“Special” dividends fly right under Wall Street’s radar. Which is great for contrarian income seekers like us. These payouts aren’t officially “counted” by most mainstream websites!

It’s a big accounting error in our favor because these dividends can really add up. Today we’ll discuss five special dividend payers with yields up to 16%.

Most websites won’t report 16%, of course. For whatever reason, they just can’t compute specials!

Special dividends are technically considered one-time payouts. So, vanilla websites assume they won’t happen again, and thus leave them out of their yield calculations.

But there’s more than one kind of special dividend. Sure, some are one-time payments. But other companies prefer to pay them year after year after year.

Special Dividend #1: We Sold Something for a Lot of Money!

One common reason to announce a special dividend is a one-time influx of cash earned from selling off part of the company, or unloading a significant part (or all) of a large stake in another firm.

As a for-instance, HSBC Holdings (HSBC), which pays regular dividends, too, announced in early April that it would pay a 21-cent-per-share special dividend. That special dividend was directly tied to the sale of HSBC Bank Canada to Royal Bank of Canada (RY), which the company says delivered an estimated gain on sale of $4.9 billion. It’s “only” worth about a half a point in annual yield—but it’s still extra cash shareholders weren’t planning on.

Special Dividend #2: Sharing Excess Profit/Cash

In mid-December 2023, Costco (COST) made an enormous splash by announcing a $15-per-share dividend. Costco had just delivered a Street-beating profit for its fiscal first quarter, but the likely driver behind the dividend was Costco’s cash hoard, which reached $17 billion. Every few years or so, when Costco’s cash pile stacks high enough, it doles out a special dividend. It did so in 2012, 2015, 2017, and 2020.

Costco’s special dividend added roughly 2% worth of annual yield, which was warmly received by investors who currently earn less than 1% on the regular.

$15 Buys Us 10 Costco Hot Dogs and Soda Combos. Coincidence?

Special Dividend #3: The Totally Normal Special Dividend

Most company directors know just how much shareholders want regular, dependable dividends. But what if the company is cyclical, or highly dependent on commodity prices, or just simply has unpredictable profits from one year to the next?

Some firms in this position have tried to deliver steady, generous dividends nonetheless, only to get kneecapped by a few lousy quarters. The solution? A dividend cut, or even a dividend suspension.

But a few crafty boards have mastered their situation. Rather than writing checks their cash flow can’t cash, they use a “hybrid” dividend program—one where they deliver a maintainable level of regular dividends, then routinely “top up” the payout via special dividends as their profits allow.

These are the dividend payers that give mainstream data sites fits! Their superior yields go completely unnoticed—except to investors willing to do the extra research.

Let me show you what I mean with a few dividend payers with “hidden” yields of up to 16%.

Dillard’s (DDS)

Listed Dividend Yield: 0.2%

Dividend Yield With Specials: 4.6%

Department store Dillard’s (DDS) offers up an almost negligible regular dividend of a quarter per share, which translates to a meager 0.2% yield—exactly what we’d imagine out of a stodgy old mall retailer.

Except over the past few years, Dillard’s has been anything but.

Dillard’s: The True Retail Juggernaut?

While many brick-and-mortar retailers were crippled by the pandemic, Dillard’s was refined by it. While revenues are virtually the same as they were a year ago, the company pulled some familiar levers like slashing hours and closing a few stores. But it also became much savvier about inventory management, leading to less discounting, which has resulted in fatter margins and better cash generation. Dillard’s has spent that cutting into its debt and building up its reserves.

And despite what the headline yield might indicate, Dillard’s also shares the wealth. It has aggressively bought back shares for years, but post-COVID, it has also started doling out massive special dividends—$15 per share at the end of 2021 and the start of 2023, then $20 to kick off 2024. That’s worth 4.4% in annual yield, taking Dillard’s from meaningless income to several times better than the market average.

It’s difficult to tell how long Dillard’s can keep up both its oversized returns and super-sized special dividends, so there’s no relying on it long-term for meaningful income. But management clearly has shareholders’ best interests at heart.

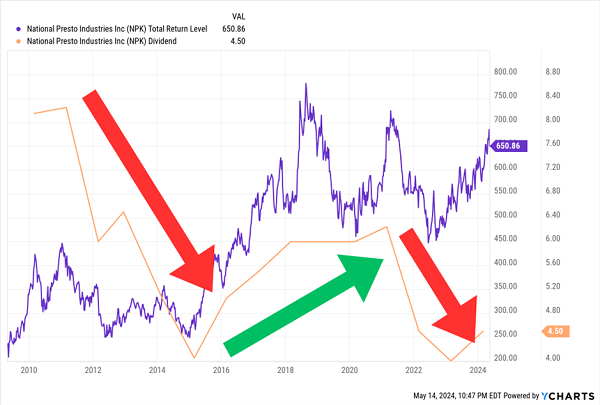

National Presto Industries (NPK)

Listed Dividend Yield: 1.3%

Dividend Yield With Specials: 5.6%

National Presto Industries (NPK) is a wide-ranging conglomerate. It’s best known for its small kitchen appliances—slow cookers, vacuum sealers, pressure canners, popcorn poppers and the like.

But that’s not its biggest business. NPK’s largest source of both sales and profits is its defense division, which produces ammunition, cartridge cases, precision metal parts for defense and aerospace, primarily through Defense Department contracts. It also has a safety division that provides things like fire extinguishers and carbon monoxide detectors.

It’s an odd bird, as far as dividends are concerned—and it’s not just the specials.

NPK pays a regular annual dividend that has been fixed at a buck a share for years. That’s good for a little more than 1% in yield; right around S&P 500 levels. But it also pays a special dividend, typically in March, and has so pretty dependably for over a decade.

How Much Is Another Question

Again, the regular payout is too low for anyone who needs to meticulously plan out an income calendar. But with the specials, NPK has been good for about 4% to 7% in annual yield for years now.

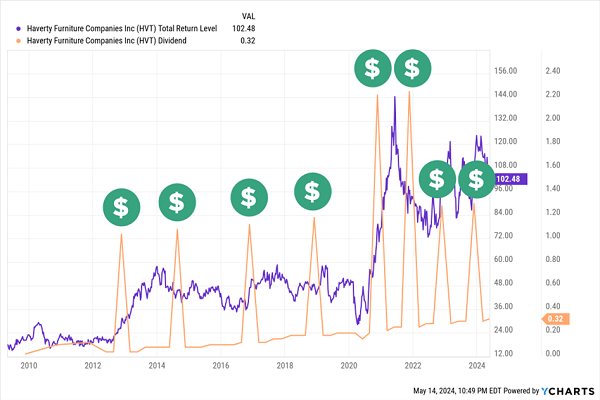

Haverty Furniture (HVT)

Listed Dividend Yield: 4.3%

Dividend Yield With Specials: 7.7%

Haverty Furniture is an upscale furniture retailer that operates 124 showrooms in 17 states, primarily in the South and Midwest.

The company was largely growing heading into the COVID pandemic, and then it got on the same roller coaster housing stocks in general have ridden since. After a brief initial dip, America’s housing market boomed, pushing gains in homebuilders and housing-adjacent stocks alike for a couple of years. However, over the past year or so, as the Federal Reserve has rapidly lifted its benchmark rate, new- and existing-home sales alike have plunged—no sweat off the brow of homebuilders, but misery for furniture firms like HVT.

Haverty’s dividend situation is the opposite of most. The annual special cash dividend is the longstanding tradition, having been paid since 1935; the quarterly payouts only began in 2008.

And When Business Boomed Post-COVID, Those Specials Got More Special

Perhaps more interesting to people considering HVT over the longer-term is the growth in the quarterly pat, which has more than doubled since 2017 to its current 32 cents per share. With a “typical” dollar-per-share special, that combines for a nearly 8% yield at current prices.

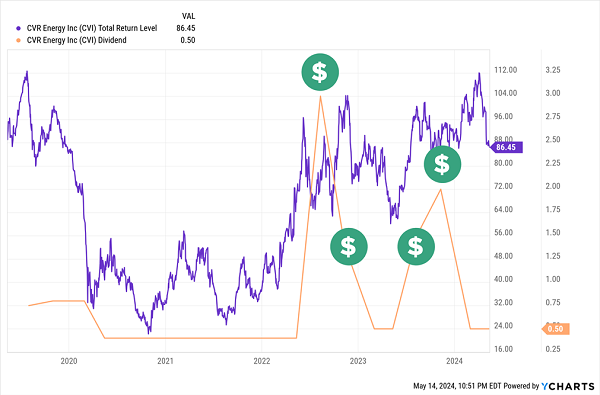

CVR Energy (CVI)

Listed Dividend Yield: 6.9%

Dividend Yield With Specials: 15.5%

In February, I discussed CVR Energy (CVI), an energy firm that deals in renewable fuels and petroleum refining—and through its interest in CVR Partners LP (UAN), it also manufactures nitrogen fertilizer.

I pointed out that CVR Energy had built up a massive bear crowd that sold 28% of shares short as of February. That number is down considerably, but still high at 17%, as the company still figures out what it plans on doing with UAN.

As I said at the time:

“Investors cheered CVR’s summer announcement that it wouldn’t pursue a spinoff of its UAN stake—good news, if nothing else, for the dividend. But the jump in stock price also triggered a big buildup of shorts—a buildup that continued after Carl Icahn (who still owns roughly two-thirds of all CVI stock) sold 4.1 million shares in September.”

But Icahn hasn’t sold more since. In fact, on March 18, Carl Icahn filed an SEC Form 3 reporting he owned a 36.8% stake in CVR Partners. Meanwhile, CVR Energy also made a filing saying that it and the activist investor’s Icahn Enterprises (IEP) were considering potential strategic transactions for UAN, “which may include the acquisition of additional entities, assets or businesses, including the acquisition of material amounts of refining assets through negotiated mergers and/or stock or asset purchase agreements by the Company or its subsidiaries.”

That deal is, to be blunt, an unknown. What is known is CVI’s more responsible regular-and-special dividend program, which it (and other energy firms) adopted in 2022 following COVID-sparked distribution cuts. Its regular payout is nothing to sneeze at, representing a nearly 7% yield currently. But its trailing-12-month specials have amounted to more than 15%.

Following the Cut, CVI’s Shares Its Wealth When It Can

It’s the energy sector. CVR is hardly an E&P play that ebbs and flows on oil prices, but it’s not irresponsible to suggest its cyclical nature might result in some years without any special dividends. Even then, the regular payout is substantial, and the specials elevate that to downright terrific. But the Icahn situation, while seemingly improving, still leaves a large cloud of uncertainty over shares.

BlackRock TCP Capital Corp. (TCPC)

Listed Dividend Yield: 12.7%

Dividend Yield With Specials: 15.9%

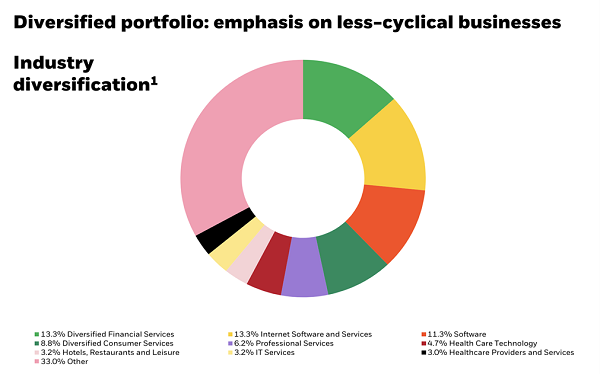

BlackRock TCP Capital Corp. (TCPC) is an externally managed business development company (BDC) that invests in the debt of middle-market companies with enterprise values of between $100 million and $1.5 billion.

TCPC currently has 157 companies in its portfolio, spread across a few dozen industries. But it does have a few heavier concentrations—internet software and services (~13%), diversified financial services (~13%) and software (~11%) earn double-digit weights.

TCPC Prefers Stability and Dependability

BlackRock TCP Capital Corp. March 2024 Investor Presentation

That said, investors are getting a new-look TCPC following the March closing of its merger with BlackRock Capital Investment Corp. (BKCC). That comes with a very tangible benefit, in which the BDC’s advisor agreed to reduce base management fees by 25 basis points, to 1.25%.

As I’ve previously said, the move should give TCPC significantly more scale, but I want to see what happens to my favorite aspect of TCPC: Its special dividends.

BlackRock TCP has been raising its quarterly dividend over time, but it’s also starting to rely on special dividends to share the wealth without overcommitting. In 2023, TCPC has distributed or announced 35 cents’ worth of specials—given that its regular is 34 cents, it’s like investors are getting a fifth quarterly payout!

So far, all special payouts have come in the back half of the year, so we’ll have to wait a bit to determine whether TCPC will further entrench this routine.

But Special Dividends Aren’t for Everyone

While specials are special, we don’t want to be hoping for a year-end payout when we’re retired on dividend income. We want—heck, we demand—our payments to be dialed in.

Quarterly payers don’t pay often enough. Which is why serious income investors own monthly dividend stocks.

These are companies and funds that pay every 30 days. Not 90. And they promise a payment, which is of course better than relying on a whim, as we’d have to with specials.

What’s better yet is that, thanks to recent volatility, select monthly dividend payers are now dishing 8%+ annual yields or better. Sound awesome? It is—so much so that these dividend deals are unlikely to last. Please click here for my latest research on the best monthly dividend stocks.

Recent Comments