Another day, another sign the economy is heading straight for that “no-landing” scenario I’ve been talking about for weeks now …

… and yet another sign the two dividends we’re going to discuss today are better buys than they’ve been in months.

(One of these staunch payers kicks out a rich 8% divvie. The other has grown its dividend a ridiculous 425% in the last five years. A buy back then would be kicking out a sweet 6.2% dividend today, thanks to that breakneck growth!)

Inside the Economy’s “Touch and Go” Landing

When you hear “no landing,” your first impression might be that it sounds like a good thing, right?

After all, it implies the economy will keep humming along, and that recession we’ve been worrying about since, well, 2020, will keep being pushed back.

All good. Except here’s the rub: Inflation comes back.

I mean, when you have a federal government spending nearly $2 trillion more than it’s taking in, it’s easy to see how this monetary inflation could seep into consumer price inflation.

And there’s no way an extra $2 trillion dropping into the system isn’t going to juice the economy! No matter who wins the election, I think we can all agree that this spending is unlikely to be tamed. The opposite, in fact—fueling inflation even more.

A quick look at the headlines brings more warnings of a potential resurgence of inflation: An expanding war in the Middle East, for example, has been pushing up oil prices. And even though the port workers’ strike has been settled, it reminds us how easily our supply chains can be disrupted.

And of course we had last week’s blowout jobs report, which showed continued strong wage growth.

Powell Sees the Inflationary Forces Lining Up Against Him—and Blinks

Jay Powell seems to see this inflationary wave rolling in. Last week, he tamped down expectations of more jumbo rate cuts, like the 50-pointer the Fed dropped last month.

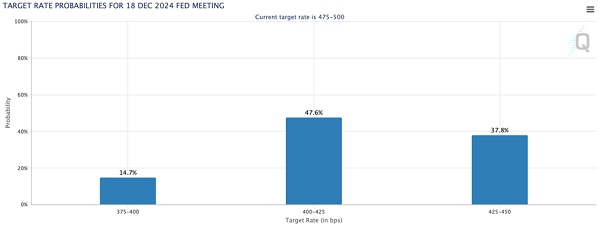

Futures markets agree—they now point to just 75 basis points in cuts between now and the Fed’s last meeting of the year, on December 18:

Source: cmegroup.com

So where does that leave us?

We’re looking to buy dividends that ride this growing economy while profiting from inflation’s return. That setup points straight to one sector: natural gas stocks.

There are two other reasons to buy “natty” stocks now, too.

First, there’s the massive stimulus plan China announced a little over a week ago. That’s likely to spur gas demand, as China is the biggest importer, according to the Energy Information Administration (EIA).

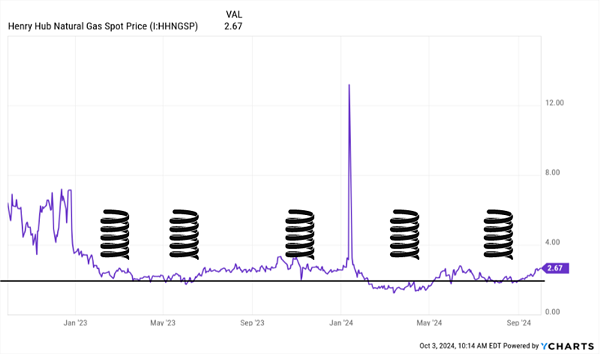

The other factor working in our favor is gas’s tendency to hit its $2 “price floor” and bounce—exactly what it’s doing now.

“Natty” Rebounds Off the $2 “Floor” (and Carries Momentum)

A price that’s bottomed and has momentum? That’s typically a great time to buy. So let’s dive into those two dividends I mentioned off the top, starting with our 8% payer.

“No-Landing” Pick No. 1: An 8% Divvie That Grows

At times like these, with energy prices still low but moving up, we look to the 8% dividend kicked out by the Alerian MLP ETF (AMLP), which holds the shares of energy infrastructure companies.

These firms—master limited partnerships (MLPs), to be exact—collect tolls on the oil and gas that moves through their lines and sits in their storage tanks.

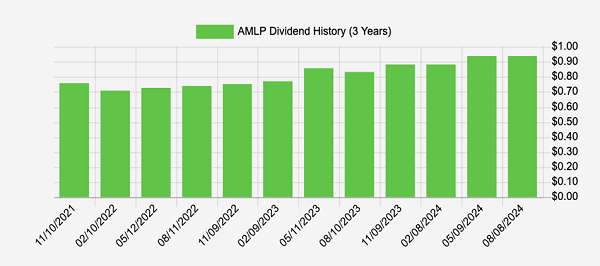

MLPs make money in all energy seasons, but it’s much better to own them when prices are at least steady or better yet rising, to snag price upside and sweet dividend payouts. When oil and gas prices (and shipping volumes) rise, the pipeline stocks AMLP owns boost their dividends. That’s resulted in a steady grind higher for the fund’s payout:

Source: Income Calendar

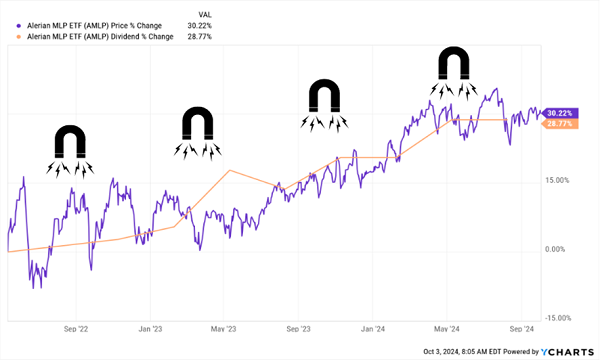

Best of all, AMLP’s rising payout pulls its price up—a phenomenon I call the “Dividend Magnet.” The pattern is unmistakable:

Dividend Hikes Ignite AMLP’s Stock

So where does that leave us? With an 8% “starter” yield that’s set to grow on a buy made today, as our “no-landing” setup pushes commodity demand (and prices) higher. Oh, and a share price poised to ride right along with it, too.

By the way, buying MLPs through AMLP also eliminates one of the headaches of buying MLPs “direct”: complicated tax reporting.

AMLP’s top holding, Plains All-American Pipeline LP (PAA), kicks you a fussy K-1 form at tax time, which is a hassle for you or the pro who files your taxes. (Trust me, I once got a firm talking-to from my accountant after buying MLPs a few years ago.)

But buy through AMLP and voila, no K-1! Just a normal 1099 showing your dividends received. Which, of course, dishes that elite 8%.

“No-Landing” Pick No. 2: EQT Corp.

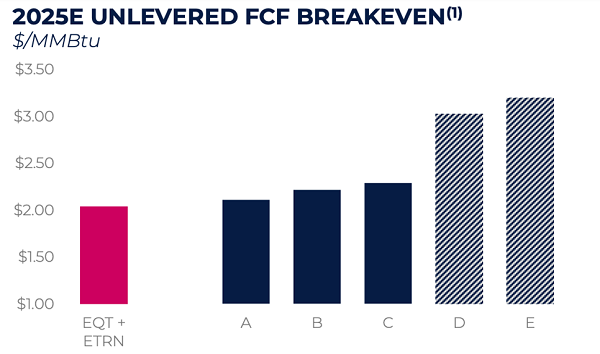

When natural gas is in the early stages of a rally, EQT Corp. (EQT) is my “go to” stock. The company boasts nearly 4,000 drilling locations—and the lowest breakeven costs in the industry. (Names hidden in the chart below to protect the less profitable!)

Source: EQT Q2 2024 earnings presentation

The prices above indicate at what level the company’s gas is profitable to drill. Notice that EQT leads the pack overall.

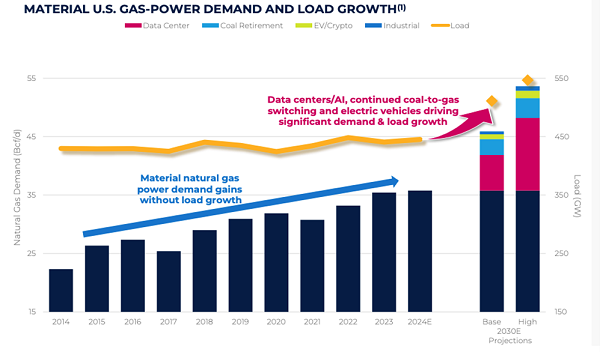

What’s more, the company is tightening its grip on the prolific Appalachian Basin through its recently completed $14-billion acquisition of Equitrans Midstream, its former midstream business, which adds 3,700 miles of pipeline, plus storage assets.

EQT sees the move resulting in $425 million in cost savings (The firm also recently cut its workforce by 15%). It also nicely positions EQT as it moves to boost production after last winter no-showed in large parts of the country, hitting gas prices.

Remember, too, that natural gas is the least offensive of the fossil fuels, which gives it long-term upside as a “transition” fuel as the world shifts toward renewables.

Source: EQT Q2 2024 earnings presentation

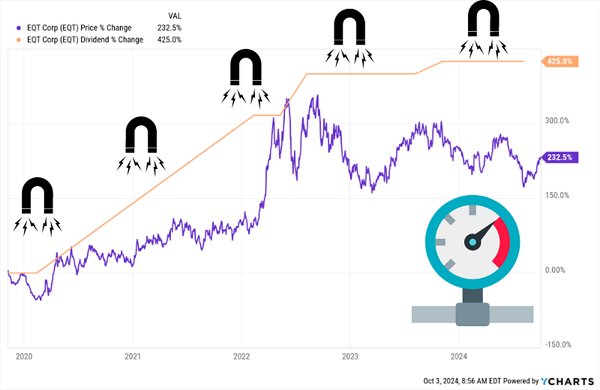

Which brings us back to the Dividend Magnet.

For months and even a few years, tickers can meander independently of their dividends. But eventually, they do follow their payouts higher like a puppy dog. EQT’s dividend has leaped above its stock, putting a strong pull on its price:

Dividend Magnet Puts Pressure On EQT’s Stock

Even if I’m wrong with my “no-landing” call, all signs point to this one winning anyway.

The stock is still well off its 2022 peak, its dividend is on a tear, and natgas production is about to ramp up, thanks in part to surging power demand from energy transition. That makes now a great time to buy EQT—and its charged-up Dividend Magnet.

Urgent: Buy These 5 “Inflation-Beating” Dividends Before Their Next Hike

Hard landing? Soft Landing? No landing?

The beauty of the Dividend Magnet is that it doesn’t care. You can use this proven strategy in any economy.

The core of my Dividend Magnet approach is simple (but not easy!): Look for a company that grows its dividend (and ideally one whose payout growth is accelerating), with a stock price that’s fallen behind.

Then BUY.

I say it’s not easy because to really see patterns like these, you need the right experience and charting tools to spot them. I’ve got both (the Dividend Magnet is at the heart of my Hidden Yields dividend-growth advisory). And I’ve done all the legwork for you.

The result is the top 5 “Dividend Magnet” winners” I’ve dropped into a recently updated Special Report. I want to share it with you today.

Sneak preview: EQT is on this list.

But it’s just the start. I’ll also tell you about a real estate investment trust (REIT) with a surging dividend and an outsized 6% yield; a “toll bridge” that makes money every time we pick up our cell phones (and pays out 6.1%); a gold miner that’s another smart play on a “no-landing” economy … and more.

They won’t be cheap for long—especially if inflation makes a surprise comeback. Don’t miss out.

Recent Comments