If I can give you just one piece of advice as we pass the midpoint of 2023, it’s this: do not trust your dividend income to ETFs!

Instead, look to the simple “payout-powered” strategy we’ll talk about in a second. As we’ll see, it generated a tidy 83% gain for readers of my Hidden Yields service in just over two years.

Now is the perfect time to put it to work again, with corporate earnings—and dividends—likely to rise next year after slumping a forecast 16% in 2023, according to a recent report from Morgan Stanley (MS). For 2024, the bank is calling for S&P profits to soar 23%, then tack on another 10% gain in 2025.

You can bet that dividends will follow those rising bottom lines. I’ll give you all the details on the proven “dividend-powered” scheme we’ll use to take full advantage in a moment.

First, let’s pick on some of the dividend ETFs many folks are sitting on these days. If you hold any of the three tickers we’ll dive into next, you’ll want to banish them from your portfolio yesterday.

Dividend ETFs Sound Great—But They “Bake In” Lame Returns

Putting all their trust in dividend ETFs is one of the biggest mistakes I see people make—especially in a rising market like this one. These folks (wrongly!) think that in a rising market, they can buy pretty well anything and be A-OK.

Not so.

In fact, a rising market when you’re most likely to buy low-quality investments, putting your portfolio in danger in the next downturn. Just ask anyone who bought crypto or profitless tech in 2021!

Dividend ETFs are at the top of our list of assets to avoid, not only now but always. For one, these funds are just too packed with blue chips whose payouts are growing at a glacial pace. Take the Schwab US Dividend Equity ETF (SCHD), a popular choice, thanks to the “Schwab” moniker.

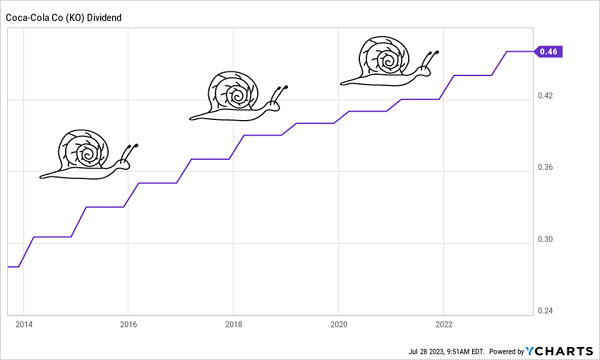

Trouble is, “robotic” ETFs often contain popular holdings like Coca-Cola (KO), whose payout inches up at a pathetic 2-cent-a-year pace.

Coke’s “Slowpoke” Dividend Weight Is a Drag on SCHD

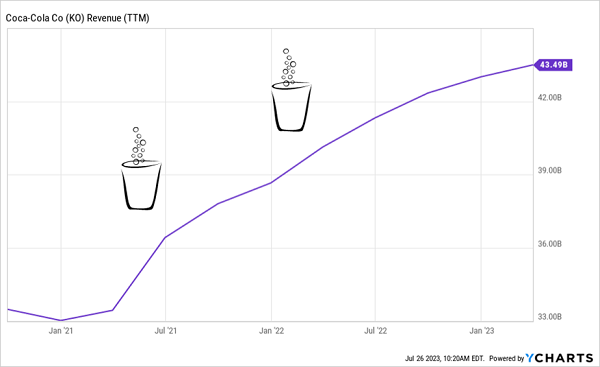

That’s inexcusable given the soaring sales Coke has booked recent years:

Coke’s Revenue Fizzes … But It’s Lean on Divs

Picks like this mean SCHD has basically gone nowhere this year, while the broader S&P 500 is up 19% as of this writing.

SCHD Barely Breaks Into the Black in ’23

This uninspiring performance isn’t just limited to SCHD, either.

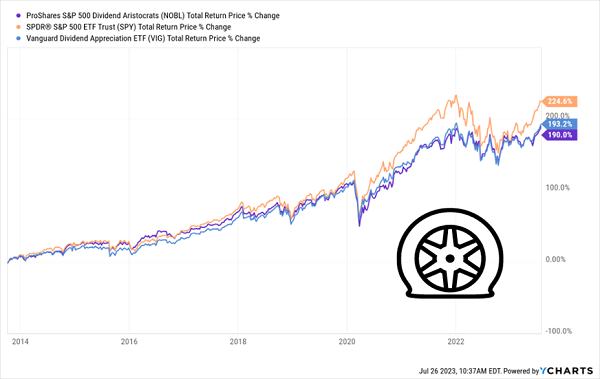

Consider two other popular picks, the Vanguard Dividend Appreciation ETF (VIG) and the ProShares S&P 500 Dividend Aristocrats ETF (NOBL). This duo are mainstays for many folks because, like SCHD, they focus on large cap stocks that regularly grow their payouts.

NOBL goes one better—as the name says, it holds the Dividend Aristocrats, the S&P 500 companies that have grown their payouts for 25 years or more. Throw in low fees (just 0.06% for VIG and 0.35% for NOBL) and, well, what’s not to like?

Lots, actually.

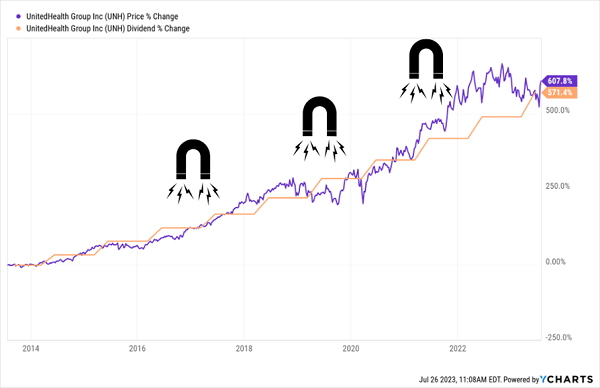

For one, both of these funds should have a built-in advantage because a growing dividend is the No. 1 driver of share prices. This is why we always target dividends that are not only growing but accelerating in the recommendations we make at my Hidden Yields advisory. These stocks’ “Dividend Magnets” pull their share prices higher over time!

So beating the market should be a cinch for them, right? Well, not so fast.

“Dividend Growth” ETFs Blow a Tire

As you can see above, VIG (in blue) and NOBL (in purple) lagged the S&P 500—shown in orange by the performance of the SPDR S&P 500 ETF Trust (SPY)—over the last decade, despite their rising payouts.

It makes you wonder why you’d bother taking the time to research a dividend ETF—especially when you look at their current yields: both pay 1.9%, only a bit more than SPY’s 1.4%.

Worse, both of these funds (like all ETFs) are locked into an underlying index: NOBL must own all of the Dividend Aristocrats, and VIG is nailed to the S&P US Dividend Growers Index, which aims to mimic the performance of US firms that have raised their payouts annually for at least 10 straight years.

So what are we doing instead?

Simple. We’re cherry-picking stocks with dividends that aren’t only growing but accelerating. As I just hinted at, a growing payout is a key share-price driver because investors catch wind of a dividend hike and drive the share price higher in lockstep.

You can see how a surging payout lifted shares of Hidden Yields holding UnitedHealth Group (UNH) over the last decade. (This one is actually VIG’s No. 3 holding—showing that the laggard ETF isn’t totally useless to us: it’s always worth picking through these funds to see if there are any gems hiding in the rocks.)

In that time, UNH’s dividend soared 571%. The share price followed, rising 609%. You can see UNH’s payout pacing its stock higher below:

UNH’s Payout-Powered Price Gain

That growth helped notch an 83% return from UNH in our first holding period, between January 2020 and December 2022, when it traded at $523.70 a share. We then went ahead and scooped it up again in February for much less than our selling price—a cool $499.

That shows the value of actively managing your dividend growers instead of going with “robotic” ETFs, whose attachment to an underlying index means they can’t shift with the market winds.

How to “Cherry-Pick” the Next UNH—Without the Work

The best news here is that you can grab powerful dividend (and price!) growers like UNH—courtesy of my proven “Dividend Magnet” system—and I’ll do all the work for you!

Recent Comments