“I’m getting close to retirement,” my friend explained after a fun round of golf. (In 2020, any round of golf is a fun round). “And…” he continued.

“You’re looking to turn your nest egg into regular cash flow,” I jumped in.

Bingo.

Most retirees and soon-to-be retirees (wisely) focus on cash flow from dividends. Like my buddy, they don’t care about beating the market.

But, with some smart high-yield buys, it is actually possible to beat the market with cash payments alone. This may sound absurd in a world where, at least once a year, investors like you and me are treated to a slew of media reports pronouncing that for yet another year, fund managers couldn’t beat their benchmarks.

It’s a taller task, no doubt. That’s because most investors make the mistake of thinking about indexes as “average.” But they’re not average. They’re dispassionate formulas and algorithms that are virtually incapable of human error—and they’re also not handicapped with the real-world expenses that active managers have to charge to make a living.

They’ve got quite the edge, and it shows.

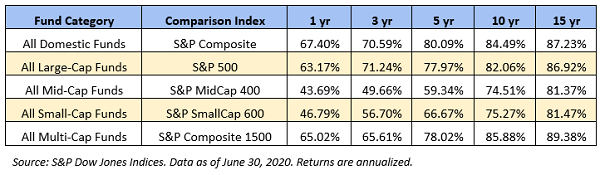

Percentage of U.S. Equity Funds Outperformed by Benchmarks

As you can see, it’s not impossible to “beat the market”—in fact, in the short-term, more mid- and small-cap managers have beaten their benchmarks than not. But over time, as managers have to time a larger number of entries and exits, they increasingly struggle to beat indexes’ automated calibrations.

One way you can try to get a leg up: Stop relying so much on price performance alone and collect large chunks of your returns in regular income checks.

But just how high of a bar do you have to clear?

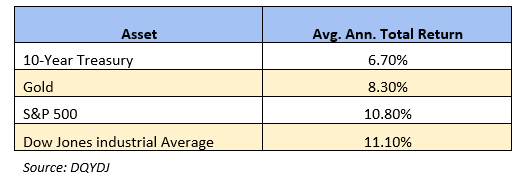

Let’s consider stocks, Treasuries and gold to see what investors likely need to beat over the very long term. Let’s also factor in numerous bear markets and bull markets alike to avoid setting unrealistically high or low expectations.

The numbers to beat:

Returns Since 1970

I know what you’re thinking: “How can I earn 11.1% annually in dividends alone?” After all, that’s roughly six times what the broader market yields!

Well,

- You don’t have to beat the market on dividends alone—if you get most of the way there, all you need is modest gains to get you over the mark. And,

- The market does include a number of extremely high-yield equities and funds that collectively can beat that roughly 11% annual stock-return average.

To start you on your way, let’s go over a three-pack of picks that collectively yield 10.7% in cash distributions, which would almost get you over the hump in cash alone.

If their payouts can indeed hold up to scrutiny, they’ll make priceless additions to your retirement portfolio for years to come.

Newtek Business Services (NEWT)

Dividend Yield: 11.7%

Let’s start by checking in with Newtek Business Services (NEWT).

Newtek is a business development company (BDC)—a type of company that Congress created in 1980 to help spur investment in small and midsize businesses. Like real estate investment trusts (REITs), they’re required to pay out at least 90% of profits as dividends, and yields in the category can reach to the sky.

It’s tough business that has only gotten more difficult over the past few years thanks to increased competition. And COVID has made BDCs’ lives downright miserable.

But Newtek isn’t like other BDCs. Whereas most of its peers are simply lenders, Newtek offers a range of services designed to help the very businesses it invests in: mobile payment processing solutions, web design, even payroll and benefits. And during COVID, it suspended its 7(a) lending program to become a Paycheck Protection Program (PPP) lender.

While Newtek looked more promising than other BDCs in more normal times, the company’s advantages simply haven’t been enough to overcome financial hardship for smaller businesses. You wouldn’t know it to look at its results from the first half of 2020: Adjusted net investment income (ANII) came to $1.58 per share, up 56% from the prior-year period!

Why, then, has NEWT struggled just as much as its peers?

BDCs: Lousy Business in 2020

It’s all about PPP. Newtek itself tells investors that “PPP lending activity contributed to record NII and ANII” during the second quarter.

But look what happened in Q3. PPP lending dried up, from $1.1 billion in the second quarter to $82 million in the third. And ANII fell off a cliff, from $1.37 per share in Q2 to just 4 cents in Q3, well below estimates.

Another round of stimulus could certainly bolster NEWT again, but shareholders seem to realize that this kind of lending is temporary, however much it helps. The core business could be painful for some time to come.

Starwood Property Trust (STWD)

Dividend Yield: 10.9%

Starwood Property Trust (STWD) is the largest commercial mortgage REIT in the U.S., but what makes this company so attractive is its diversified business lines.

The commercial lending business itself involves loans of anywhere between $5 million and more than $500 million in the U.S. and Europe across numerous property types. STWD deals in numerous forms of debt, including first mortgages, bridge loans, mezzanines and more, and even preferred equity.

But it also invests in high-quality real estate, including medical offices, multifamily properties in Florida and even Irish office and multifamily assets. It even provides infrastructure lending, too – construction loans, acquisition finance and project bonds, among others.

Starwood has taken its lumps just like the rest of the space. The biggest dent was felt in Q2, when core earnings dropped 17%.

Starwood (STWD): Hurting, But Not Lagging Its Field

But all told, STWD is holding up pretty well. Core earnings across the first nine months of 2020 are actually up 11% to $1.48 per share (4 cents more than its dividend obligations so far), including a less-than-4% decline in the third quarter’s core earnings.

The key here, and why Starwood might be worth a stab, is that multi-pronged business model that allows it to pivot when necessary. The company pulled back on its deployments in Q2 only to unload $1.5 billion in Q3, and when it did, it put $1 billion of that into non-core businesses—simply because that’s where the most attractive opportunities were.

That kind of flexibility, a wide runway for recovery and a nearly 11% yield make STWD a potential contrarian winner.

Office Properties Trust

Dividend Yield: 9.5%

Office Properties Trust (OPI) is a real estate investment trust (REIT) leases out nearly 25 million square feet of office space across 184 properties in 34 states and the District of Columbia. It primarily targets single tenants, especially those with “high credit quality characteristics”—about 65% of revenues come from investment-grade tenants.

Unsurprisingly, OPI took a nasty hit during the pandemic’s first wave, losing about half its value from its 2020 peak. Shares still are deeply in the red, in fact, off more than a quarter year-to-date even after vaccine developments sparked a quick but sizable run.

Office Properties Trust Still Has a Lot of Ground to Claw Back

Little wonder there. Office Properties Trust’s funds from operations (FFO) from the first nine months of 2020 dropped 11%, including a 15% decline in the second quarter.

That’s certainly not good, but let’s give credit where credit is due: OPI is at least a comparatively good operator. Third-quarter results, while down, were better than expected. The company has $800 million in liquidity. Its 55-cent-per-share quarterly dividend is more than 180% covered by FFO.

Occupancy did tick down by 50 basis points to 91.2% from the previous quarter, but here’s a welcome tidbit from the Q3 report (emphasis mine):

OPI entered new and renewal leases for an aggregate of 595,000 rentable square feet at weighted (by rentable square feet) average rents that were 31.0% above prior rents for the same space.

That Office Properties Trust shares remain so depressed is a message from the market. They’re not worried about OPI’s quality—they’re worried about a “new normal” in which telecommuting gradually drives down the amount of office space most companies need.

That’s not OPI’s fault, but it is OPI’s problem.

Don’t Miss My “Crisis-Ready” 10% Monthly Payer Portfolio

Do you know what I love about matching the market in cash alone?

Not having to draw down your nest egg just to enjoy those gains.

That’s what so many retirees simply don’t—and can’t—factor in. They think about averages, but you and I both know that every year is different. If you need 7% or 8% in capital gains to pay the bills, what happens in years like 2011 or 2015 when the market gives you 1% or 2%? Or 2018 when you’re sitting on a loss?

Crack-crack-crack goes the nest egg!

But with my 10% Monthly Payer Portfolio, not only can you enjoy a comfortable retirement without ever needing to eat away at your savings—you can collect your income checks just as frequently as your mailman delivers your regular bills!

These stocks and funds make up an “all-weather” portfolio that doesn’t need a perfect economic environment to churn out all-star income. But they’re not just dividend payers—they’re total return machines that have delivered (and can continue to generate) market-beating gains, allowing you to actually build your nest egg even when you’re retired!

Best of all: They’re recently nestled perfectly within my “buy-in” range.

I’ve personally hand-picked and safety-checked this unique portfolio, from every angle, for maximum safety. That includes a can’t-miss 7%-yielding preferred-stock fund that—unlike PFF, SPFF and PFFA—is actually increasing its cash distributions.

It’s a combination of stocks and funds that are so cheap that they could easily hold their own, even if political tumult and a COVID “second wave” put the market’s recent rally on ice—but if the rally does pick up steam, watch out above!

Either way, we’ll be soaking up 10% average yields the whole time!

These picks deliver truly life-changing dividends: In fact, if you drop $500K into this powerful portfolio right now, you’ll kick-start a $50,000 income stream.

That’s $4,166 a month in regular income checks!

Now is the time to get in, while you can still do so at a bargain. Click here to get everything you need—names, tickers, complete dividend histories and more—instantly.

Recent Comments