One of the worst disasters to befall investors in this crisis was something called the MORL dividend.

MORL is—or rather was—the ticker for the ETRACS Monthly Pay 2XLeveraged ETN (MORL). What’s MORL? It’s a double-leveraged bank-issued note designed to track the MVIS Global Mortgage REITs Index, a market-cap-weighted global mortgage-REIT index.

A mouthful, right?

But the jargon and obscure nature of this investment didn’t stop a lot of people from buying in. The reason was simple: MORL yielded as much as 25% back in March.

Think about that for a minute: a 25% dividend. Hold MORL for just four years and you’d get your entire investment back in cash payouts without selling a single share. Invest $100,000 and you’ll get over $2,000 a month, enough to live a comfortable lifestyle in parts of the country. Who wouldn’t want the option to retire on $100K?

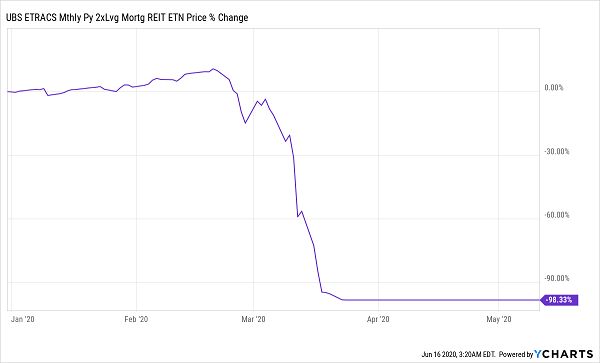

That’s a powerful siren song, to be sure. There was just one problem with MORL, which you can see in this chart.

A Complete Collapse

After the coronavirus hit, MORL lost over half of its value in days. But unlike many other assets, which have largely recovered, MORL went the other way, quickly becoming worthless.

Today, MORL no longer exists, having been liquidated by its issuer, Swiss investment bank UBS, which gave investors pennies on the dollar. That $100,000 retirement? It ended up costing investors $100K.

And consider this: that collapse hit individual investors who were aiming to fund a decent retirement for themselves. Big hedge funds and investment banks owned none of MORL when it collapsed.

That makes MORL worth a deeper look because it reveals two things these folks missed—and shows us how to avoid making the same mistakes ourselves.

MORL Dividend Takeaway No. 1: Know What You’re Buying

It’s clear that many people bought MORL purely for the dividend. But a big dividend is meaningless if you don’t know what’s producing your payout. If an investment promises a 25% yield but doesn’t make a 25% profit to cover that dividend, it’s going to lose value. And there are hundreds of assets promising big dividends that fail because they can’t cover their payout.

Investors could have avoided this if they knew what MORL invests in and, more importantly, how it invests.

MORL mainly invested in mREITs, or real estate investment trusts that hold mortgages. An mREIT is a kind of fund where management pools investors’ money and invests it in real estate. Many REITs buy properties, but mREITs buy mortgages from banks instead. So when a borrower pays their home loan back, that cash goes to the mREIT.

Some high-quality mREITs, like AGNC Investment Corp. (AGNC), have been around for years, and even though they’ve lost value in this crisis, they haven’t suffered nearly as much as MORL. But the fact that MORL invested in mREITs wasn’t the problem—it was how it was investing in those assets.

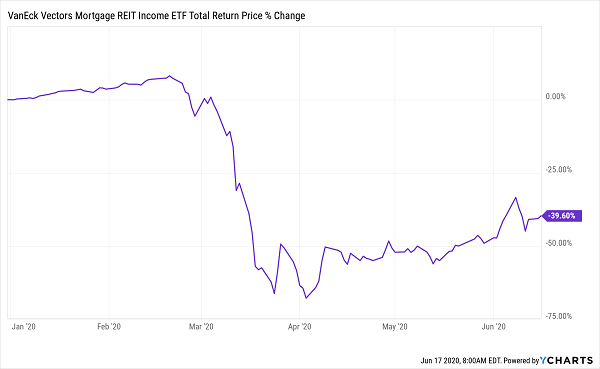

A Plunge in mREITs

To explain this, let’s first look at the VanEck Vectors Mortgage REIT Income ETF (MORT), a good benchmark for mREITs. MORT fell 70% from before the COVID-19 crisis, due to the panic selloff of mREITs. MORT has recovered a bit, as mREITs slowly get back to normal, while MORL, of course, did no such thing.

Why? Because MORL isn’t an exchange-traded fund (ETF) like MORT. It’s an exchange-traded note (ETN). Because it was an ETN, MORL was essentially an IOU created by its sponsor, Swiss investment bank UBS, to investors.

It basically works like this: you give UBS $100, and UBS says it will give you a cash dividend similar to what you’d get if you bought $100 in mREITs instead. You can then buy back your initial investment at the current market value of those mREITs.

If this sounds like it’s investing in mREITs with extra steps, that’s because it is.

But those extra steps came with benefits for the bank, and for investors. For the bank, there was an opportunity to earn fees (UBS gets a nearly 1% fee for its ETNs, although there isn’t much effort required to maintain them). On the investor side, there was the opportunity to get full leverage, meaning for every dollar you invest, you could also borrow a dollar and invest that, too. The bank also gets interest income from that leverage.

MORL Dividend Takeaway No. 2: Always read the Fine Print

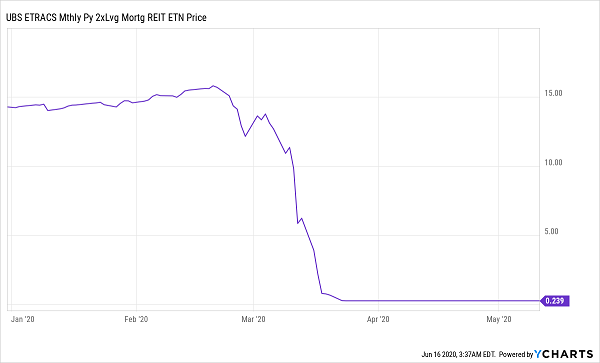

So ETNs are obviously complicated, but that’s not the main problem. This is: one of the covenants of ETNs is that when they fall below a certain value ($5 per share in MORL’s case), the bank can redeem the ETN. That means it can shut down the ETN and give investors cash in lieu of their shares at the current market value.

Redemption at the Worst Possible Time

When UBS did this, investors who had bought into MORL for $15.00 just a single month prior were suddenly given back just 24 cents. And that’s how a 25% dividend—and the too-good-to-be-true promise of a $100K retirement—led to steep losses.

4 “Dividend Lifeboats” (Yielding 9.4%) to Buy in This Crisis

Dividend traps like MORL are obvious in hindsight, but they’re so easy to fall into in the moment. In this case, folks who didn’t stop to consider the crucial differences between an ETN and an ETF wound up with a crippling 98% loss.

That’s why, at my CEF Insider service, we always go with plain vanilla, picking easy-to-understand funds run by real human managers that are as transparent as can be: you can always clearly see what’s supporting your dividend. I wouldn’t have it any other way.

I brought that same focus on transparency and accountability to the 4 CEF picks I named as my very best picks for this crisis (and beyond). They yield an outsized 9.4%, on average, right now. Plus, my proven CEF-picking model has pegged them for 20%+ price upside in the next 12 months.

When you add in their huge 9.4% dividends, you’re looking at 30% in payouts and upside here!

Recent Comments