One of the biggest retirement-investment mistakes you can make is to make things more complicated than they need to be.

Funny thing is, Wall Street actually makes it easy to fall into this trap! Case in point: A new “financial product” from a group of companies, including BlackRock, that combines target-date funds and annuities.

We’ll get into why this isn’t a strong retirement option for those still working in a second. Then we’ll stack it up against a “straight down the middle” 9.2%-paying closed-end fund (CEF) that gives you the dividends, liquidity and growth necessary to fund a more comfortable retirement—maybe a lot sooner than you think.

First, let’s dive into the worrying retirement stats behind products like this.

$2,061 a Month Is Nobody’s Idea of a Comfortable Retirement

The average retirement account is worth just $88,400 today, according to a Northwest Mutual study. And the Federal Reserve estimates that Americans between 55 and 64 have an average net worth of $364,000.

Neither of these figures are enough to retire on, especially if you go by conventional wisdom. Under the “4% rule,” a guideline many financial advisors use as the “safe” amount you can withdraw every year in retirement, the average American nearing the end of their working years can expect $294 a month from their account, based on that $88,400 figure.

Social Security can’t fill the gap. The average American gets just $1,767 a month from that. In other words, a retiree who wants to stay in their home could expect $2,061 per month to live on, which is less than $1,000 per month above the poverty line.

I don’t doubt someone could retire on that, but I do doubt anyone would want to.

This is where that target-date-fund/annuity combo comes in. It’s a new kind of 401(k) product that aims to provide two benefits:

- It automatically diversifies an investor’s savings based on their age.

- It structures the investor’s savings to offer an annual income for life.

That annual income for life sounds attractive, of course. But the devil is, as always, in the details.

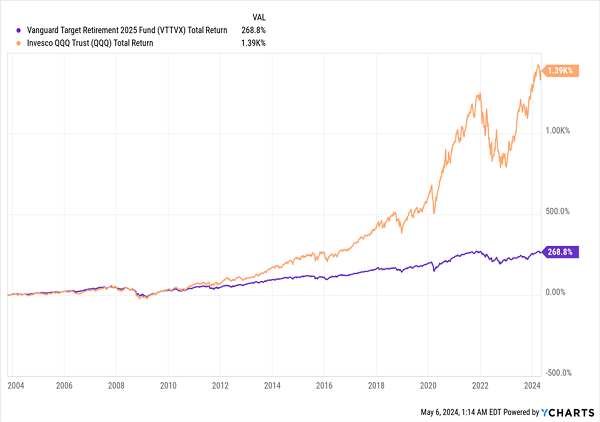

Step 1 involves a kind of target-date approach that has been popular in 401(k) plans for decades. Let’s look at what kind of performance a buyer could expect here, using a target-date fund we discussed recently, the Vanguard Target Retirement 2025 Fund (VTTVX), in purple below:

Target-Date Funds Bake In Lower Returns Than Stocks

As you can see, anyone who held this fund in their employer sponsored 401(k) for 20 years would’ve missed out on a far higher return from the NASDAQ, as shown through the benchmark index fund, the Invesco QQQ Trust (QQQ).

(Sure, the NASDAQ may be an aggressive comparison here, but the S&P 500 still more than doubled VTTVX’s return, so even a more conservative approach would have been much more profitable).

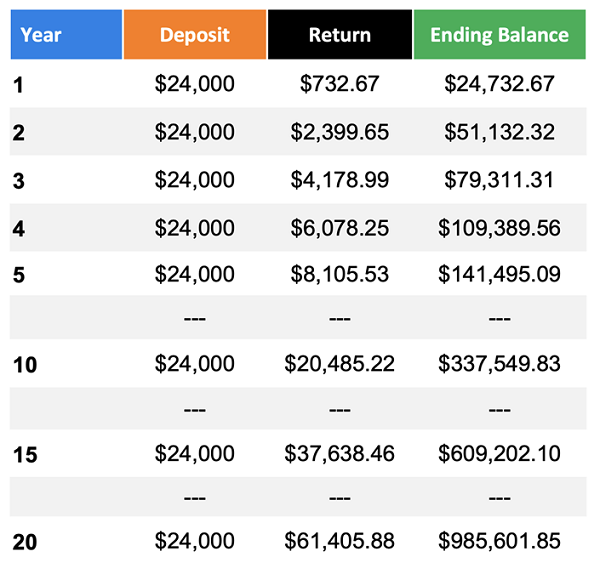

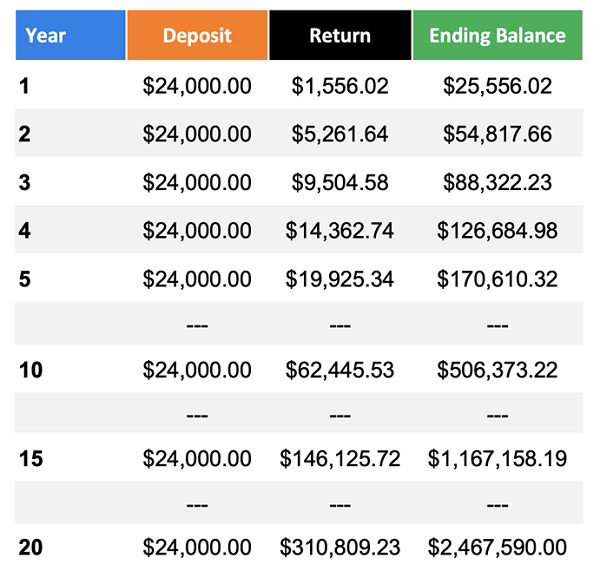

Now let’s make the above scenario a bit more real by comparing two hypothetical savers: one invests $2,000 per month over a 20-year holding period in VTTVX. The other chooses QQQ. Everything else is the same.

Target-Date Fund Returns

NASDAQ Returns

Our QQQ investor ended up with nearly $2.5 million, which at a 4% withdrawal rate nets $8,225 per month in income. The employee who followed their company-sponsored plan, however, had enough for just $3,286 a month using VTTVX’s return as our target-date-fund guideline here.

I think you’ll agree that this near-$5,000 per month in lost income is enough to keep many folks from clocking out. But it’ll still look appealing to workers because the promise of guaranteed income sounds great. (Heck, that weak return even benefits employers who might want their workers to stick around longer in the midst of a labor shortage!)

Here’s where the second part of this new product comes in: the structured income. Unfortunately, it only kicks in when the investor turns 55, so it will take younger workers decades to see if it works out for them. Even then, they likely won’t be too aware of the millions they missed out on.

This 9.2%-Paying CEF Is a Much Better Retirement Option

An advisor might respond to this with something like: “Sure, you’ll do better with just stocks, but you risk running out of money in retirement by selling at the wrong time, or by having bad luck.”

This is true. Which is why the answer for retirees isn’t pivoting to low-performing bonds as they age but finding ways to get a steady income out of their stocks without selling.

This is exactly what CEFs are designed to do—and many of the best ones have been providing this kind of income to investors for a long time.

Let me give you an example using the Liberty All-Star Growth Fund (ASG), which launched in 1986. The fund holds blue chips like Visa (V), Amazon.com (AMZN) and Microsoft (MSFT), as well as mid-cap growth stocks like SPS Commerce (SPSC), a maker of software for managing supply chains.

ASG yields 9.3%, which translates to $775 per month for every $100k invested. The fund does tie its payouts to the performance of its underlying portfolio, though, so they float from year to year. But that’s a plus because it lets management invest more money when there are bargains to be had. It also works to ensure you’re getting the fund’s entire return in dividend cash, which is how things have played out for our 20-year holders.

You can then choose to either reinvest in ASG or another asset or withdraw the funds to pay your bills. That’s one reason why retirees love CEFs, but here’s another:

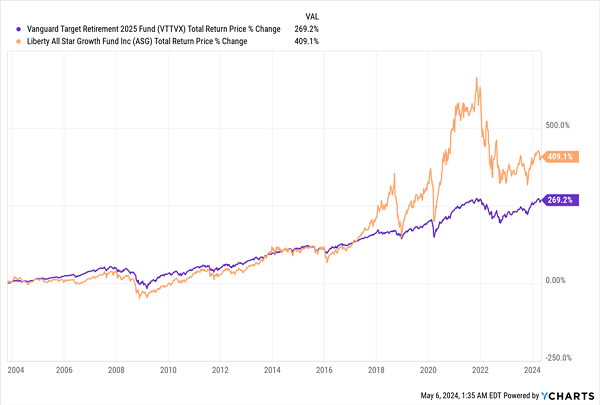

Bigger Long-Term Gains Than the Target-Date Option

ASG has crushed VTTVX while providing the liquidity an index fund cannot, making CEFs like this one the best of both worlds. Because of that strong return, and because that return has come as dividends, an investor who bought $100,000 worth of ASG 20 years ago would now have well more than double what the VTTVX buyer would’ve saved.

Finally—and even more important—ASG’s yield is so large we can forget about both Wall Street’s financial products and its “4% rule”: ASG yields more than twice that now, putting a “dividends-only” retirement squarely on the table.

5 BIG Yielding CEFs Kicking Out 100%-Predictable Dividends Every Month

ASG is a great way to “convert” the market’s gains into cash dividends. But as we discussed, its payout does float around a bit. And I know that many folks want a predictable income stream that rolls in every month, like clockwork!

I hear it from income investors all the time. And there are plenty of CEFs that do just that— like the 5 monthly dividend CEFs I’m urging investors to buy now. These 5 funds yield a rich 9.2% between them and their payouts come your way every 30 (or 31) days.

With an income stream like that, you could pocket $767 a month on a $100k investment. $3,835 a month on $500k, $7,670 a month on a mil … you get the idea.

All 5 of these reliable monthly payers are waiting to be bought now. Click here and I’ll explain how CEFs can offer these big—and monthly—payouts, which are pretty much unheard of in other parts of the investment world. You’ll also get a free downloadable Special Report revealing the names and tickers of all 5 of these bargain-priced 9.2% monthly payers.

Recent Comments