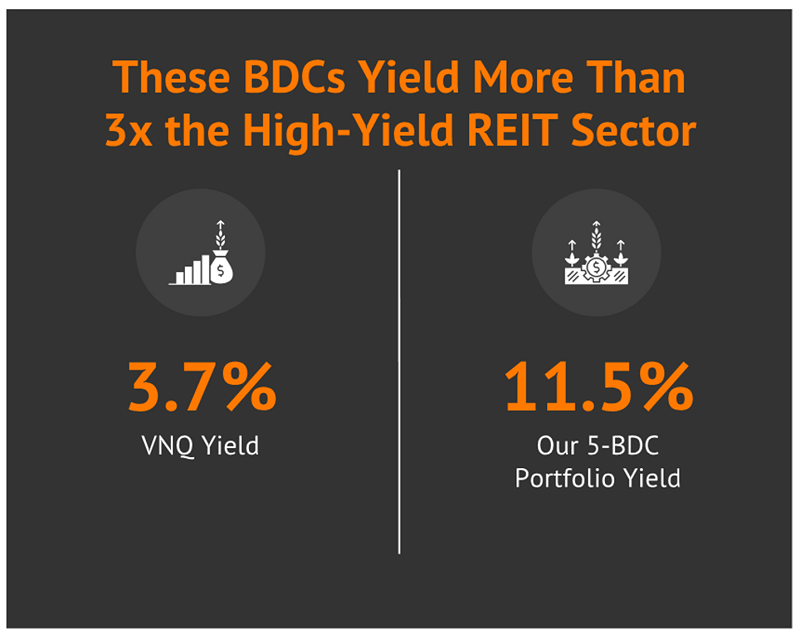

The manic market has been dumping business development companies (BDCs) left and right. Let’s talk about a seven-stock BDC portfolio (yielding 13.5%!) that is poised to bounce back when sanity returns.

BDCs, which lend money to small businesses, are on the “outs” with the Wall Street suits after countless soft jobs reports. The spreadsheet jockeys fret about an unemployment-induced economic slowdown and miss the real story: small businesses are making more money than ever thanks to AI.

Here is what’s actually happening in the Main Street economy:

- Employers—especially nimble small business owners—are implementing AI to streamline and even run their operations.

Recent Comments