Does the name William Bengen ring a bell? If not, don’t worry. Many people haven’t heard of him. But he’s likely to have a major influence on your financial situation (if he hasn’t already).

Bengen is the (now retired) financial advisor who came up with the so-called “4% rule,” which is seductive due to its simplicity: it says you can safely withdraw up to 4% of your assets in retirement without having to worry about running out of money.

Obviously, such a vague rule has critics, with most of them suggesting 4% is too lenient. Most of these folks are financial advisors who take fees to manage people’s money, so they definitely have an incentive to keep their clients working and investing!

Others, like me, argue the rule is too strict, and that one can safely withdraw more per year with the right strategy. That strategy starts with choosing a high-yielding closed-end fund (CEF) that invests in strong blue chip stocks and has a proven track record. We’ll talk about just such a fund in a bit.

But first, back to the 4% rule. Despite its controversies, it’s been the backbone of much of the asset management and financial planning in the US for decades, meaning that when people advise you on retirement, they’re likely to use the 4% rule as a starting point—maybe even an ending point.

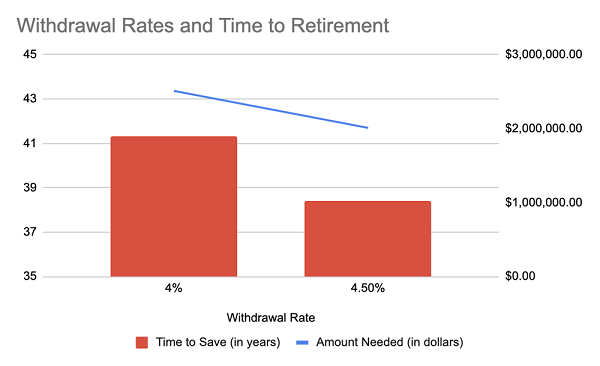

I’m not the only one who thinks Bengen’s rule is outdated and too strict; Bengen himself agrees. In the 2000s and the 2010s, both before and after the dot-com crash and Great Recession, Bengen revised his number to 4.2% (and more recently to 4.5%).

That’s a big difference; it means someone saving 10% of their income and earning $100,000 a year could cut how much they have to work by a full three years.

Source: CEF Insider

Now, if Bengen’s rule was wrong the first time, when he said 4%, could it be wrong again at 4.2% or 4.5%? I think all of these numbers are way too stingy because I know people who have been retired for decades on a much higher income stream—plus their principal has grown sharply over the same period.

The Secret to Big—and Safe—Retirement Income

This is where CEFs shine because they convert much of the gains from whatever assets they hold into an annual income stream. The Nuveen Nasdaq 100 Overwrite Fund (QQQX), for instance, buys all the stocks in the Nasdaq 100 and translates its profits into quarterly dividends that currently yield 6.8%.

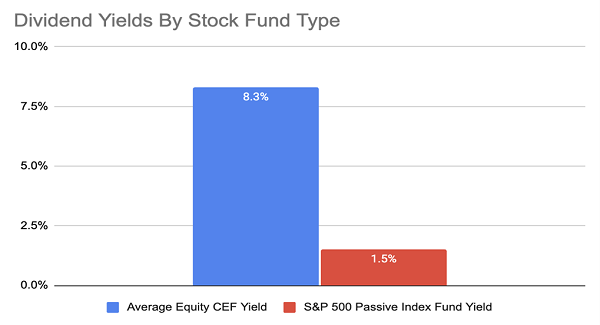

And that’s actually on the lower end for CEFs: the 500 or so of these funds out there currently yield around 8.3%, nearly six times what the average S&P 500 stock pays:

Source: CEF Insider

Immediately something becomes obvious: if the equity CEF doesn’t lower its payouts, you’ve got an 8.3% passive income stream, meaning you could retire with less than $1.1 million instead of $2.5 million (assuming your numbers match the example above). That’s not just cutting your total savings in half; it’s lowering the amount of time you have to keep working, too.

What if Payouts Decrease (or Stop)?

One worry about high-yielding funds is that they may cut payouts. And I will admit, some CEFs do this. Others don’t, though, and it isn’t always the highest-yielding ones cutting the most! It’s more complicated than that.

But even then, there isn’t reason to worry if you choose a good CEF. I want to show you what I’m talking about with the example of the oldest CEF on the market, which actually dates back to the mid-19th century: the Adams Diversified Equity Fund (ADX), which has survived the Great Depression, two world wars and every market calamity since.

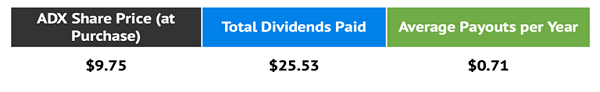

But ADX holders (including those who bought on my recommendation through my CEF Insider service) aren’t worried about their income, thanks to this:

Going back to the late 1980s, ADX has paid out an average 7.2% per yield. This means that the $2.25 million our hypothetical retiree needs at 4% withdrawals has collapsed to $1.25 million.

Note that ADX pays out the bulk of its dividend as a year-end special payout and these payouts can range, depending on the performance of the fund’s net asset value (NAV. or the value of its underlying portfolio).

Management is committed to paying out at least 6% of the fund’s trailing-12-month average month-end market price, but its yields are usually much higher, as you can tell by the 7.2% average above. Last year, for example, ADX paid out 8.1%, despite the 2022 pullback.

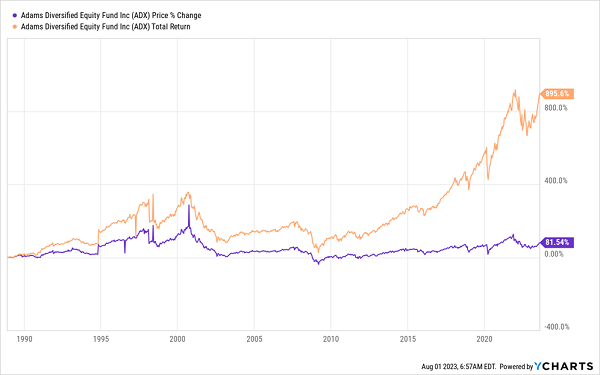

The difference between 4% and ADX’s 7.2% long-term average yield is huge: it amounts to a decade of working and saving. And there are share price gains to consider here, too:

More Than Just Income

With income, ADX’s total returns are nearly 900%, but since it’s really a machine to turn stock returns into annual payouts, most of that is paid out as dividends. But ADX earns more than its payouts and has done so for decades. Which is why anyone who bought ADX back would have also seen the value of their investment grow 81.5%, over and above their 7.2% average yield.

This is why CEFs should have a place in your portfolio: by picking the right ones and diversifying across the CEF space (these funds invest in a range of assets, from blue chips to corporate bonds to REITs), they can deliver high income that could give investors financial freedom years earlier than they thought.

5 More CEFs to Buy Now—for 9.1% Dividends and “Clockwork” Monthly Payouts

ADX is one of my favorite CEFs—management’s pledge to keep dividends high is ironclad. But its approach does mean its yield moves around a bit from year to year.

If you want a steadier income stream, I get it. And CEFs can easily give you that. In fact, more than half of these funds pay dividends every single month.

And you don’t have to sacrifice high yields to get these predictable payouts. My 5 top picks in monthly paying CEFs yield 9.1% now, and I’ve put my latest research on them in a Special Report I want to share with you now.

Recent Comments