There’s a dangerous dividend trap setting up out there. It’s easy to fall into, and if you make this mistake, you could do fatal damage to your nest egg—and income stream—in 2021.

It’s a classic error called “reaching for yield.” It happens when investors put too much weight on an investment’s current dividend yield without considering what’s behind that payout. More and more folks are making this blunder today.

I know what you’re thinking: “Michael, I can easily sidestep a mistake like that.” That’s easy to say, but it can be hard to resist when you’re confronted with, say, a 5% payout that seems safe at a time when income go-tos like Treasuries and stocks pay a meager 0.8% and 1.5%, respectively.

(This, by the way, is where we closed-end fund investors have an advantage: we can get much higher dividends from stocks and bonds—I’m talking payouts of 7%+—and downside protection when we purchase our investments through discounted CEFs.)

Junk-Bond Buyers Take More Risk for Less Yield

That brings me to the place where I see the next big yield trap forming: in high-yield (or “junk”) bonds. Yields on these assets have actually fallen to around 5%, on average, from well north of 11% when the COVID-19 crisis hit back in the spring.

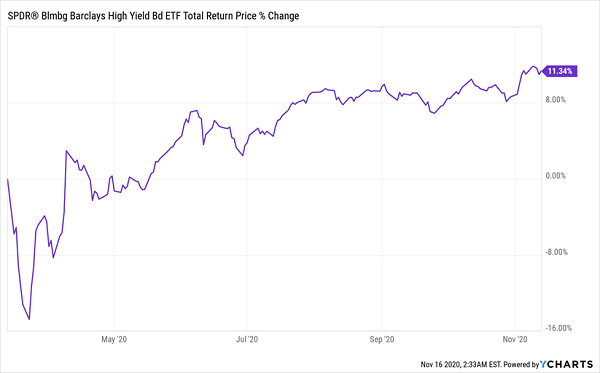

The yields on these bonds have fallen because yield-hungry investors have piled in, driving their prices up (and, in tandem, their yields down). You can see desperate yield-seekers bidding up the price of the SPDR Bloomberg Barclays High Yield Bond ETF (JNK):

Higher Defaults—But Higher Bond Prices?

Trouble is, with coronavirus infections spiking, consumers are sticking close to home again. That benefits some firms, like Amazon.com (AMZN), Apple (AAPL) and Google (GOOGL), but their bonds aren’t high yield. In fact, some yield less than government bonds!

The companies most negatively affected are the same ones that issue junk bonds. But that hasn’t stopped mainstream investors: they look at JNK’s 5%+ yield, compare it to the meager payouts on stocks and Treasuries and dive in regardless.

The bottom line is that the junk-bond market isn’t pricing in the amount of risk involved, which is why we need to be particularly wary now—and only buy (or hold) junk-bond CEFs trading at healthy discounts to their net asset value.

How to Get a Lower-Risk 7.2% Dividend (No Reaching Required)

This brings me back to CEFs, which provide a handy solution to today’s income dilemma, because they give you high yields from investments we all know well.

Consider the Nuveen S&P 500 BuyWrite Income Fund (BXMX). As the name suggests, it holds the stocks in the S&P 500 index. The main difference is that, unlike an index fund, BXMX gives you most of your yearly return in cash, thanks to its 7.2% dividend. That payout is five times bigger than the one on the benchmark S&P 500 ETF, and it’s more than JNK pays, too.The fund generates that income stream by selling call options, a kind of contract that offers speculators the option to buy BXMX’s holdings in the future in exchange for cash right now.

This strategy also helps reduce the fund’s volatility, which is why it sports a five-year beta rating of 0.86, meaning it’s 14% less volatile than the S&P 500—even though it holds the same stocks.

This also means that, if the market stalls in the future, BXMX will continue paying its income stream while protecting itself from major losses. But if the market continues to rise in 2021, as good vaccine news comes out, BXMX will also rise. That it BXMX an appealing hedge for the uncertain weeks ahead.

5 “Safety-First” 8% Dividends With 20% Upside (Bull or Bear)

BXMX clearly shows why you and I should part company with the mainstream crowd—the folks who think their only two options are to take heart-stopping risks for high yields … or settle for pathetically low payouts.

BXMX shows that a third way is possible—and that way leads straight through the closed-end fund market. And BXMX just scratches the surface; there are plenty of other CEFs out there paying even more than this fund’s 7.2% payout, and trading at even bigger discounts, too.

But you’ll never hear about these funds from advisors, or even from fund companies themselves! They’d much rather you simply buy an ETF. It’s easier for them to sell, and the costs of running an ETF—which, remember, is run by an algorithm, not a human manager—is basically nothing.

Trouble is, unlike CEFs, ETFs are never on sale. And, as we saw above, their payouts are much too small for you to build a healthy retirement on.

This is why I recently released my 5 top CEFs for you to buy now. These 5 income machines yield 8% now, and they trade at such deep discounts to the value of their portfolios that I see them jumping 20%+ in the next 12 months alone!

This remarkable 5-CEF mini-portfolio is perfect for the uncertain weeks ahead. The time to buy them is now. Go here and I’ll share everything with you: names, tickers, complete dividend histories and everything else you need to know before you buy.

Recent Comments