Fifteen months ago, we contrarians started the bond bandwagon. It’s hard to believe now, but back then the financial suits hated fixed income. We faded their fears, bought bonds and benefited.

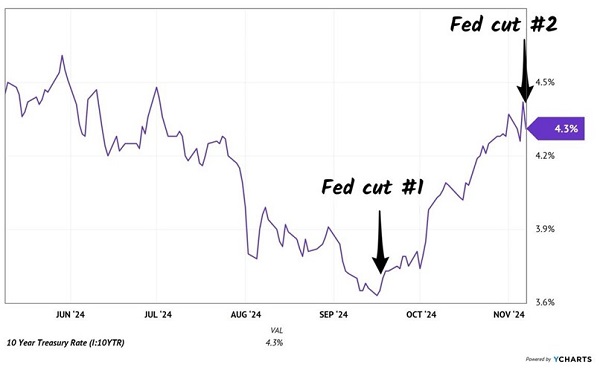

Now, however, I’m cautious on bonds. The 10-year Treasury yield has been on a tear since Jay Powell first cut the Fed Funds Rate.

Bond Vigilantes Scoff at Powell’s Rate Cuts

You can’t make this stuff up. On September 18, Powell cut rates by 50 basis points. However, this was only the “short end” of the yield curve. The 10-year yield meanwhile (the “long end”) popped from 3.7% to nearly 4.5% in a matter of weeks!

Oh, the irony! The bond vigilantes put Powell on notice that inflation is not dead yet. So, did Powell take the hint? Nope—he cut rates again.

If it sounds like Powell is like a desperate poker player on tilt, well, it gets worse. The Fed Chair is aware, as we all are, that Trump dislikes him. Powell has already said he will not resign if asked by the President-elect.

Which is a funny question because Powell does not report to the President. Perhaps even funnier that he answered it.

Net-net we should look for Powell to keep his punch bowl flowing to ease the political pressure on him. He’s already been conducting quiet QE. Why not keep loosening money?

Liquidity is bullish for stocks, which increases consumers’ spending power and the prices of what they buy. Meanwhile, we have three pillars of Trump 2.0: economic growth, tariffs and lower immigration. Three more boosts for higher prices.

Which means bonds, especially the vanilla kind issued by the US Treasury, are not the most appealing place to stash money for 10 years. Would you want to lend to Uncle Sam for a decade at just 4%+ annually given this backdrop?

Bonds become hot potatoes in this environment. These fixed-rate payers lose luster as rates rise.

Floating-rate bonds (with coupons that increase alongside interest rates) don’t have this problem. They keep their value and can even appreciate.

Tickers? Let’s start with these three ETFs, which combine for more than $11 billion in assets under management:

- iShares Floating Rate Bond ETF (FLOT, 5.5% SEC yield): FLOT, the largest pure-play floating-rate bond ETF, tracks an index of roughly 375 investment-grade floating-rate bonds. The portfolio is roughly three-quarters invested in corporates, including a heavy 50% weighting in banking-sector bonds. However, the remaining quarter is in supranational bonds—debt issued by international organizations such as the International Monetary Fund and the World Bank.

- SPDR® Bloomberg Investment Grade Floating Rate ETF (FLRN, 5.4% SEC yield): FLRN costs the same (0.15% in annual expenses) as FLOT and even tracks the same index, but it’s not identical. There are a few small differences, including a slightly higher weighting in finance-sector bonds and a little more exposure to AAA-rated debt.

- VanEck IG Floating Rate ETF (FLTR, 5.6% SEC yield): FLTR actually provides a little differentiation. This is a global floating-rate portfolio—55% is invested in U.S. bonds, with the remaining 45% spread across seven other developed nations, including Australia, Canada, and the United Kingdom. Also, this fund is entirely made up of corporate bonds, 85% of which are from the financial sector.

All three of these funds are entirely (or virtually entirely) invested in bonds with maturities of 5 years or less. That’s par for the course for floating-rate funds.

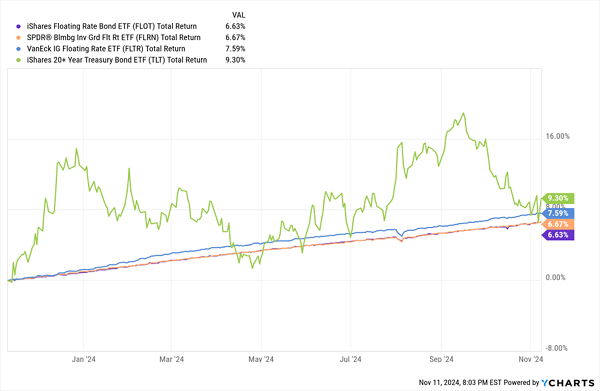

Regular bonds within this maturity schedule have also suffered since the Powell rate cut, just not by as much as longer-dated bonds. So floating-rate bond ETFs, shorter-term as they might be, are still very much bucking the trend:

But Wow, They Don’t Really Move All That Much, Do They?

Yes, these floating-rate ETFs are about as steady as steady gets, and they’ve certainly made it through the past few months with gusto.

But as crazy as it sounds, they leave a lot of yield on the table.

Floating-rate closed-end funds (CEFs) can get us into the double digits—though we do need to determine whether we’re buying high yields, or high-yield traps.

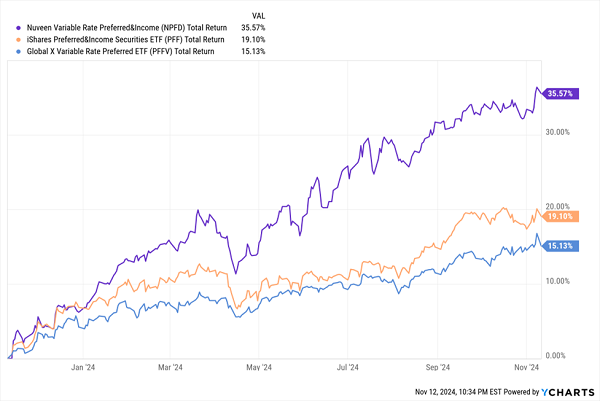

Nuveen Variable Rate Preferred & Income Fund (NPFD, 10.5% distribution rate) is an interesting alternative to bond-specific floating-rate fixed income.

This relatively young fund, which came into being a little less than three years ago, primarily invests in companies’ variable-rate preferred securities (and other variable-rate income-producing securities). And like most preferred funds, it’s heavy in financials. In fact, its four top industries—diversified banks (32%) such as JPMorgan Chase (JPM) and Citigroup (C), insurance (16%), capital markets (12%), and regional banks (11%)—are all within the sector. Credit quality is quite high, too; more than 75% of assets are invested in investment-grade preferreds.

I first wrote about this fund a couple of years ago in the middle of a slump for preferreds and noted that it was bleeding even more profusely than its plain-vanilla counterparts across both traditional and variable-rate issues.

But that CEF juice (read: 37% debt leverage) is working in NPFD’s favor in this part of the rate cycle, and it has managed to keep pushing higher following the September rate cut.

Management Is Simply Better Armed and Positioned to Capture Upside

NPFD also gives us the monthly dividends we value, and it has even put together a nice little streak of distribution hikes.

Valuation is a little difficult to get a read on, however. This Nuveen CEF trades at a 6% discount to net asset value (NAV), which isn’t bad, but there’s limited history; its 1-year average discount is deeper, though, at 11%.

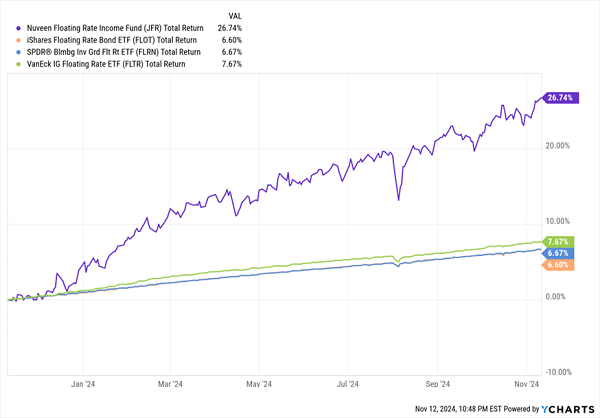

Another Nuveen fund worth a look is the Nuveen Floating Rate Income Fund (JFR, 11.4%), which is a more traditional variable-rate CEF with a massive monthly payout.

This is an actively managed portfolio of roughly 430 corporate floating-rate bonds. Credit is on the junkier side, with only 10% of assets in investment-grade bonds. But it is nicely spread out—five sectors have double-digit weightings, led by consumer discretionary at 19% and information technology at 17%.

Perhaps most helpful at the moment, though, is its holdings’ maturities. JFR’s bonds aren’t particularly long, but they’re longer than the ETFs above, with 58% in the 0- to 4-year range, and the rest in 5- to 9-year territory.

That, and a heaping helping of debt leverage (38%), have helped JFR rocket past its more tempered ETF rivals:

But patience is a virtue here. The cat is largely out of the bag, with NPFD’s discount to NAV closing from its roughly 9% five-year average to a currently slim 3%.

The One 11% Dividend to Own Now

That 11% dividend might be out of bounds for now, but my One 11% Dividend to Own Now is still firmly in “buy” territory.

Secure dividends are the ultimate safety net—they’re cash in your pocket, right here, and right now, no matter whether your tickers are flashing green or red.

The dividend stocks above provide a lot of market cover even at single-digit yields.

So just imagine what kind of protection against volatility you could get from a 11% dividend.

My One 11% Dividend to Own Now is a rare machine capable of generating a simply ludicrous amount of cash. A 11% yield, in the most practical terms, is:

- $916 a month from a mere $100,000 investment

- $55,000 a year—a proper salary in many parts of the U.S.—from a mere $500,000 nest egg

- A wild $110,000 annually if you have a million bucks to put to work

Paid out for sitting around and doing nothing but waiting.

That kind of money doesn’t just buy you things.

It buys you comfort. It buys you peace of mind. It buys you a regular good night’s sleep—where you stop wondering and worrying about which way the market’s winds will blow next.

It could even buy you the ability to live off of dividends alone, without ever laying a finger on your nest egg.

But you don’t have much time. If you miss the deadline to get on the list now, in a few days, you could be leaving money on the table—and might not be able to lock in this 11% when the next distribution comes around.

Recent Comments