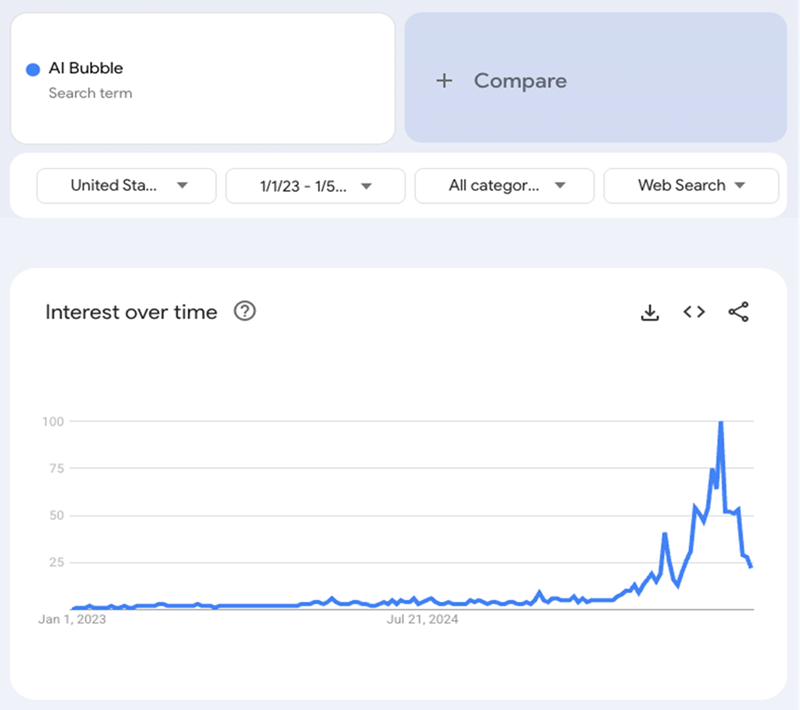

Then, as AI spread in 2024, hopes—and NVIDIA’s stock—soared. That was followed by more fears of a bubble in AI. As with NVIDIA’s share price, a chart is the best way to do these worries justice:

The Bubble in Worries About an AI Bubble

There’s so much discussion of an AI bubble now that we seem to be in a bubble of talking about bubbles!… Read more

Recent Comments