I spend a lot of time parsing the latest economic data before recommending funds in our monthly CEF Insider service. And while the business press almost always leads with fear when it comes to the economy, the real numbers tell us something else entirely.

Case in point: The three little-discussed economic stats we’re going to dissect today. Taken together, they tell us that now is a great time to buy stocks.

But to make the most of the shifts they foretell in the economy, 8%+ yielding closed-end funds (CEFs) are a far better pickup.

Here are the three factors I’m talking about (in order of importance):

- American incomes are still growing.

- American savings rates are higher than they’ve ever been, and

- The Fed is likely to start cutting rates, which would send more of those savings into CEFs.

Let’s work our way along, starting with income. To be honest, a range of CEFs will profit from what we’re going to discuss today, but one ticker—a kind of one-stop shop for these high-income funds that pays an outsized 13.8% dividend—is especially well positioned.

So are average Americans really getting richer? The data says yes, absolutely.

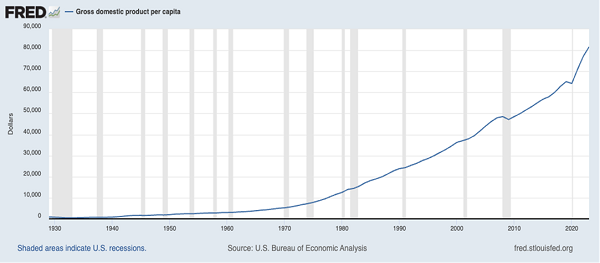

More GDP = More Income

When talking wages, the best place to start is GDP per capita, or the economic output per average American. According to this chart, it’s now worth $81,624 per year and growing fast.

That’s showing up in the average American salary: In 2023, it grew 5.6%, above the 4.8% average rate since 1930, when this data was first recorded. That’s a nice balance, with the economy improving for many people but not growing unsustainably.

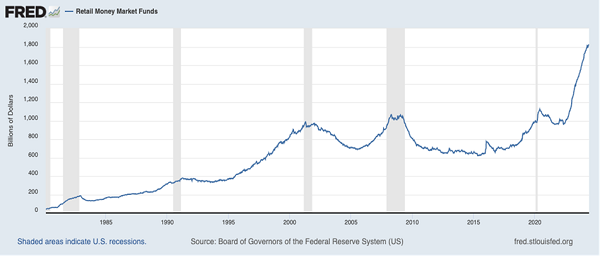

Let’s continue on to savings rates, which, as you’d expect, are growing, too, alongside wages. In fact, some stats surrounding the savings rate can sound downright unbelievable.

In Monday’s article, for example, we talked about the $6.4 trillion parked in money-market funds now. But what’s really eye-catching is that the amount of cash sitting in retail money-market funds (i.e., those aimed at average investors) has doubled from a decade ago and is growing at the fastest rate in history.

Americans’ Savings Are in Overdrive

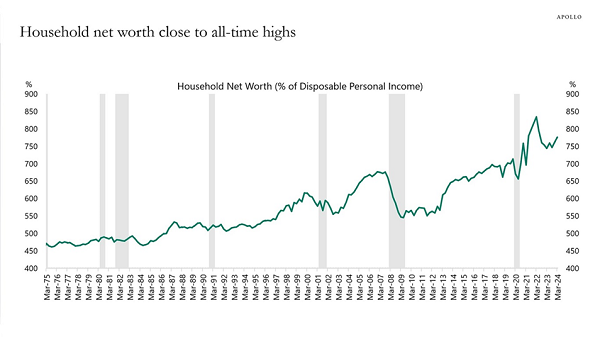

Moreover, the average American household has also seen its savings double what they were just a generation ago.

All this saved cash is making Americans feel richer, prompting them to spend more. But more of this cash will likely come off the sidelines and flow into other, higher-paying options when the Fed lowers interest rates, a move that will reduce the amount of interest paid by savings accounts and the like.

Stocks are likely to get a boost, sure. But remember that a lot of these folks are going to be looking to replace the income they were getting from money-market funds and similar investments, and the S&P 500, with its current yield of 1.3%, won’t cut it.

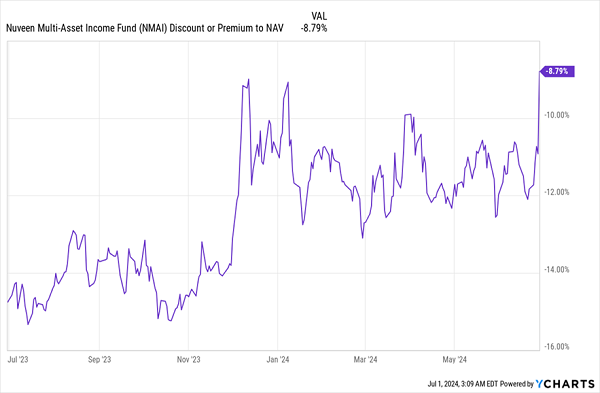

What will? CEFs! With average yields of around 8%, they’ll not only replace but build on the income these investors are collecting now. For example, you could replace the average American income of $78,000 by investing $624,000 in the Nuveen Multi-Asset Income Fund (NMAI), which yields 13.8% as I write this.

The fund also recently hiked its payout, defying the idea that high-yielding assets come up short on the dividend-growth front.

Unlike a lot of CEFs, which tend to focus mainly on one sector, NMAI is diversified across emerging markets, short-term US corporate bonds, blue chip stocks—Microsoft Corp. (MSFT) is a top holding—mortgage bonds and even real estate investment trusts (REITs) like cell-tower owner (and strong performer) American Tower Corp (AMT).

The fact that NMAI is a one-stop shop for diversified investing means more investors are likely to be drawn to it for income and diversification as rates fall. In fact, they aren’t waiting, as we can see in this chart of NMAI’s discount to net asset value (NAV)—the critical valuation measure for CEFs. It currently sits at 8.8%, and it’s been narrowing:

NMAI’s Discount Set to Shrink Further

More awareness of NMAI and other CEFs like it will probably prompt their discounts to narrow further.

I don’t expect the average American household to actually buy NMAI at scale. But a growing number of US investors will likely buy funds like it when they realize just how much income is on the table.

Of course, some investors have been using CEFs to maintain financial independence for years. Their ranks include CEF Insider members, some of whom have been with us since we launched eight years ago.

And since newcomers to CEFs need to buy their shares from those already in the market (as CEFs generally can’t issue new shares to new investors), those of us who’ve known about CEFs and bought them discounts are well-positioned to sell to these new buyers.

4 AI Funds (Yielding 8.1%) Primed to Soar as Cash Rolls Off the Sidelines

Here’s something else that may surprise you: artificial intelligence investments will be winners as cash rolls off the sidelines—just not the AI investments everyone thinks.

That might sound surprising, given the run AI stocks have been on lately. But that’s the beauty of CEFs’ discounts: They effectively let us buy the stocks these funds hold at prices we last saw weeks—and even months—ago.

The 4 AI funds I’m urging investors to buy now yield 8.1% on average and trade at deep discounts, setting us up for strong gains in the coming months. I expect this “gain-plus-dividend” formula to be irresistible to investors coming back into the market in the months ahead.

Recent Comments