I hadn’t seen my boy in years. He wasted no time laying into my career decisions.

“Why are you messing around with the finance stuff? The blogging? No future in it.”

Well, good to see you too, buddy.

“You have real value in the software thing you’re doing. Stick with that.”

His advice was to leave Wall Street to him. He worked for a big-name firm. At the time of our run in, we were five or so years out of undergrad.

In true contrarian form, I ignored him. And it’s a good thing! Here we are talking stocks together and the software startup he wanted me to focus 100% on? The thing never made much money. I sold my stake in 2018 and never looked back.

My point? Wall Street guys don’t know the world outside of Manhattan.

But people listen to these Wall Street types like their word is scripture—and it’s anything but. Because these guys don’t have jobs that are down in the mainstream economy day to day. They don’t actually know what’s happening on the ground. They’re getting their information secondhand, thirdhand. They’re smart people, sure. They just don’t have the info.

And that is why we use analyst sentiment as a contrarian indicator. Kind of like magazine covers—by the time the suits catch a trend, that trend might be about to turn. So we actually want to find stocks where analysts are disinterested, or outright negative, or just asleep at the wheel. Because that is where the value hides—especially when those hated stocks are paying fat dividends.

I have my eye on five of them right now, yielding 6.5% to 15.6%. But first, let me show you just how asleep at the wheel the pros really are. You and I both know how they get their access—it’s with honey, not vinegar. So naturally, consensus ratings on most stocks tend to be overwhelmingly bullish.

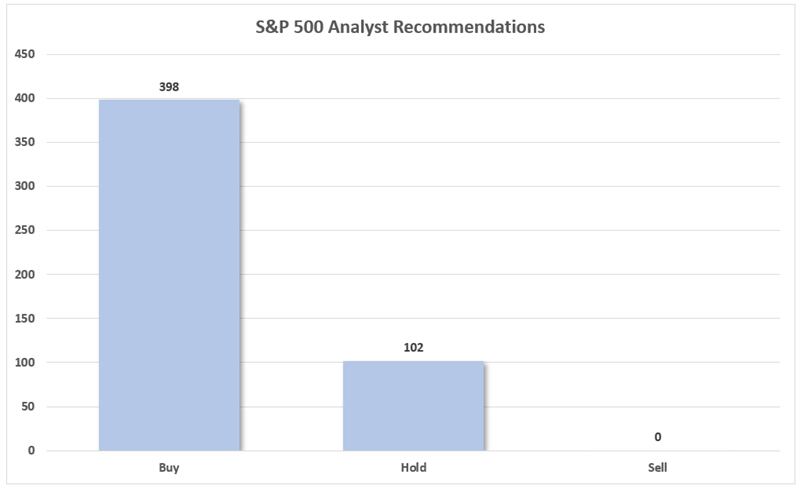

But even I was surprised by how ridiculous it’s gotten. Take a look at consensus analyst recommendations on the S&P 500’s components:

Not One. Single. Sell.

Source: S&P Global Market Intelligence

Buys make up about 80% of the calls. The remaining 20%? Mere Holds. Not a single Sell among them!

Remember: These ratings generally pertain to the coming 12 months. That’s an astonishingly optimistic view of every single S&P 500 component—especially with this many economic question marks floating around.

But if we venture outside of the S&P 500, we do find a few more bearish ratings. And those are much more meaningful to us. Because despite analysts’ well-understood bent, investors are still willing to follow their lead. Sell calls have far more room for upgrades that can trigger buying, which can trigger more upgrades, and turn into a virtuous cycle of higher ratings and share prices.

Which is exactly why we contrarians should always keep an eye on the Sell bin: names like these 6.5% to 15.6% payers are packed with potential on sentiment alone.

Now, let’s see if these names pass more than just the vibes test.

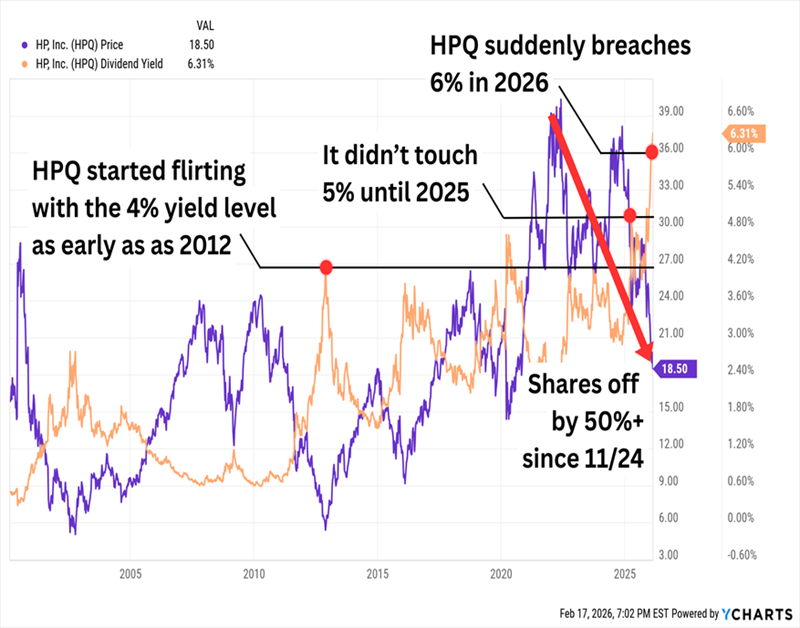

I’ll start with HP Inc. (HPQ, 6.5% yield), the personal computing and printing technology company that only recently started pinging my high-yield radar. In theory, that could happen from a massive dividend hike, but more often than not? It’s because shares have started tanking.

Looks Like the Latter

HP’s product lineup is actually quite wide. Its Personal Systems division spans commercial and consumer desktops, notebooks and workstations—plus point-of-sale systems, displays, even endpoint security. Printing covers consumer and commercial printers, supplies, solutions, and 3D printing. And then there’s Corporate Investments, a business incubation and investment division.

HPQ is cratering because those first two arms are being significantly impacted by what’s being called a “memory crisis”—memory-chip producers simply can’t keep up with the simultaneous demand from AI data centers and consumer electronics. This is driving up prices—DRAM pricing is expected to grow another 14% in 2026, while NAND pricing is set to explode by 140%—and forcing companies to re-price their offerings to salvage margins.

Combine all of that with a continued decline in print interest, plus the sudden early February exit of CEO Enrique Lores (who moved over to PayPal (PYPL)), and there’s not much for us to like about HPQ right now. In fact, I’m surprised the consensus isn’t worse. HPQ could be considered a “Bearish Hold” at this point; 8 pros call it a Hold, versus 4 Buys and 5 Sells.

HPQ, to its credit, has been dutifully raising its dividend every year for a decade now, including a 3%-plus hike to 30 cents per share near the end of 2025. And the payout still seems plenty safe at just 40% of current-year EPS estimates. But we could be looking at a falling knife as long as memory woes persist. If and when that changes, it might warrant another look from our corner.

Wendy’s (WEN, 7.0% yield) is another “Bearish Hold” (4 Buys/20 Holds/5 Sells) in the midst of a complete stock collapse. The burger slinger’s shares have been cut in half over the past year and lost 70% of their value since this point in 2023. That has sent our yield skyward!

And Wendy’s Even Cut Its Dividend by 44% in 2025

And as if the chart needed more drama, shares have been whipping around on fresh headlines. WEN surged 14% on Wednesday after activist investor Trian Fund Management said it was exploring strategic options, including a potential takeover of the company. As of this writing, the stock is already in retreat from that move. This kind of volatility tells you traders are speculating on deal chatter—not betting on a fundamental turnaround just yet.

The fast-food industry’s 2025 woes were well-reported, and they certainly weren’t limited to Wendy’s, the No. 2 U.S. hamburger quick-service restaurant in the nation. No. 1 McDonald’s (MCD) and No. 3 Burger King—part of Restaurant Brands International (QSR)—also suffered slumping sales in 2025.

But while MCD and QSR managed to find their footing thanks to improved lineups and stronger promotions, Wendy’s simply didn’t. It recently reported an 11.3% drop in same-restaurant sales for the final quarter of 2025 and provided an EPS outlook that was well short of expectations (56-60 cents vs. 86 cents). The pros now see 2026 earnings tanking by around 33%-34%.

It’s not for lack of a turnaround plan—Wendy’s launched “Project Fresh” last year to stem the bleeding. But a look at the details shows a lot of back-end focus (“optimizing labor,” “enhance brand relevance,” “digital and equipment efficiency”). It’ll close 5% to 6% of its 5,800-plus restaurants. It’ll cut back on breakfast in some locations. But where’s the plan that actually gets diners back through the door? I’m not seeing it.

Wendy’s is also doing all this under an interim CEO; Kirk Tanner departed in July 2025 for Hershey’s (HSY). Not exactly a vote of confidence.

That said: Wendy’s turnaround isn’t necessarily doomed for failure. Problem is, recent results hint toward a revival taking longer than expected. Plus, a new leader might very well want to tweak the plans based on his or her expertise.

But your yield is every bit as juicy as a Dave’s Double, so if WEN can maintain the dividend at current levels, this could end up being a deep dividend value for our portfolios. Shares just need to stay on the grill a little longer for now.

Let’s move on to a few more truly hated names—and a couple that we might actually want to keep our eye on.

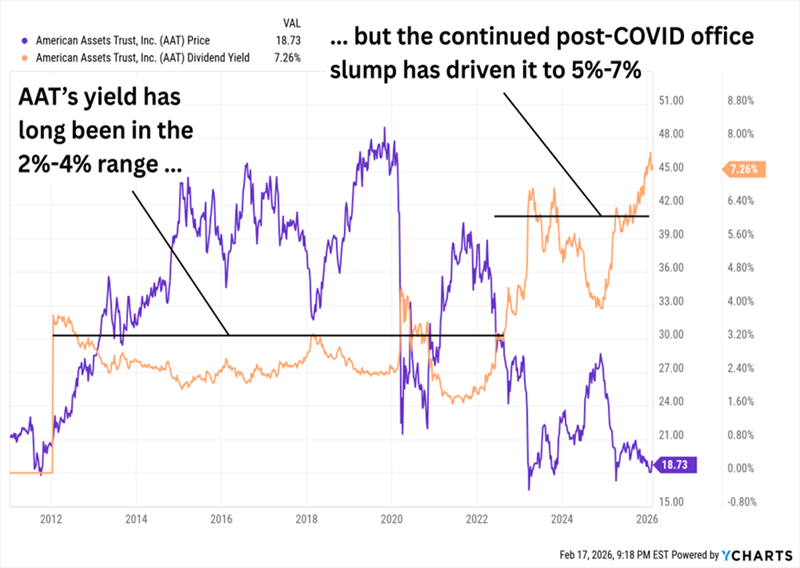

American Assets Trust (AAT, 7.3% yield) is a modest real estate investment trust (REIT) at just 31 buildings across the Pacific Coast, Hawaii and Texas—but those buildings include 4.3 million square feet of office space, 2.4 million square feet of retail space, 2,302 multifamily units, and 369 hotel suites.

On its face, the 7%-plus yield on a REIT like AAT would be less alarming than it would be on a Wendy’s or HP, just given the industry’s income-friendly nature. But AAT is just like those two companies in that its currently high yield has much less to do with its (glacially) growing payout and much more to do with its sinking share price.

RTO Still Hasn’t Revived AAT

No wonder “the Street” is sour on the name. AAT not only has zero Buy calls, but it also has a thin analyst following of just four names (2 Holds, 2 Sells). That small amount of coverage is telling, too—rather than place a Sell call on shares, it’s common for analysts to simply bow out and not risk peeving management. (Can you blame them?)

The company is coming off a brutal 2025 that saw funds from operations (FFO) drop to $2.00 per share, from $2.58 in 2024. The good news? It’s partly an effect of difficult year-over-year comparisons thanks to one-time leases. The bad news? It’s also a reflection of an extremely weak West Coast office market that’s not expected to get better anytime soon.

But it could get better eventually. Signs are showing a potential bottoming out in markets such as San Francisco and San Diego. There are other draws for our contrarian radar, too. AAT trades at about 9 times FFO estimates for 2026 and 2027. It yields 7%-plus thanks to sluggish shares. And that distribution is less than 70% of those FFO estimates—which, from that view, is pretty safe.

Problem is, those FFO estimates imply basically sideways to slightly down profitability over the next two years. Same-store growth was only about 1% in 2025, with little hope for improvement this year. And despite the seemingly low payout ratio, AAT pays out enough that it has little room to reduce its high leverage or develop new properties. Said another way: The dividend might be less certain than the payout ratio suggests if management wants to jump-start the business. We’ll keep watching, but we’re not jumping in yet.

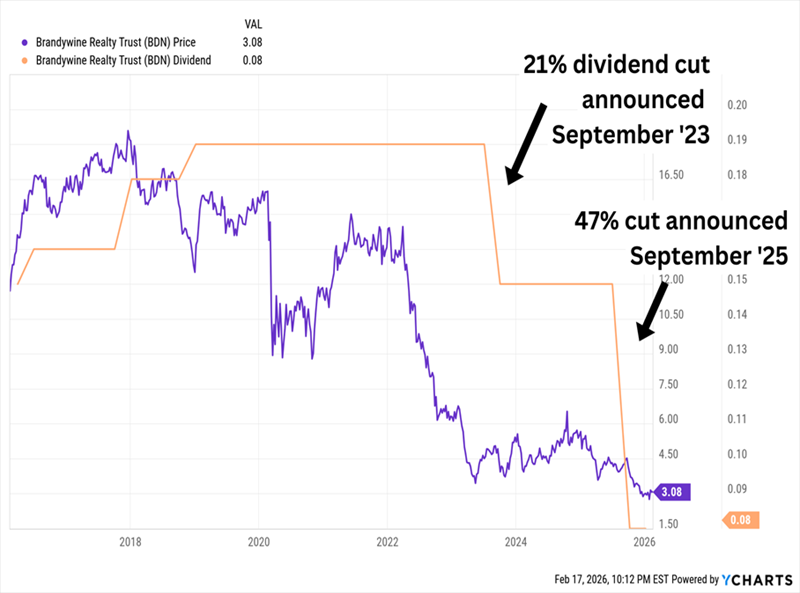

Brandywine Realty Trust (BDN, 10.4% yield) is one of the largest “integrated” (or “hybrid”) REITs in the U.S. Its full portfolio consists of 120 properties, but its “core” portfolio of roughly 60 properties is largely concentrated in Philadelphia and Austin—and is roughly 90% office in nature.

I looked at BDN back in September 2025. At the time, I said:

But let’s keep a really close eye on the dividend. The payout was 107% of FFO through the first half of 2025, and full-year FFO are expected to just barely pay for the dividend. If Brandywine runs into liquidity issues, that 13%-plus yield could be a rug-pull just waiting to happen.

Literally that same week, BDN announced its second dividend reduction in three years. (I wish I’d been wrong on that one!)

Poor Office Trends Have Crippled Brandywine’s Distribution

Again, office properties are having a miserable time of it. No wonder the pros have no love for Brandywine—three Holds, two Sells, and not a single Buy call.

But I want to focus on a few current and emerging positives that might make BDN more appealing for us down the road.

Brandywine still pays out 10% despite its significantly reduced dividend, and that dividend represents just 56% of consensus FFO estimates—a much healthier coverage ratio! The stock trades at just 5.4 times FFO estimates for 2026. And remember, I mentioned in September that “joint ventures have been Brandywine’s Achilles’ heel of late” because of how burdensome the development deals are on BDN. Well, BDN is working on simplifying its JV portfolio—for instance, it bought out its partner at 3151 Market St. (Philadelphia) during the most recent quarter. That’s the kind of cleanup we want to see.

The REIT still has more headwinds than tailwinds, and the environment for its core property type is miserable. Asset sales and balance-sheet cleanup would go a long way toward building confidence in this down-on-its-luck property owner. One for our watch list.

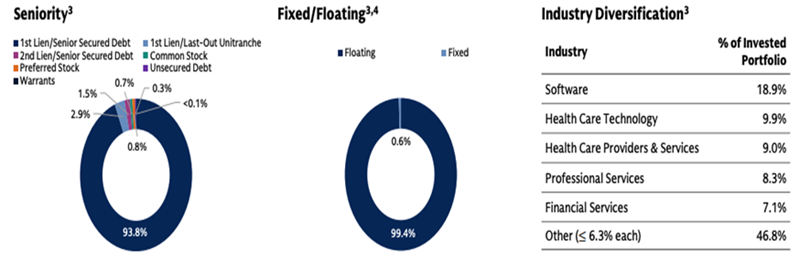

Goldman Sachs BDC (GSBD, 15.6% yield), which is coming off its own 2025 dividend cut, is a business development company (BDC) that provides financing to companies with annual EBITDA of between $5 million and $75 million. Its 171-holding portfolio spans about a dozen industries, and it’s concentrated in software (about 19% of the invested portfolio).

Source: Goldman Sachs BDC Q3 2025 Investor Presentation

GSBD also has zero Buy calls to its name, with a sparse analyst following that breaks down to 4 Holds and 1 Sell. The lack of analyst participation is even more glaring given that GSBD is one of the largest BDCs and is tethered to mega-cap investment bank Goldman Sachs (GS). You’d think that brand name alone would attract more attention!

Why the hate? Goldman Sachs BDC has been underwhelming since its 2015 IPO. It has grossly underperformed since the COVID market rebound. And it slashed its core payout by 29% in 2025. (GSBD also pays supplemental dividends; 1.7 points of its 15.6% yield come from these extra distributions.)

But there are two reasons we should keep watching GSBD despite its historical stank: 1.) It’s cheaply priced at just 72% of its net asset value (NAV)—that’s a 28% discount to what it owns!—and 2.) it has been ditching its legacy portfolio and been much more aggressive making deals of late.

This 11% Dividend Is Overlooked, Too—But in Much Better Position

My favorite “hated” dividend right now is every bit as diversified as GSBD. But instead of a portfolio of small businesses (which we don’t love in a shaky economy), it’s a smartly built bond portfolio that’s set to gain as rates fall.

But that’s not the only reason we love it. This fund …

- Pays out 11% in annual income!

- Has increased its dividend over time

- Has paid out multiple special dividends

- And pays its dividends each and every month!

That’s a resume few income investors could resist … and why would we?

This fund pays us $1,100 for every $10K we invest. All we need to do is sit back, relax, and let a skilled manager call the shots.

But premiums on funds like these tend to rise as volatility ticks higher and as investors rotate out of growth stocks and into reliable sources of income like this. I don’t want you to miss your chance. Click here and I’ll introduce you to this “ironclad” 11% payer and give you a free Special Report revealing its name and ticker.

Recent Comments