If Trump 2.0 rhymes with Trump 1.0, then this is an intriguing time to consider small cap dividends. Let me explain—and then we’ll highlight a handful of 11.1% to 12.6% dividend ideas.

In 2016, smaller companies popped for weeks amid largely sentiment over what President Donald Trump’s election would mean for the market broadly and small caps specifically. But that sentiment-related pop eventually turned into years of underperformance as theory became reality—and unfavorable conditions forced investors to stop betting on small caps as a group, and instead separate winners and losers.

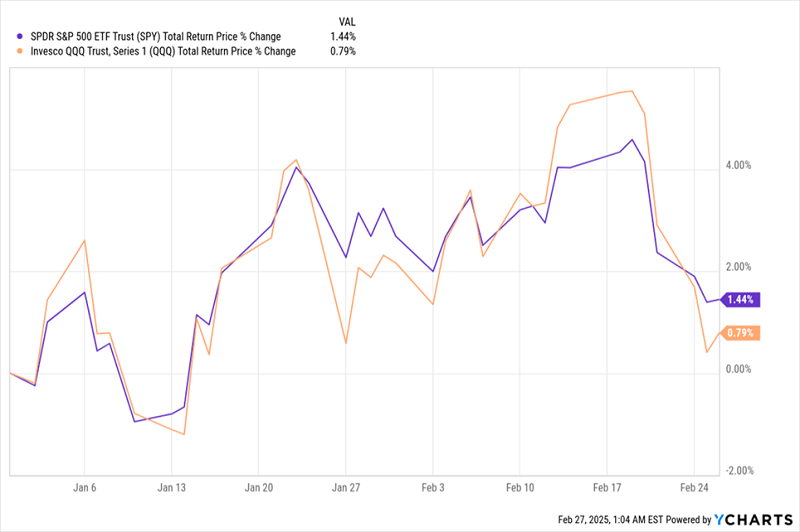

Fast-forward to Trump 2.0. I wrote in December that small caps were soaring following Trump’s second electoral victory in hopes that reduced regulations will let these companies run free.… Read more

Recent Comments