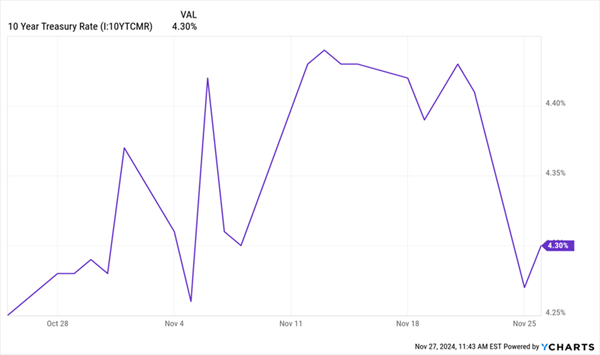

Most people think inflation will rise in a second Trump term—we can see it in the jump in 10-year Treasury rates over the last few weeks.

But that trade is getting just a little bit crowded—and we contrarians are going to take advantage of that with a 10.4%-yielding closed-end fund (CEF) that’s come back to earth as a result.

This situation reminds me a little of October 2023, when investors were also betting on “inflation forever.” We didn’t buy it then, either. Instead I named the DoubleLine Yield Opportunities Fund (DLY), payer of a 9.5% yield at the time, as one of the top portfolio buys in my Contrarian Income Report service.

DLY has posted a 25% total return in the 13 months since, as of this writing—a big move for a bond fund:

DLY Rose During the Inflation Panic of 2023

This time around we’re also looking at bonds—in particular high-yield corporate-bond CEFs like DLY—as plays on lower 10-year Treasury rates.

Before we go further, I should say that, yes, the second Trump administration will put pressure on the bond market via higher rates. I still believe that, but as mentioned, so does the rest of the investing herd.

What I’m getting at here, much like a year ago, is the fact that anytime the masses believe something is going to happen—such as higher rates—the market inevitably moves in the other direction, at least in the short term.

In fact, last week’s headlines may have given us the nod we were looking for on that outcome, when President-elect Trump appointed hedge fund manager Scott Bessent as treasury secretary. Bessent is seen as more nuanced on tariffs and more focused on keeping the “bond vigilantes” at bay.

Ten-year Treasury yields have leveled off after the election, then pulled back on the Bessent news, as you can see below:

10-Year Spikes Post-Election, Then Turns Lower

To be clear, we aren’t going back to the bargain-basement rates of the 2010s. I continue to see a “no-landing” economy ahead, where growth rolls on and inflation remains elevated. And tariffs are still likely to rise as immigration declines—two more pillars of higher prices.

That said, given the recent spike in Treasury rates, if inflation comes in even a bit lower than expected in the months ahead, bond prices will rise as bond yields fall. That’s just how it works in bond-land.

Meantime, we’ll be well paid while we wait for that to happen.

While we still like DLY, and it remains a CIR holding, it hasn’t quite pulled back below my “buy-under” price yet. That makes it a good fund to hold (and collect its payout, which yields 8.6% as I write this).

While we wait for our window to open on DLY, though, we’re going to pick up its sister fund, the DoubleLine Income Solutions Fund (DSL), payer of a rich (and monthly paid) 10.4% dividend now.

This 10.4%-Paying CEF Will Benefit From Trump 2.0

Like DLY, DSL is run by the “Bond God” Jeffrey Gundlach, whom we trust with our bond holdings: He predicted the subprime mortgage crisis, Donald Trump’s 2016 win and the 2022 market panic—to pick some of his best calls.

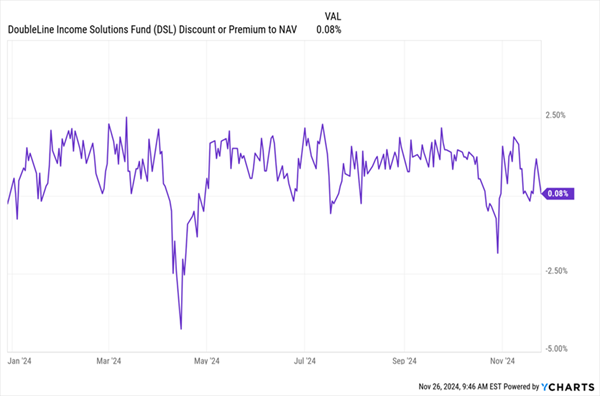

He does the hard work, scouring the globe for fixed-income deals. We kick back and buy his funds when they are trading at discounts to net asset value (NAV, or the value of their underlying holdings), or at least at par, as DSL is now. Those deals are rare.

DSL’s Par Valuation Is a Discount in Disguise

Gundlach, fixed-income alpha dog he is, doesn’t fool around with investment-grade bonds. Instead, he holds a little over 82% of DSL’s portfolio in below-investment-grade or unrated securities. This is where the biggest bargains lie, as many of the big players are limited to investment-grade paper.

The duration of DSL’s holdings is also long, at 5.4 years, so it will continue to enjoy high yields as the Fed continues to cut rates. The fund also uses 22.7% leverage, which is a happy medium—not high enough to add much risk but still sufficient to boost returns.

And, of course, its borrowing costs will fall as the Fed cuts interest rates, as CEF borrowing costs are more linked to short-term rates, such as the Fed rate, rather than the 10-year Treasury rate.

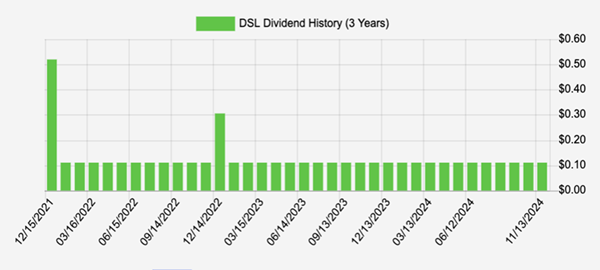

That will help sustain DSL’s 10.4% payout, which has held steady since the fund’s inception in 2013, with its only reduction coming in the pandemic year of 2020. It went on to keep payouts steady through the 2022 dumpster fire, plus we’ve seen two special payouts in the last three years:

A Steady 10.4% Dividend, With Special Payouts, Too

Source: Income Calendar

One last reason why we trust Gundlach to navigate the bond-market waters? Connections! They matter in the bond world, which is smaller and “cozier” than the stock market. And managers don’t come more connected than Gundlach, who gets the first call when the best new issues come to market. No algorithm-run ETF can match that edge.

My Top 8%+ Yielding Monthly Dividends to Buy for Trump 2.0

One thing most people don’t realize is that there are actually quite a few investments out there—DSL included—that pay dividends monthly.

And they drop high dividends too—like the stocks and funds in my “8%+ Monthly Dividend Portfolio.” As the name says, this unique portfolio’s diversified collection of investments yield 8% on average. And, yes, you get your dividends every month, not every quarter like most people who invest in “regular” stocks.

I’m ready to show you all the investments in this unique portfolio now.

Don’t miss this opportunity to see steady 8% yearly dividends drop into your account, month after month. Click here to learn more about my 8% Monthly Dividend Portfolio and get a free Special Report naming the stocks and funds inside.

Recent Comments