Only here at Contrarian Outlook can we banter for an hour-plus about closed-end funds, utilities and oil dividends! This site is our sanctuary, my income friends.

I’m talking about our Contrarian Outlook 2024 Q2 VIP Webcast. Every quarter we fire up GoToWebinar and discuss the top high-yield stocks and bonds on my mind, along with your questions. A big thanks to my 1,151 subscriber friends who attended the meeting live.

On the call I fielded some questions about closed-end funds (CEFs) that we didn’t have time to cover. I said I’d read them all and, well, I did. So, let’s address them now.

Now, on to your CEF questions and answers…

Many CEFs have been losing their principal (price) steadily over the last five to ten years. Should total return be a more important factor to consider when buying CEFs? – Sam A.

Sam—yes! Many CEFs are, sadly, dividend dogs. There are many loser managers in the sector who give CEFs a bad name.

Our old doormat Brookfield Real Assets Income Fund (RA) comes to mind. It has a fund name that hints infrastructure, but the fund is heavily invested in securitized real estate credit. Not what we wanted!

The fund recently yielded 18.9%. But that payout proved a paper tiger when RA gutted its distribution. Since inception, this dog has only delivered a total return of 4.8% per year.

This return is not enough. We are looking for 7% to 8%+ total annual returns from our CEFs. After all, we can net 5% in boring old money markets—as my friend Rodmund points out.

With money market funds hovering around 5%, is there any reason to hold CEFs paying less than that? – Rodmund B.

Only if we believe the CEFs are due for price gains, Rodmund. Given the “no brainer” 5% we have in money markets today, we shoot for 7% to 8% annualized total returns, or better, with CEFs. If we can’t achieve this, why own the CEF?

And we can’t take the yields at face value, either. RA shows us why. We’re not here to collect a payout only to lose some of it (or more) in price losses. RA debuted above $22 per share in 2016—it now trades for $12-something. This is why, despite a high headline yield, the fund has only returned 4.8% per year.

We need to jump the 7% to 8% annual return hurdle combining dividend and price. Sounds obvious I know, but many vanilla investors blindly take the stated yield at face value. Investing in CEFs is more nuanced than this.

What do you think about muni funds NVG, NEA, NZF and NAD? – Michael O.

Talk dirty to me, Michael. Next to US Treasuries, muni bonds are the safest bonds in America. No debt drama for these boring payers.

And when it comes to bonds, boring is good.

Munis are usually so mundane and reliable that they rarely go on sale. And here’s a great thing about municipalities, at least for us investors: when they need money—taxpayers, cover your eyes!—they issue bonds. The writers of muni bonds are not interest rate sensitive.

Which means muni funds are the place to be right now. But you wouldn’t know it from their valuations. These four boring ‘ol muni funds trade at 11% discounts to their NAVs (net asset values) today:

Yup! These well-run muni funds from Nuveen, the Cadillac of muni managers, are on sale for 89 cents on the dollar.

And oh, by the way, these funds just raised their monthly payouts! They now dish 7.7% and on a tax-exempt basis—they are tax exempt, remember—it’s even better. For my top tax-bracket ballers, this is a tax equivalent yield of nearly 10.4%:

My only issue (nitpick, really) with munis is that I liked them even better a few weeks ago, before they rallied furiously. Three of these funds were best buys in our May edition of Contrarian Income Report. Since then, NEA and NAD have rallied 7.2%! Meanwhile, “laggard” NZF gained 5.1%.

I hate to chase bond funds when they are hot. But on the next pullback, we’ll look to pounce again. (Hopefully you CIR readers took advantage of our May heads up!)

Status on KYN? – Will S.

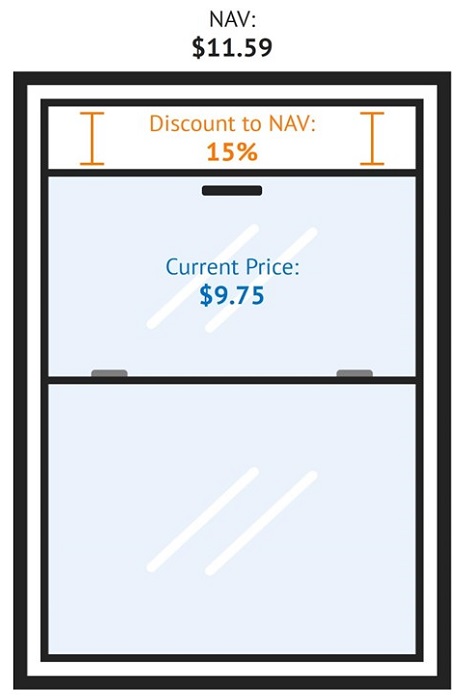

Kayne Anderson MLP (KYN) is my “go to” energy CEF. As I write, this 8.6% payer trades at a very rare 15% discount from its NAV.

KYN owns high-quality names like The Williams Companies (WMB) (its number four holding, making up 9% of the fund). KYN should be trading closer to its net asset value. There is no reason why, for example, WMB shares would be available for 85 cents on the dollar in a rational market!

Heck, KYN traded at a premium back in 2018 and energy was in a bear market! Now, it’s making a multi-year run higher.

But when there is fear in the broader stock market, we can buy KYN for less than the value of the stocks it holds. Today, its portfolio is selling at 15% off its portfolio market value.

It’s an $11.59 stock trading for $9.75—eighty-five cents on the dollar to be precise. On sale! And by the way, KYN gets around the K-1 hassle—your accountant’s nightmare—by issuing one neat 1099.

PDO is at a premium. Is it OK to reinvest when that happens? – Amy E.

As you note Amy, PIMCO Dynamic Opportunities Fund (PDO) now trades at a 4% premium to NAV. It sported a 2% discount when added to our CIR portfolio. So, we’ve gained 6% in “valuation” alone.

PDO paid 12.1% then, 11.6% now. Same dividend but the price gains have modestly compressed the yield.

I have PDO rated a Hold because we always demand a discount. Picky, I know. That said, we are not tossing PDO out of the income hot tub. Its 11.6% payout makes up for many character flaws, including its 4% premium.

That said, do we make an exception for dividend reinvestment? Technically we would say no. Put new money into Buys only.

But we are splitting hairs here. If PDO lost its premium over the next 12 months, it would still return 7.6%. Not bad. Plus, PDO will have the wind at its back as interest rates decline. The value of its bonds will rise along with its NAV and price.

Amy, I’m not going to tell you to do it. I am, however, going to look the other way.

And, Amy, I’ll remind you that we do have 8%+ monthly payers with a bit more near term upside—like these high-quality monthly dividend bond funds.

Recent Comments