As contrarians, you and I make our profits from stocks that are under-loved and under-covered. And today, we’re going to discuss five “under the radar” names with the potential to return up to 34% per year, every year, no matter what happens with the broader markets.

These stock prices have the potential to increase by 10% to 34% annually because that is how fast these dividends are growing. This type of growth may sound remarkable, and that is because the best dividend-growth opportunities are found in Wall Street’s blind spot: “mid caps.”

Mid-cap stocks don’t get the love that blue chips enjoy, which is perfect for us, because these are dividends that literally double every few years.

The Case for Mid Caps

Just like most things that don’t sit at the extremes, mid-cap stocks—those companies worth between $2 billion and $10 billion in market capitalization—often lack attention.

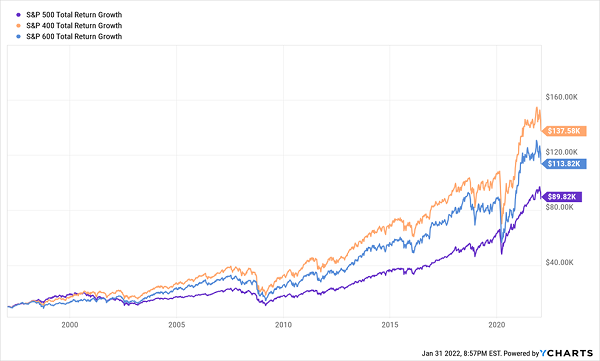

Basic investors buy blue chips. Gamblers buy small caps. But smart contrarians like us play the middle, because that’s where the best performance is.

If we had invested $10,000 each in small, mid- and large-cap stocks at this point in 1997, we’d be sitting on tens of thousands of dollars more in returns. Plus, we’d enjoy a lower risk profile than supposedly “growthier” small companies.

The Middle Ground is Pretty Fertile

What makes mid caps so great?

- Mid caps typically have stronger financial footing and have more access to capital than small-cap companies, making them a better bet in volatile markets (like these).

- Many mid caps do indeed pay dividends, whereas most small caps simply aren’t ready for that kind of financial responsibility.

- Plus, they still have more room to grow than their large-cap counterparts. Consider that more than half of the S&P 500 is over $32 billion in market cap, meaning a mid cap could grow by 3x to 16x and still only be a middle-of-the-road large cap.

- Mid caps also are small enough to avoid heavy media and analyst coverage alike, meaning there’s a greater chance for their stocks to become disconnected from their valuations. (Read: They tend to go on sale more frequently, and often sport much cheaper prices overall than overcrowded blue chips.

Mid caps fly under the radar in other ways, too. For instance, while you’re certainly aware of the “Dividend Aristocrats”—the shorthand for the S&P 500 Dividend Aristocrats—you might not know that there’s a mid-cap version of this venerable index, too.

The S&P MidCap 400 Dividend Aristocrats don’t have the same stringent criteria as the S&P 500 Aristocrats, requiring just 15 years of consecutive annual dividend hikes to earn membership. But this index is nonetheless chock-full of prolific dividend raisers, which my readers know allows the “dividend magnet” to do its work and pull shares higher.

To better understand just how much these lesser-known stocks can immediately upgrade your income portfolio, let’s dig into a few of the most prolific mid-cap Aristocrats that have been averaging roughly double-digit or better annual dividend raises for years.

Graco (GGG)

Dividend Yield: 1.1%

1-Year Dividend Growth: 12.0%

3-Year Dividend Growth: 9.5%

Graco (GGG) is a niche industrial company that deals in fluid management products across a wide array of businesses, from automotive, military and aerospace to downstream oil and gas. Just a few of their offerings include paint sprayers, automatic lubrication systems for heavy machinery, and diaphragm pumps for things such as fruit juices, pastes, jams and jellies.

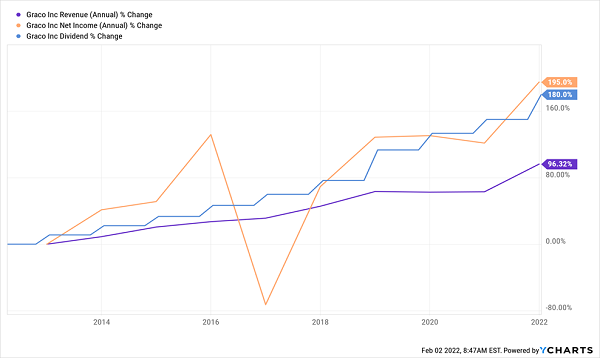

Boring? Beautifully so. Graco is a growth vehicle—sales have been higher in 11 of the past 12 years, and the company has averaged 5.5% annual top-line growth over the past 20 years. GGG is fairly dependent on the construction business, which made up almost half of 2020 sales, so that’s a cyclical risk to mind over the long run, but in the short run, that means Graco should be a beneficiary of 2021’s Infrastructure Investment and Jobs Act.

This consistent growth has done wonders for the dividend.

While the MidCap 400 Dividend Aristocrats have a lower bar to clear as far as consecutive raises are concerned, Graco is one of several that would qualify for the “big leagues” if it were ever elevated into the S&P 500. That is, in late 2021, GGG announced a 12% dividend raise to 21 cents per share, starting with the February 2022 payment—setting it up for a 25th consecutive annual dividend raise this year.

Graco Puts Its Profits Directly Into Shareholders’ Pockets

Silgan (SLGN)

Dividend Yield: 1.2%

1-Year Dividend Growth: 16.7%

3-Year Dividend Growth: 11.9%

You’ve almost certainly never heard of diversified packaging manufacturer Silgan (SLGN), but you almost certainly come in contact with its products every single day. That’s because its products are what consumer companies slap their labels on—everything from spray bottles to soup cans to microwave-dinner trays and more.

In fact, more than half of America’s metal food containers can be traced back to Silgan.

Given that many of Silgan’s customers are consumer staples names, this isn’t an overly cyclical business, and its consistency over time shows that—SLGN has posted top-line expansion in 10 of the past 12 years. Also interesting to note is that most of the company’s metal container customers are locked into long-term contracts that actually pass on commodity inflation, making recent metal-cost rises a pleasantly moot point.

Meanwhile, Silgan had already been aggressively raising its payout for years, but it gave investors a real treat in 2021. That is, a 2-cent hike to 14 cents per share came to a nearly 17% raise—well above SLGN’s already generous longer-term average. That marked the company’s 17th consecutive dividend increase since it initiated its regular payout.

American Financial Group (AFG)

Dividend Yield: 1.7%

1-Year Dividend Growth: 12.0%

3-Year Dividend Growth: 11.9%

Dividend Aristocrats have a reputation for dividend growth, sure, but also for low yields on current prices—which one would expect, as those dividend hikes keep pulling share prices along for the ride higher.

On the surface, American Financial Group (AFG) would seem to fit that mold, but a deeper dive reveals a truly powerful income factory.

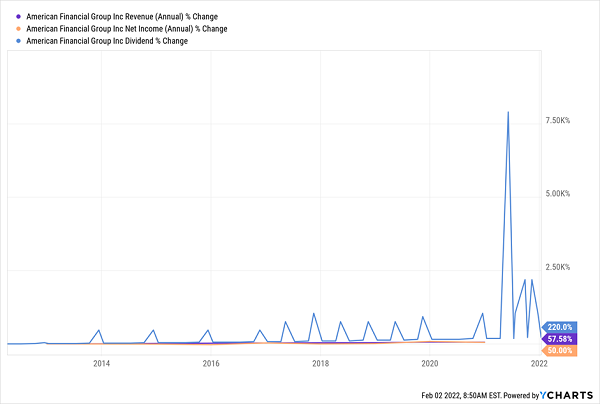

AFG is a financial insurance group specializing in property and casualty (P&C) insurance, specifically in commercial products aimed at businesses. The company’s roots go all the way back to 1872, when the Great American Insurance Company was founded. And while the bottom line is exactly what you should expect from a company whose payouts to clients are bound to vary from year to year, it has generally headed higher for decades, and are supported by extremely consistent and persistent revenue growth.

With the company’s 12% payout hike last year to 56 cents per share quarterly, American Financial Group clinched a 16th consecutive year of higher annual dividends. That’s impressive—but far more eye-opening is the company’s special dividends.

AFG typically pays out a special dividend or two every year as profits allow, often doubling or even tripling the yield provided by its regular dividend. But 2021 was truly “special,” with five such payouts combining with the regular dividend to return more than $28 per share to stockholders, or a yield on current prices of more than 21%!

Both the number of special payouts, and the size, were certainly anomalous in 2021. But what you can rely on is that special dividends will typically make AFG’s income proposition much more than what it seems.

AFG: A Rare “Regular” Special Dividend Payer

Nordson (NDSN)

Dividend Yield: 0.9%

1-Year Dividend Growth: 30.8%

3-Year Dividend Growth: 13.4%

Nordson (NDSN) is one of a couple MidCap 400 Dividend Aristocrats that really put the dividend pedal to the metal in 2021.

Like most of the other companies on this list, Nordson’s underlying business isn’t exactly a scintillating conversation topic. This is an equipment manufacturer whose products help other companies in dispensing adhesives, coatings, sealants and more; fluid management; and UV curing and plasma surface treatment. Its industrial coating systems, for instance, allow companies to do anything from producing cans to applying sealants.

Nordson is similar to these other mid caps in that its top and bottom lines have been broadly headed in the right direction for the past couple of decades. But NDSN has suffered some notable hiccups—including in 2015 and 2019. 2020 was especially (and unsurprisingly) painful, with profits dropping by 25% year-over-year.

Still, the company snapped back strongly in 2021, and Nordson seems positioned to handle inflationary pressures well given relatively small material costs compared to its peers.

As for the dividend? NDSN is as storied as they come, boasting 58 consecutive annual payout hikes. That includes a whopper in 2021—a roughly 31% hike to 51 cents per share quarterly.

Williams-Sonoma (WSM)

Dividend Yield: 1.7%

1-Year Dividend Growth: 34.0%

3-Year Dividend Growth: 18.2%

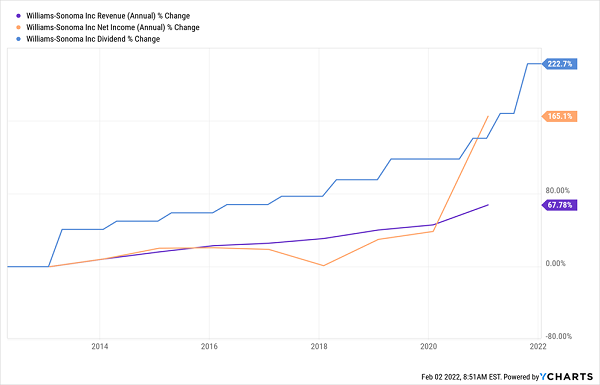

One of the biggest dividend increases from the mid-cap set in 2021 came from Williams-Sonoma (WSM)—purveyor of fine kitchen accessories and the oft-derided holiday-season Williams-Sonoma Catalog.

You might not realize this, but Williams-Sonoma is one of the most skilled e-tailers in the U.S., and that had absolutely nothing to do with COVID. Prior to the pandemic, the company had been deriving more than half its sales from its online channels. WSM, more than most of its competitors, saw the writing on the wall as Amazon.com (AMZN) knocked out retailer after retailer, and quickly pushed to deliver a superior online experience—which, to be fair, one would expect from someone peddling $4,000 espresso makers.

Love WSM’s Dividend? Chalk It Up to Peppermint Bark

That, and a firm footing in the luxury home-goods space, has made WSM the envy of other retailers, boasting consistent (and at times, robust) growth over the past decade. Recent years have been particularly good to the company. Williams-Sonoma generated $5.7 billion in sales in full-year 2019; over the trailing 12 months ending Oct. 31, it had brought in slightly more than $8 billion.

WSM—a relative young’un among the MidCap 400 Dividend Aristocrats at 16 years of consecutive hikes—has been able to fund a briskly growing dividend as a result. Though the company really rolled out the red carpet in 2021, when it announced two hikes—from 53 to 59 cents, then to 71 cents, for a combined 34% improvement.

Make 15% Every Year—Even During Recessions!

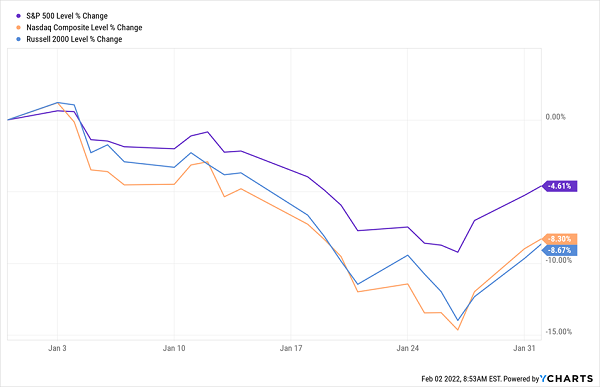

First-level investors that “buy and hope,” praying a relentless bull market will allow them to retire comfortably, are hoping against hope that 2022 will deliver the same red-hot returns we got in 2021.

So far, so bad.

I don’t know about you, but I prefer not to gamble my retirement savings away. I’d rather “dial in” 15% dividend-powered returns every year—bull or bear!

My baseline goal is to generate a minimum of 15% in returns each year, and right now, I’m targeting seven dividend-growth stocks that are capable of delivering at least that, if not more.

In fact, each and every one of these names is flashing all the telltale signs of stocks that are primed to double in just a few years.

It’s a bold claim, I know. But the reason I expect each of these seven stocks to deliver a minimum of 15% in annual returns is because they ace the so-called “shareholder trifecta,” where a stock pays us in three different ways:

- With a dividend today.

- A payout raise tomorrow (which lifts the share price accordingly).

- And by repurchasing shares (less float means more mileage per share on dividends and raises).

These “Hidden Yields” stocks can provide us with a recession-proof retirement. They can even make us as rich as we’d hoped to be in our younger days!

These dividends should pop, pop, pop—and when they do, their share prices will quickly follow. In other words, the best time to buy them is right now—before they soar, not after!

Bull or bear, I don’t care. These seven recession-proof dividend stocks are primed to deliver 15% returns per year, every year. Click now to get their names, tickers, buy-in prices and analysis explaining why their dividends are about to explode higher!

Recent Comments