These days, I’m seeing something I’ve frankly never seen before in the markets: a lot of people questioning so-called investment “truths” they thought were frankly unmovable.

Most people’s natural instinct is to withdraw in times like these, but that would be a mistake in this case, especially for closed-end fund (CEF) investors, as it may result in funds that seem to always trade at a discount suddenly seeing those “eternal” sales come to a swift end.

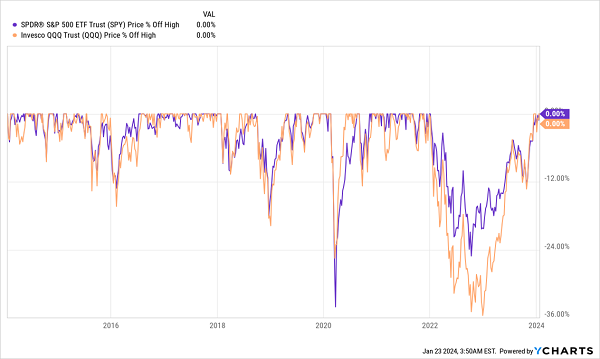

I know that’s quite a bit to unpack, so let’s start with the skepticism that seems to be rolling through the markets today, starting with the S&P 500’s new—and long-awaited—all-time high.

Back to Normal?

The first thing to note about this chart is how flat it is at the top. This is because the S&P 500 typically stays at or near all-time highs for a long time. Crashes, however, tend to mean stocks stay below their all-time-highs for a short period of time but fall steeply, hence the old phrase “stocks take the stairs up and the elevator down.”

Note that 2022 was a bit odd, at least compared to down markets over the last decade. With two years’ time to recovery, that bear market was much longer than usual.

That also means that our biggest risk is fear itself: With stocks now finally back at all-time highs after a painfully slow recovery, pundits continue to stoke worries that we could be heading for another pullback. That’s something to keep in mind when we read the financial headlines—and a very good reason not to make decisions based on them.

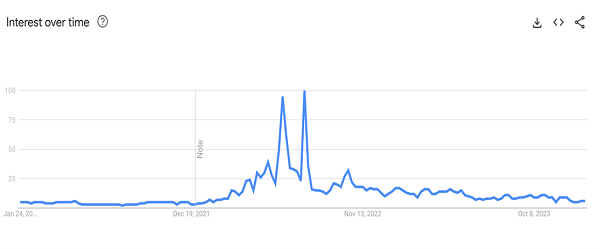

Markets aren’t panicking yet, of course; “Wall Street Forecasters Are Rushing to Lift Stock Outlooks” goes one Bloomberg headline, and the idea that we’re nearing a recession is almost becoming taboo. Just check out how often people are searching for “recession” now compared to in 2022:

Market Fears Collapse

Source: Google

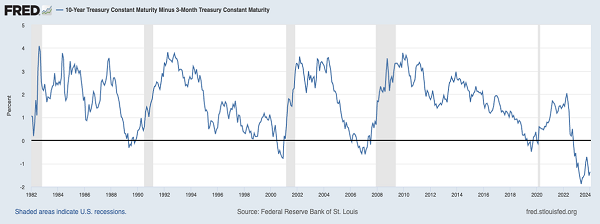

Truth be told, some data suggests there’s reason to be wary, particularly the so-called “inverted yield curve,” which occurs when yields on shorter-term Treasuries are higher than those on longer term notes. As the chart below shows, the yield curve (calculated on the yields of the three-month and 10-year Treasuries) remains inverted nearly two years after it first flipped:

Recession Indicator Still Flashing

That might make you think we’re overdue for a recession. But the definition of a recession matters, and there’s a wildcard that few folks pay attention to.

Recessions are officially defined by the Business Cycle Dating Committee at the National Bureau of Economic Research—basically a group of academics. Recessions are not, as most people believe, automatically defined by two consecutive quarters of economic decline.

This complicates our assumption that the inverted yield curve is predicting a recession, however. Truth is, the members of the Business Cycle Dating Committee can choose to define a recession whenever they want, really, as long as they agree.

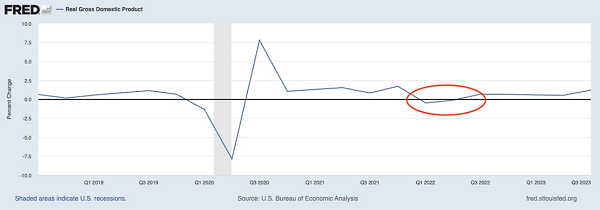

Typically, they declare a recession when there’s been two quarters of negative GDP growth, but they haven’t always. In early 2022, the economy saw slight declines for two quarters, so shallow that the NBER committee did not call it a recession, a move they were criticized for:

The Non-Recession Recession of Early 2022

But what if the yield-curve inversion doesn’t predict what the NBER says, but rather recessions based on the more commonly known definition of two quarters of economic decline?

In that case, the “recession” it predicted has already happened.

That would mean now is the time to buy CEFs, particularly stock-focused CEFs trading at discounts—and that goes double if we get a market pullback. Those discounts help secure our future upside, while bringing us a large income stream (CEFs commonly yield 8%+). That gives us a reliable cash flow we can reinvest in our CEFs during the short-term pullbacks (which are likely to be good buying opportunities).

I’d suggest going further and buying funds with long-term historical discounts. These are uncommon in a market like this, where everything is changing quickly and assumptions of the past, like the predictive power of the inverted yield curve, are being rethought.

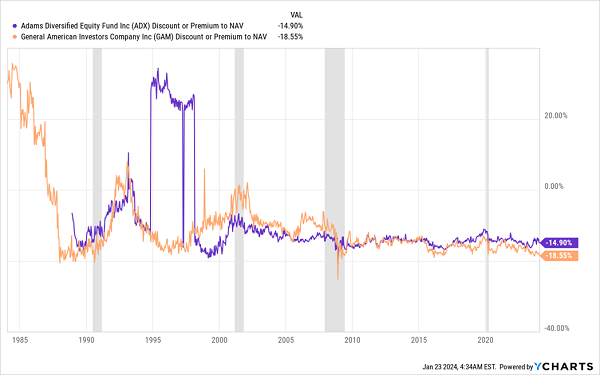

Two examples? The 6.2%-yielding General American Investors (GAM) and the 7.3%-yielding Adams Diversified Equity Fund (ADX).

(Both of these funds pay most of their dividends as year-end special payouts, and their overall payouts do float a bit. But that’s a plus for us, as it gives management more flexibility to devote cash to undervalued stocks when it comes across them.)

Both funds currently sport large discounts—15% for ADX and close to 19% for GAM—and that’s despite the fact that this duo both hold large-cap-stock portfolios that bear a resemblance to the S&P 500: ADX’s top holdings include Microsoft (MSFT), Apple (AAPL) and Amazon.com (AMZN), while GAM’s top picks are similar, Microsoft, Apple and value-focused names like Berkshire Hathaway (BRK.A).

Both also have nearly a century of history, with GAM being established back in 1927 and ADX in 1929. So we’ve got a lot of institutional memory working for us here. Yet both funds have been discounted for a long time—though not forever.

ADX, GAM Headed for Premiums of the Past?

Note from the chart above that previous generations rediscovered these funds and bid them to narrower discounts, and indeed premiums, from time to time, particularly in the 1980s and 1990s.

With more people re-evaluating investment touchstones they used to see as given, it might be time to bet that more will rediscover the classics.

These Are the 9%+ Dividends to Own as Investors Switch to the “Tried and True”

As I just mentioned, this market uncertainty has set up an ideal (and underappreciated) opportunity to buy our favorite high-yield CEFs: I’m talking funds with deep discounts, long track records and management teams who’ve profited in all types of markets.

The 4 funds I’m pounding the table on now are perfect examples, and the uncertainty we’ve seen from investors has extended their discount sales. In fact, they’re trading at such wide discounts I’m calling for 20%+ price upside this year, in addition to their 9%+ average yields

But as with ADX and GAM, I expect these discounts to disappear. Click here to read more about these 4 proven income (and gain) plays and download a FREE Special Report revealing their names and tickers.

Recent Comments