Today I’m going to show you, hands-down, the easiest way to add rental real estate to your portfolio.

Don’t worry—you won’t have to leave your computer! Instead of hitting the streets to buy a four-plex or apartment building to rent out, we’re going to purchase a recession-proof real estate income stream straight from your online brokerage account.

And believe it or not, thanks to a current market anomaly, we can snag better deals online right now than we can in person. I’ll explain the details in a moment—including 2 stocks with yields that double what your average stock pays, and double-digit payout growth, too!

First, let me give you the lay of the residential real estate landscape.

A Bait-and-Switch Market

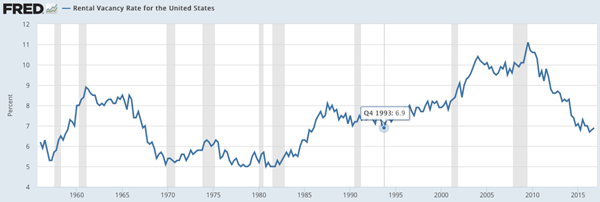

As I write, apartment vacancy rates across the US are tight—sitting at 6.9%, the lowest level in 24 years!

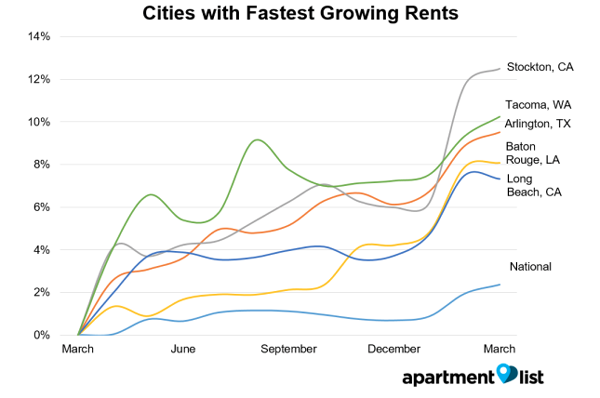

And if you happen to own a rental abode in the nation’s hottest locales, congrats! Squeezing more income out of it has never been easier. Check out the year-over-year gains in the five best places to be a landlord:

All this makes buying a residential rental property a no-brainer, right?

No way.

Because outside those scorching markets, fatter rent checks could soon be history: in March, for example, rents nationwide rose 2.4% from a year ago, which is below the 2.7% inflation rate.

Think about that for a moment: if you can’t raise the rent above inflation, it’s the same as a dividend cut!

And the trend is looking worse.

This year’s rise is down from 2.8% in 2016 and way off from 3.7% in 2015. And late-to-the-party developers are about to throw open the doors on scores of new units, clamping another weight onto rent growth.

That leaves you betting on capital gains—but with mortgage rates rising and more rate hikes ahead, there’s no free lunch here, either.

Which brings me back to those great real estate deals I mentioned earlier.

REITs: No-Hassle Real Estate Profits

They’re real estate investment trusts (REITs)—or companies that own or finance income-producing properties.

They’re a way better option than going DIY, because the REIT does all the work—it buys the properties, fixes the broken elevators and collects the rent—and passes the cash on to you.

Plus, REITs don’t pay federal income tax, so long as they payout 90% of their profits as dividends, which means high yields are common in this corner of the market. The best REITs are throwing out reliable dividend hikes year in and year out, too.

Those are two things your average landlord can only dream about.

And there’s one more thing he’s missing: a decent yield! That’s because the average condo in the US:

- Sells for $264,000

- Rents for $959/month (or $11,508/year) before expenses

Which yields the condo investor a paltry 4.4% on his initial capital. No, thanks!

We’re also ignoring the value of our property baron’s time—to fix leaky faucets, find new tenants, collect rent and dozens of other things that come with the job.

Funny thing is, you can almost exactly match that 4.4% yield just by purchasing the Vanguard REIT ETF (VNQ), which pays 4.3% today. Better yet, as I wrote on March 15, there hasn’t been a better time to buy REITs since July 2009.

Time to Get Greedy

Our REIT opportunity exists because of a silly fear first-level investors just can’t shake: that REITs suffer when rates rise.

I can’t believe this one’s still around, because it’s been proven wrong over and over again.

Take the last rising-rate period, from July 2004 through June 2006, when the Fed hiked rates from 1.25% to 5.25% and 30-year mortgage rates soared to 6.8%.

Earth shattering. And it should have demolished REITs, right?

Wrong.

They soared, more than doubling the gains in housing and the S&P 500:

Which brings me to today.

Thanks to overhyped rate fears, many REITs are throwing off yields higher than they have in years (because current yields rise as share prices fall).

Take VNQ: at 4.3%, its payout is near levels it hasn’t seen since 2009, and if you’d bought back then, you’d have cruised to a market-beating 174% total return.

Now history is about to repeat. But we can do much better than VNQ’s ho-hum 4.3%.

2 REITs That Do All the Work for You

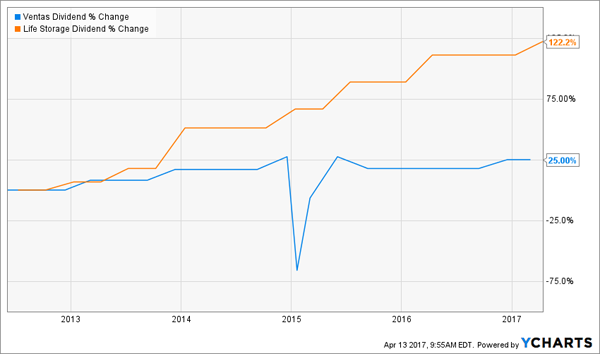

Here are two trusts—Life Storage (LSI) and Ventas (VTR)—that stand out from the REIT pack for three reasons: above-average yields, steady dividend growth, payouts that are well covered by funds from operations (FFO; the REIT equivalent of earnings per share) and attractive valuations.

Between them, these 2 REITs get you in on two growing sectors (self storage and health care, respectively) and geographic diversification (Life Storage alone has some 650 locations in 29 states).

Market-Leading Payouts

Right away, we can see that our two champs beat out VNQ’s current yield.

Now check out the payout hikes they’ve been handing out in the past five years (Ventas paid a pro-rated first quarter dividend in 2015 in connection with its acquisition of American Realty Capital Healthcare Trust, which explains the dip you see in the chart):

Ventas’s payout also stands to rise as baby boomers retire (the REIT has 760 senior-housing communities in its portfolio).

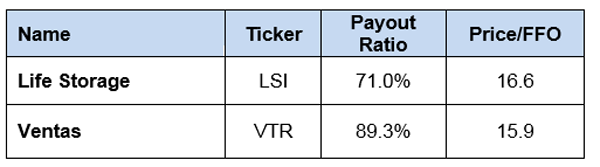

Finally, let’s take a look at dividend coverage and valuation:

Again, these are reasonable numbers in the REIT sector, where payout ratios of 85% to 90% are common (and manageable) thanks to the steady rent checks these companies collect.

The bottom line: Buying these 2 REITs now—with their prices down (and their yields way up) from their mid-2016 highs—is a great way to add diversification, gain potential, high yields and fast dividend growth to your portfolio.

And you won’t have to unplug toilets, kick out rowdy tenants or chase down late rent checks to do it.

How to Double Your REIT Yields and Live on Dividends Alone

These REITs’ outsized payout growth is great, but if you buy now, you’ll still be waiting years for your initial sub-5% yield to rise much higher.

And even though REITs move more in sync with real estate than the stock market, you can bet they’ll still take a serious hit in the next meltdown.

If you’ve got just a few years left to go till retirement—or are enjoying your golden years now—that’s a fatal flaw that could trigger a retiree’s worst nightmare: outliving your nest egg.

That’s why we’ve developed a breakthrough portfolio that hands you a safe 8% income stream today—enough for you to sock away $500,000 and trigger a reliable $40,000 cash flow that holds up in any market weather.

Think about that for a moment: with that kind of income, you’ll be sitting pretty in the next meltdown while others are forced into a “fire sale” on their best stocks just to generate extra cash!

Your average REIT investor would need close to $1 million to get the same level of income.

And don’t get me started on the so-called Dividend Aristocrats. They yield a piddling 2%, on average, right now. So you’d need a ridiculous two million bucks to match our portfolio’s income stream.

That’s pathetic—and something you won’t have to spend a second worrying about with the portfolio I’m going to show you now.

Every single detail is in a new FREE report I’ve just released. Simply go right here to get your copy and unlock the secret to a secure retirement today.

Recent Comments