After a decade in the basement, interest rates are finally starting to move meaningfully higher. Let’s discuss the best stocks and bonds to buy with this backdrop.

If it feels like we had forever to prepare our portfolios for this moment – well, we did. This interest rate run has largely taken place on a treadmill. We’re almost two-and-a-half years into the Fed’s current rate hike cycle, and the Fed Funds rate is up a modest 1.25%.

Meanwhile the 10-year Treasury rate hadn’t really moved until recently. At all. The benchmark long bond now pays 2.86%:

Rates Slowly Grind Higher

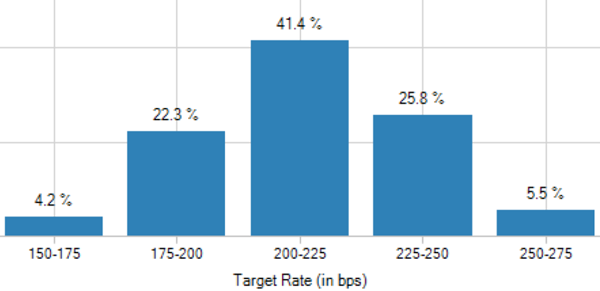

If you believe your portfolio is behind the rate hike curve, it’s not by much. Rates haven’t really moved yet. But this could change soon, with traders currently handicapping three Fed increases by the end of 2018.

3 Likely Hikes By December

A 0.75% move doesn’t sound huge, but it’s big enough to bother regular vanilla bonds when you’ve been living in a no-yield world. After all, who wants to buy a 2.86% coupon today when it could be a 3.5% or 4% coupon tomorrow?

This move could also be enough to bother over-extended dividend payers, too. These are bad times for “bond proxy” stocks like General Mills (GIS), which doesn’t yield quite enough (3.9%) or have a growth catalyst (Cheerios + Ancient Grains? Seriously?) to give investors any reason to own it.

So where should we turn for secure rate-proof yields with price upside to boot? Here are three promising places.

Rising Rate Buy #1: Dividend Growers

Let’s review the three-year period starting in May 2003 when the 10-year rate climbed a full two hundred basis points – from 3.2% to 5.2%. It’s a fair comparison to where we may go from here.

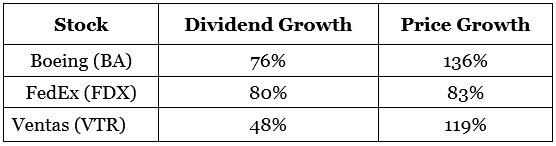

Back then, familiar dividend growers like FedEx (FDX), Ventas (VTR) and Boeing (BA) climbed higher right alongside long-term rates. Their secret? Their payouts simply outran the steady – but slow – bond market:

Dividend Growth Drives Big Returns (June 2003-06)

Will this rising rate cycle be any different? Perhaps only in name – of the stocks leading the charge, that is. The winning strategy remains the same: Buy the stocks of the companies that are growing their payouts the fastest.

Rising Rate Buy #2: Banks and, Better Yet, Insurance Firms

Banks and insurance companies are helped by higher rates because they have an increased “spread” to make money on. Insurance is my favorite because, when done responsibly, it can generate tremendous amounts of “free cash.”

These firms collect payments up front from their customers but may not have to pay them out in claims for a long time, if ever. The companies then invest that money – called “float” – and pocket the income they earn.

If they priced risk properly upfront, they make more on premiums than they have to pay out in claims. Plus, they get to keep the profits they made on the capital they borrowed for free!

This lets reinsurers quickly compound their profits. Higher interest rates let them compound their profits faster than usual (because insurers tend to buy secure short-term government bonds, which pay more as rates rise.)

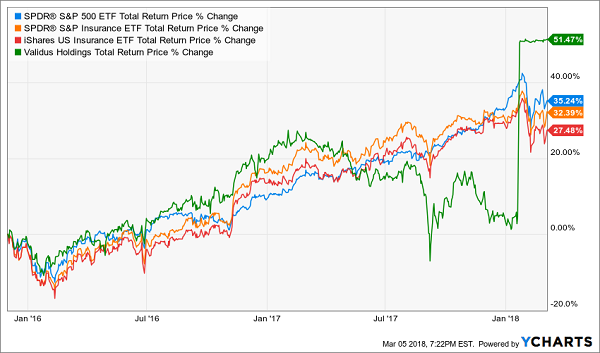

I would encourage you to cherry pick your insurers. The blended baskets provided by ETFs have actually underperformed the broader market since the Fed woke up in late 2015. But Hidden Yields subscribers will fondly remember Validus Holdings (VR), our cash cow reinsurer that giant AIG (AIG) purchased from us (at as substantial price premium) – a reminder of why it pays to buy the best:

Insurance Stock Picking Adds “Alpha”

Elite insurance stocks are able to deliver high “shareholder yields” year-after-year, often thanks to stock buybacks. But there’s one drawback to shareholder yield – it isn’t cash in your pocket!

For meaningful cash yields (5%+) today, we’ll look to bonds.

Rising Rate Buy #3: Floating Rate Bonds for 5%+

Floating-rate bonds have variable coupons (interest payments) that are calculated quarterly, or even monthly. Their rates take some reference rate (such as the federal funds rate) and add a defined payout percentage to it. As the reference rate ticks higher, so does the coupon’s payout.

There are now two reputable ETF options for Treasury investors who want the adjustable rates: The iShares Treasury Floating Rate Bond ETF (TFLO) and the WisdomTree Bloomberg Floating Rate Treasury ETF (USFR). Both should perform better than fixed-rate Treasuries when the Fed moves.

But that’ll be a function of not losing money rather than producing meaningful yield. Since their inception in February 2014, TFLO and USFR have produced a total return of 1.7% and 1.1% respectively. They may be geared for good relative performances with respect to Treasuries, but their absolute performances are awful.

Instead of investing in these barely-cash equivalents, I prefer corporate debt. After all, the Fed is raising rates because the economy is rolling. That’s good for corporations’ balance sheets and their ability to repay their loans.

We need to pick the right companies, of course, to make sure you get paid back. This “real yield” buffers us from Fed chair Jerome Powell, the bond vigilantes and anyone else who should be “credited” for higher rates when they come.

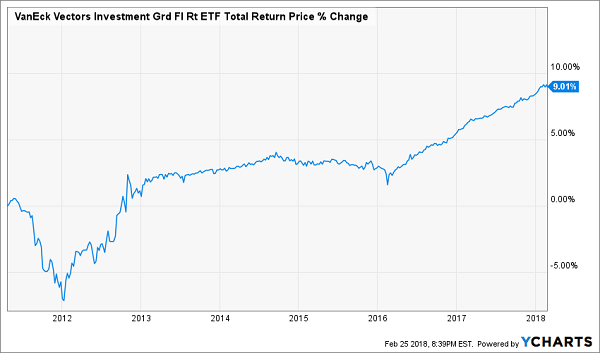

On the corporate side, the Market Vectors Investment Grade Floating Rate ETF (FLTR) buys floating rate notes from businesses that are rated as investment grade by Moody’s, S&P, or Fitch. It currently pays a paltry 1.9%:

FLTR: Slightly Better Than Your Mattress

But FLTR has delivered a total return to investors of just 9% since inception (nearly seven years ago). Yikes.

The best deals in the corporate bond market are actually just below the somewhat arbitrary investment grade cutoff. It’s where contrarian fund managers and investors like us capitalize on the fact that any pension funds, banks, and insurance companies are not allowed to invest in these “low quality” issues per their by-laws.

The result is a sweet spot of value, thanks to the lack of big money chasing these types of bonds.

Agencies’ ratings shortchange a lot of very good debt. You just have to pick and choose the quality companies with plenty of cash flow to service their debt obligations. Or those with enough assets to make their creditors whole no matter what happens.

My preferred way to invest in this market is with my favorite floating-rate bond fund that today pays 5.1% yearly (and has double-digit price upside potential, too.)

With a single-click of our mouse (or tap of our phone), we can hire the best (and most well connected) bond managers on the planet to build a portfolio for us. And we can even get them to work for us for free if we buy the fund today!

This ultimate rate-proof bond fund also pays a monthly dividend, good for 5.1% annually. And it delivers total returns between 10% and 15% yearly when the Fed is raising interest rates (as it is right now).

It’s one of 12 monthly payers in my “8% Monthly Payer Portfolio”. With just $500,000 invested, it’ll hand you a rock-solid $40,000-a-year income stream. That’s an 8% dividend yield … and it’s easily enough for most folks to retire on.

The best part is you won’t have to go back to “lumpy” quarterly payouts to do it! Of the 19 income studs in this unique portfolio, 12 pay dividends monthly, so you can look forward to the steady drip of $3,333 in income, month in and month out—give or take a couple hundred bucks – on every $500K in capital you’re able to invest.

I’d love to share my 8 favorite monthly payers with you today, along with the name, ticker, and buy price for this floating rate bargain. Click here to get a full copy of my research on Monthly Dividend Superstars: 8% Annual Yields with 10% Price Upside, Too.

Recent Comments