There’s one 68% (!) paying fund out there that will give us a lump of coal this Christmas, if we’re not careful enough to avoid it.

I’m talking about the YieldMax Ultra Income Strategy ETF (ULTY), which we last discussed in September. Its 68% payout is so ridiculous that you could be forgiven for wondering if I missed a period between the 6 and the 8.

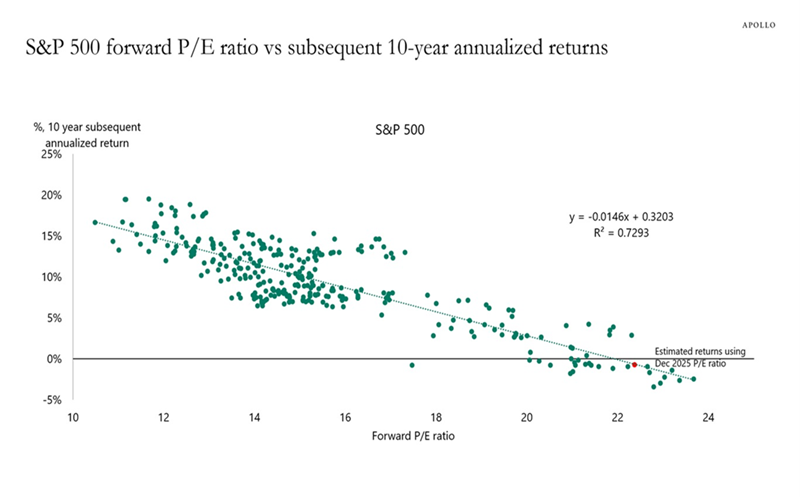

It’s easy to see how one could fall for a payout like that. As 2025 wraps up, we’re looking at a third straight year of double-digit gains for the S&P 500. Nothing breeds complacency like a levitating stock market!… Read more

Recent Comments