The stock market is currently caught up in its deepest slide since July. We contrarians are prepared to move quickly for deep-dip-buying opportunities.

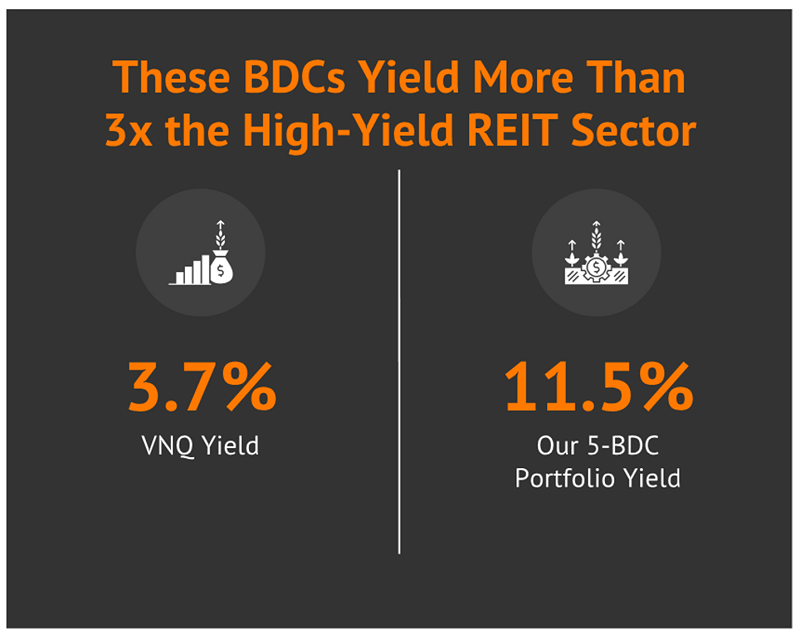

Right now, I’m paying close attention to already-high-paying corners of the market, where we can get 9.4% to 13.1% yields right this very minute. I’m talking about from the business development company (BDC) industry, where those sky-high yields aren’t rare—they’re the norm. In fact, right now, if we threw darts at a board of BDCs, we’d be likelier to hit a double-digit payout than one in the single digits.

But it’s not just the yields I love—it’s the access.… Read more

Recent Comments