“Regular” REITs typically buy physical properties, find someone to manage them, and lease them out. They collect rent checks and avoid paying taxes on most of these profits if they pay most of their earnings out as dividends (per the terms of their tax loophole, which frees them from paying taxes if they distribute 90% of their profits as payouts). This is the reason REIT stocks typically boast big yields.

Mortgage REITs (mREITs), on the other hand, don’t own buildings. They own paper. Specifically, they buy mortgage loans and collect the interest. How do they make money? By borrowing short (assuming short-term rates are lower) and lending long (if long-term rates are, as they tend to be, higher).

This business model prints money when long-term rates are steady or, better yet, declining. When long-term rates drop, these existing mortgages become more valuable (because new loans pay less).

Of course, the traditional mREIT’s gravy train derails when rates rise and these mortgage portfolios decline in value. Historically, rising rate environments have been very bad for mREITs and resulted in deadly dividend cuts.

But smart mREITs like New Residential Investment (NRZ) are prepared to profit as rates soar. NRZ has expanded its portfolio of investments and services in recent years so that it can benefit from rising rates. It is now the largest non-bank owner of mortgage service rights (MSRs) in the world.

MSRs aren’t the loans themselves; they are the rights to service these loans—a subtle but important difference.

MSRs typically earn 0.25% of the payments that they collect. My wife and I recently refinanced our house and our mortgage service company, Truist Bank, is making easy money for the right to service our mortgage. We already have our account on autopay!

The potential risk to MSRs is that interest rates go down. If so, then homeowners like us will consider refinancing yet again and the mortgage (and service rights) will be “called away” early.

It’s a longshot, however, with interest rates already near historic lows. Sure, they could fall through the basement floor, but we’ll bet they won’t.

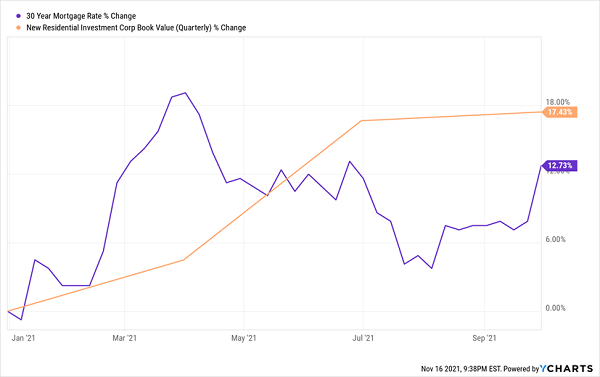

Just look at how NRZ has navigated 2021’s rising-rate environment:

NRZ’s Book Value Is Up 17%+ This Year

This is what we want to see in a potential mREIT investment as Treasury rates head higher and the Federal Reserve faces increasing pressure to hike its own benchmark rate.

Read on, and we’ll explore three of the market’s top mREITs—which yield 8.9% on average—to see if they’re similarly built to handle higher long-term rates.

AGNC Investment Corp (AGNC)

Dividend Yield: 9.0%

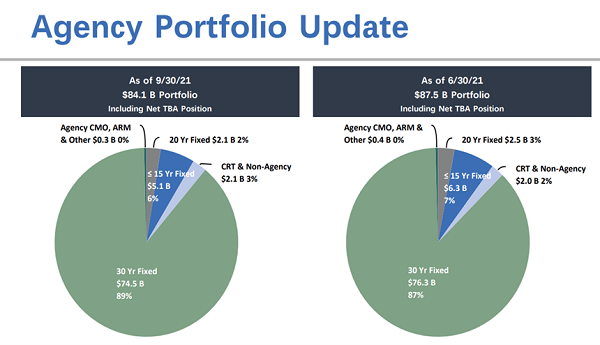

We’ll start with AGNC Investment Corp. (AGNC), which invests almost entirely in agency mortgage-backed securities (MBSes). As of the end of the third quarter, AGNC’s $84.1 billion portfolio included $53.7 billion in residential MBSes, and most of the rest ($28.3 billion) in a “TBA” position.

TBAs are quite literally “to-be-announced” securities that will involve buying or selling an agency MBS at some predetermined price, face amount, issuer, etc., at a later date, but the MBS won’t be identified until soon before the settlement date. TL;DR: We know they’re MBSes, but that’s about it.

What we do know, however, is that the lion’s share of AGNC’s portfolio is fixed-rate; almost 90% of the agency portfolio is in 30-year fixed mortgages.

Source: Q3 2021 Shareholder Presentation

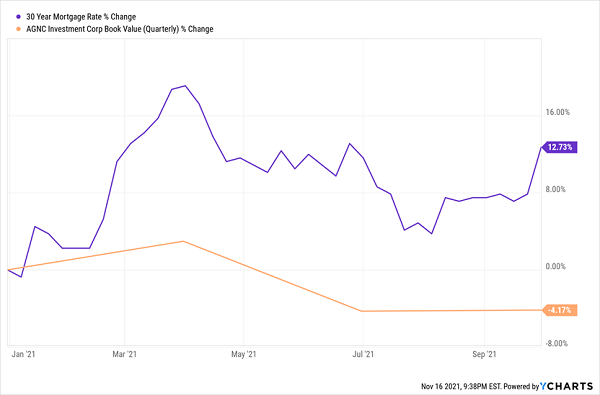

That’s a warnings sign, as is AGNC’s performance amid rising rates so far in 2021:

AGNC’s Book Value Takes a Step Back

What’s even more troubling than the potential for price declines is the possibility that a run of continued weakness could result in a dividend cut—again. AGNC manages its dividend by the skin of its teeth, which has forced the mREIT to scale back four times over the past six years, and several times more before that.

Imagine a Healthy Dividend Chart. This Is Its Opposite.

What good is a 9% dividend today if there’s little reason to believe it’ll be 9% next year?

Starwood Property Trust (STWD)

Dividend Yield: 7.4%

With Starwood Property Trust (STWD), we’re sacrificing some yield to get “just” 7%-plus in annual income…but in turn, we might just be getting some peace of mind.

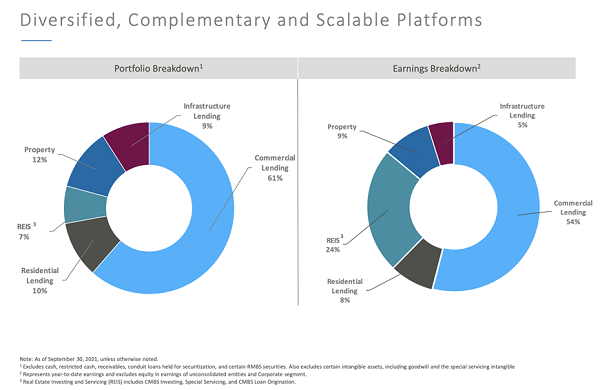

Starwood also deals in mortgage-backed securities, but the majority of its business is in commercial lending. It does have roughly 10% exposure to both residential and infrastructure lending, with the rest tied up in property investments and real estate investing and servicing businesses.

Source: Starwood November 2021 Investor Presentation

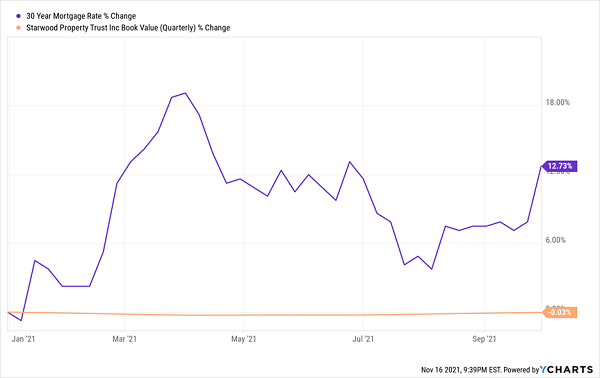

Of course, what kind of lending Starwood does isn’t terribly important insofar as how interest rates will impact it. And good news on that front: In its primary commercial lending business, a good 96% of loans are floating-rate, giving STWD a better chance to roll with the punches.

Starwood’s BV Is at Least Treading Water in This Rising-Rate Environment

And if you’re wondering whether you can count on that 7%-plus yield sticking around? Know that the dividend hasn’t been cut since 2009—even during a tumultuous 2020 that saw many of its peers hack their payouts.

Annaly Capital Management (NLY)

Dividend Yield: 10.3%

Now let’s look at Annaly Capital Management (NLY), America’s largest mortgage REIT at some $12 billion in market capitalization and $94 billion in assets.

Its 10%-plus yield is also one of the highest in the industry.

NLY also invests in agency MBSes collateralized by residential mortgages guaranteed by Freddie Mac, Fannie Mae or Ginnie Mae. It will also invest in commercial MBSes, and even mortgage servicing rights just like New Residential.

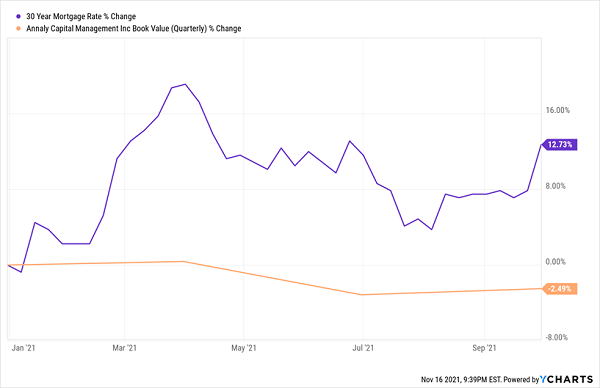

Unfortunately, MSRs Aren’t Saving NLY

Annaly technically does invest in MSRs, but it doesn’t invest very much. The estimated fair value of Annaly’s mortgage service rights as of Sept. 30 was a little more than $660 million—that’s less than 1% of its total investments, compared to 29% for NRZ. For context, NLY’s agency fixed-rate securities have an estimated fair value of $62.5 billion; another $23.6 billion in TBAs (which likely will be primarily fixed-rate); and $8.4 billion in its residential credit portfolio.

The results of late have been similar to AGNC, with book value on the decline as interest rates have swelled in 2021.

It also shares another unfavorable trait with AGNC:

Annaly Has Experience Cutting Dividends, Too

Sky-High Dividends You Can Count on for DECADES

That, in a nutshell, is one of the gravest dangers of investing in uber-high-yield stocks:

They’ve got too many “buts.”

- Nice yield … but rising rates will tear it to shreds.

- Great payout … but it’s always being cut, not increased.

- What a dividend … but the stock swings around like Tarzan.

The majority of the market’s most mouth-watering payouts force you to make some sort of critical tradeoff. But a few select gems offer it all: The right payout, the right price, the right potential.

And these stocks are all part of my “Perfect Income” portfolio.

Most of my readers have told me that these stocks have doubled and even tripled the dividends they were earning from their old income portfolios. (And in some rare cases, it could mean a 4x jump in your regular checks!)

That alone is a massive upgrade to any set of retirement holdings. But more important is that my Perfect Income Portfolio delivers that level of cash while also…

- Paying those dividends consistently, predictably and reliably.

- Surviving, even thriving, in market crashes.

- Delivering double-digit returns across several safe investments.

- Gambling your hard-earned nest egg on flimsy day-trading strategies, options contracts or penny stocks.

Let me show you the stocks and funds you need to stabilize your retirement. But more importantly, let me teach you more about this incredible strategy itself and make you a better investor in the process!

Take control of your financial legacy today. Let me show you how to get 2x to 4x your current income with this simple, straightforward system. Click here to get a FREE copy of my Perfect Income Portfolio report, including tickers, dividend yields, full analyses of each pick … and a few other bonuses!

Recent Comments