In case you haven’t heard, the Federal Reserve is about to cut interest rates. That is big news for this trio of dividend payers, dishing between 11.1% to 12.6% per year.

These stocks survived the high-rate cycle. Are they about to thrive as the Fed eases?

Yeah, probably—so long as the Fed doesn’t also put them out of business in the process! Let me explain…

Mortgage REITs (mREITs): High Risk, Even Higher Dividends

Mortgage real estate investment trusts, colloquially known as mREITs, are a real estate niche

When we think about REITs, we typically picture equity REITs. They own (and sometimes operate) physical real estate like apartments, strip malls, hospitals, ski resorts.

Mortgage REITs, on the other hand, buy stacks of paper.

The mREIT business goes like this:

- Borrow money at short-term interest rates.

- Buy bundled-up packages of mortgages, aka securitized mortgages.

- Collect the income these mortgages produce thanks to (hopefully!) higher long-term interest rates.

Mortgage REITs and equity REITs are bound by the same rules, including that they must dole out 90% or more of their profits back to shareholders as dividends.

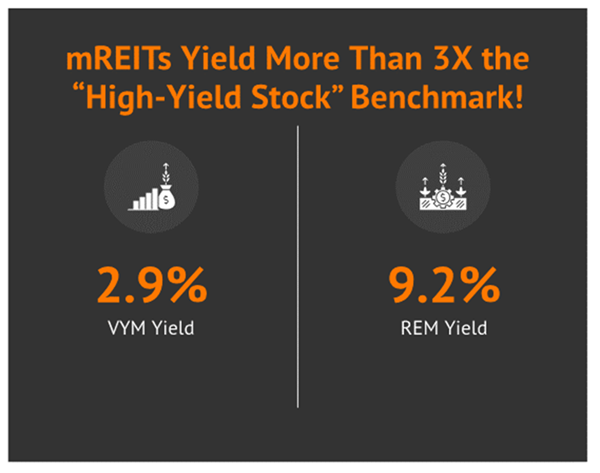

These paper tigers known as mREITs pay. A lot. On paper, at least. The vanilla mREIT ETF—the iShares Mortgage Real Estate Capped ETF (REM)—yields more than 9% right now!

REM brings us diversification. Unfortunately, in this space, that is a poor quality.

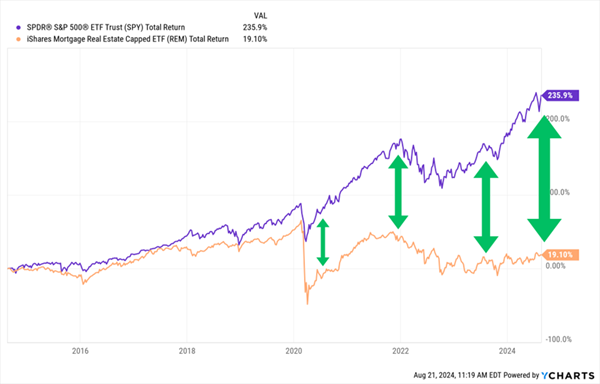

Mortgages are a difficult business. Even including its big payout, REM has gained just less than 20% over the past 10 years—including dividends. The S&P 500 has more than tripled in that same time. REM has a history of dishing out big dividends and subsequently losing most of the payouts in price setbacks.

Dividends Are the Only Thing Keeping This Group Above Water

Is the Fed Here to Help?

Falling rates are generally considered better for mREITs than rising rates. But it’s not that simple. Lower rates make borrowing cheaper, sure, and they also help mREITs refinance existing debt at better rates. The mortgages held in those securities can also appreciate in price, too.

But consumers get the same benefit—they can refinance their mortgages. When that happens, the MBS is paid off right then and there, typically at a value lower than what would’ve been collected over the life of the mortgage. And also, those mortgages will eventually be replaced by mortgages with lower values.

That’s why we must be selective when buying mREITs. Only the most resilient will do.

Franklin BSP Realty Trust (FBRT)

Dividend Yield: 11.1%

Let’s begin with Franklin BSP Realty Trust (FBRT), a mortgage REIT dealing in commercial mortgage-backed securities (CMBSs). Multifamily is king here, at nearly three-quarters of the portfolio, but FBRT is happy to take on just about any type of commercial property—it also holds loans in the hospitality (14%), office (5%), industrial (5%) and other sectors.

FBRT wins style points for its financing sources. A full 75% of the portfolio comes from collateralized loan obligations (CLOs), but it also has 17% exposure to warehouse lending (credit lines extended by banks to originate mortgages), 5% to repurchase agreements (repo). The remaining 3% is a peppering of unsecured debt and asset-specific financing.

Unfortunately, Franklin BSP Realty will feel the pain of any interest-rate cuts. Specifically, a 50-basis-point decline in the Secured Overnight Financing Rate (SOFR) will shave about 5 cents per share off of annual earnings.

But at least short-term Fed pain is a given for most REITs. Can FBRT withstand it? The company has plenty of liquidity ($700 million at the end of Q2 2024) and low leverage of 2.7x.

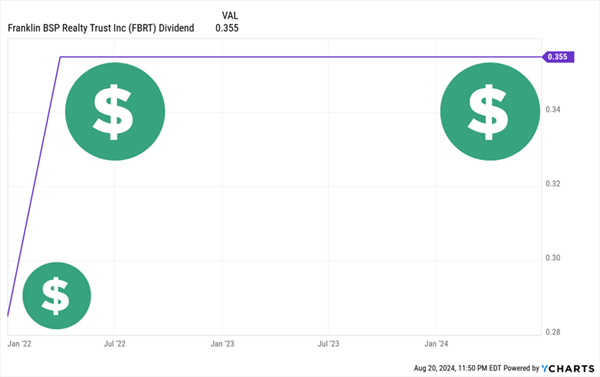

FBRT is also buying back shares. The firm repurchased $3 million in shares last quarter, giving it $31 million left under its $65 million share authorization, and its quarterly 35.5-cent-per-share dividend should remain well-covered based on earnings estimates for the next few years. The dividend, however, rarely moves:

FBRT’s Static Dividend

FBRT has only been trading since 2021; the company was born from the combination of Franklin (formerly known as Benefit Street Partners Realty Trust) and Capstead Mortgage Corporation. The latter had a shaky payout history that included both raises and cuts.

Investors have so far slept on this financial quality, letting shares go dormant in 2024 (flat year-to-date) while trading at just 0.85 times book.

Ellington Financial (EFC)

Dividend Yield: 11.9%

Ellington Financial (EFC), a “hybrid” mREIT, will invest in just about every kind of paper real estate you can find. Commercial and residential mortgage loans. Commercial and residential MBSs. Consumer loans. Debt and equity investments in loan originators. It even has a reverse-mortgage arm (Longbridge Financial, which was acquired in 2022).

Another thing Ellington has exposure to are “agency” assets. Agency MBSs are issued or guaranteed by government agencies, most commonly Fannie Mae, Freddie Mac, and Ginnie Mae. And given that they’re backed by government agencies, these securities tend to have much smaller credit risk than traditional instruments.

But this agency exposure is a moving (and shrinking) target—a look at its latest report shows that Ellington shed 31% of its agency portfolio, following a 22% reduction in Q1. Agency assets now account for just 12% of assets.

Financial performance so far this year has been good, not great. Net interest income and margins have improved modestly. Book value has inched forward. Liquidity is good. And this has shown up in shares, which are outperforming the industry with a low-double-digit total return.

But oh, the dividend.

EFC’s payout sports a wild 12% yield and is paid monthly. But Ellington has given shareholders no reason over its history to believe that today’s dividend will still be there tomorrow. The latest cut—a 13% clipping to 13 cents per share—came earlier this year, not too far removed from EFC’s merger with fellow mortgage REIT Arlington Asset Investment.

That’s an 83% Dividend Drop in Roughly a Decade

Dynex Capital (DX)

Dividend Yield: 12.6%

Unlike Ellington, Dynex Capital (DX) fully embraces agency debt. The market’s longest-tenured mREIT is a specialist in agency MBSs—residential agency MBSs make up a whopping 97% of the portfolio, and commercial agency MBSs are another 2% or so. Non-agency? Less than 1%.

Agency MBSs, while somewhat “safer,” tend to pay lower interest rates as a result. So you’ll tend to see much higher leverage from agency MBSs, as they try to squeeze out performance and those high mREIT dividends. Dynex’s leverage was down to 7.9x at the end of the most recent quarter. Should the yield curve steepen (the gap between short- and long-term rates widen), Dynex is positioned well to benefit.

About that backstop? DX is plenty liquid, with some $644 million of cash and unencumbered assets.

That said, Dynex shares trade at just a hair under book—it’s not expensive, but it’s not cheap either. The dividend could be less worrisome, too.

Another 83% Dividend Drop—But Is the Payout Safer Than It Seems?

The company is actually projected to have a deeply red “earnings available for distribution” (EAD) in 2024 before bouncing back in ’25 and ’26.

On the one hand, Dynex’s EAD is an incomplete metric and doesn’t tell the full coverage story. Plus, the market isn’t pricing in a dividend cut at all.

But no one would be blamed for being a little nervous given Dynex’s troubling dividend history.

Exclusive: How to Build a Monthly Income Stream With Yields Up to 10.5%

I don’t love these payout histories, but I sure do love the yields.

So instead, let’s lock in a few life-changing dividends without worrying about them imploding tomorrow.

And let’s collect these fat checks every single month while we’re at it.

That’s exactly what you can expect from my “8%+ Monthly Payer Portfolio”—a group of reliable, relentless dividend payers that yield into the double digits and drop off income 12 times a year.

I don’t know about you, but I’d much rather get cash in hand every 30 (or 31) days than have to wait three long months. It matches up with our monthly bills (particularly good for retirees!) and lets us reinvest our payouts faster.

And with my top 3 monthly payers to buy now, you can pocket payouts up to 10.5%.

Recent Comments