Today I want to show you three funds that are highly unusual in a way that matters a lot to many folks: all three are free from a management-fee perspective.

In fact, these three funds—closed-end funds (CEFs), to be precise—are more than free: they have negative management costs!

What do I mean? Well, usually index funds sell themselves on being cheap. Fees on the Vanguard S&P 500 ETF (VOO), for example, are just 0.03%, or $300 in annual fees for every $1 million invested, in other words.

There are even funds out there that cost nothing, like the Fidelity ZERO Total Market Index Fund (FZROX), which has no expenses at all.

Sounds attractive, right? Well, not so fast—there are, of course, many things to consider when picking a fund besides fees. But let’s for the sake of argument say that fees are your highest priority. In that case, we still haven’t dug to the depths of how cheap funds can be.

Enter the world of negative ownership cost (NOC).

CEFs and NOC

Because many CEFs trade at discounts to net asset value (NAV, or the value of the assets in their portfolios), there are some easy ways to buy CEFs whose discounts are so big that the fund’s overall fees become negative.

We discussed the math behind this in a November 6 Contrarian Outlook article, so let’s skip to the good bit: a portfolio of three CEFs with negative ownership costs.

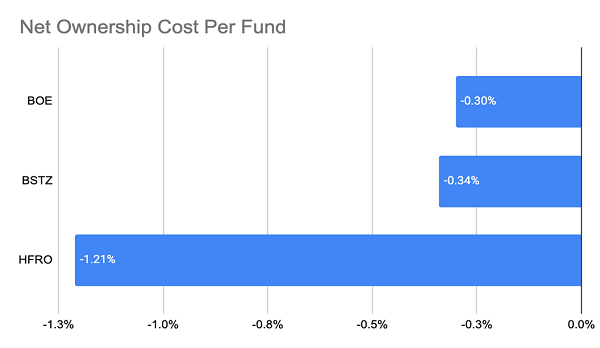

Source: CEF Insider

First, there’s the BlackRock Enhanced Global Dividend Trust (BOE), which yields 8% as of this writing and sports a 14.6% discount to NAV, a -0.3% ownership cost and a diversified portfolio of bonds issued by governments and companies around the world.

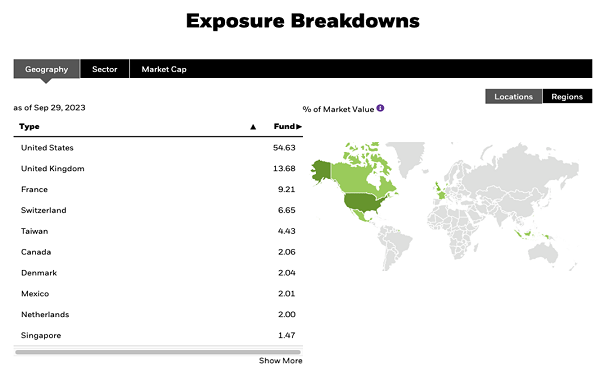

Source: BlackRock.com

With bond yields as high as they are, these bond bets are already paying off, with higher net investment income shoring up BOE’s dividend. This is because BOE is rotating its portfolio into newer, higher-yielding bonds, boosting the income it can pay to shareholders as dividends.

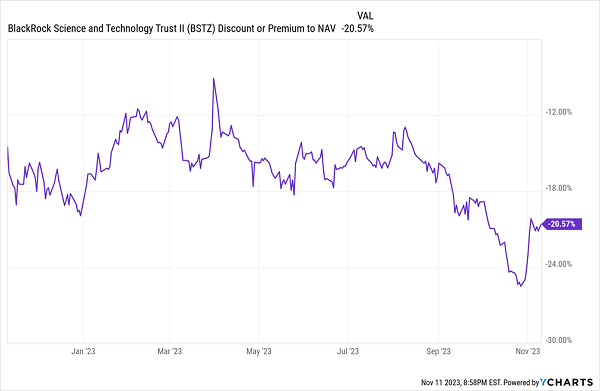

Our second fund is the BlackRock Science and Technology Term Trust (BSTZ), which is an even better deal for investors, thanks to its huge discount to NAV—20.6% as I write this—and its -0.34% net ownership cost. This one also yields 7.7%.

A Big Sale, Likely to End Soon

The chart above is a clear snapshot of a CEF buying opportunity: at my CEF Insider service, we love to buy more of a CEF when it’s still deeply discounted, but that discount has momentum (or its moving swiftly toward par. You can clearly see that here.

We also like BSTZ because it’s managed by BlackRock, the world’s biggest asset manager—and that opens doors for us. As you’d expect from a tech fund, BSTZ gives us positions in firms like NVIDIA (NVDA), Synopsys (SNPS), whose products help with the design of semiconductors, and Tesla (TSLA).

But BSTZ also invests in privately held techs—including those in the AI space—that individual investors like you and I can’t normally buy a piece of.

These companies can take off when they eventually go public, but of course, they carry risks, too. This is why we trust BlackRock, with its boundless research resources, to navigate this market for us and get us into the best private firms. That, plus the discount, dividend and NOC, make BSTZ a worthy addition to your portfolio’s tech allocation.

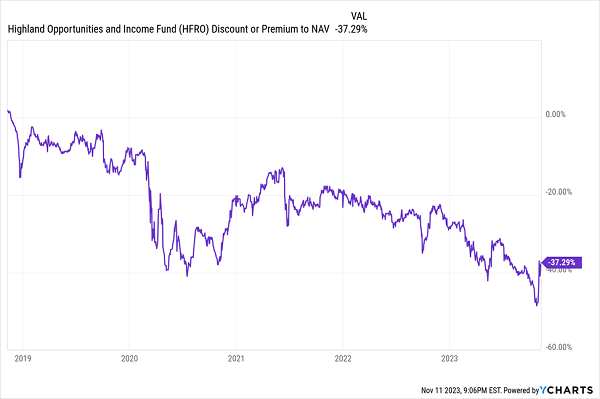

Our third fund yields a whopping 11.6%, which is compelling on its own. But its discount to NAV is so far off the charts that I’m honestly surprised this deal is on the market at all.

The Highland Opportunities and Income Fund (HFRO) sports a -1.21% ownership cost and a 37.3% discount to NAV (you read that right!), setting it up for price upside on top of its huge yield. (We’re essentially buying HFRO’s portfolio for 63 cents on the dollar here.)

HFRO also stands out because of its asset class: senior loans; after the interest-rate jumps in the past couple of years, these loans have been oversold, and HFRO has been heavily oversold on top of that, hence the outsized discount. Which is an opportunity today.

Recently, the market has kept testing lower and lower pricing of HFRO until it hit a post-pandemic low. That’s when it spiked upwards, providing a similar “momentum-plus-deep-discount” entry point as we just discussed with BSTZ.

HFRO’s Sale Bottomed Out

Put together, you can see how looking at CEFs’ income streams, fees and discounts provide a holistic perspective on how these funds not only get you passive income quickly, but also price upside, too.

How We’ll Bag 8%+ Yields, “Discount-Driven” Gains From CEFs (for Years and Years)

Bagging 8%+ dividends and 15%+ price gains in CEFs is all about tracking down nuances like NOC and the “discount momentum” we just discussed. Both are signs that a CEF could have a place in your retirement portfolio.

But these are tough indicators to find on your own, which is why we launched our CEF Insider service. With a (deliberately) small group of members, we’re zeroing on the high-yield CEFs that are the key to a “dividends-only” retirement, funded by payouts alone.

To help you get a true sense of whether CEFs are for you, I’d like to invite you to take a no-risk 60-day trial to CEF Insider today. When you do, you’ll get instant access to our full CEF Insider portfolio (average yield: 9.8%), a complete library of Special Reports showing you the nuts and bolts of CEF investing, and much more.

Click here and I’ll explain my full CEF investing strategy, including why these “hidden” funds never get any attention from Wall Street and the mainstream press. Near the bottom of that investor briefing, you’ll get a chance to sign up for your no-risk trial to CEF Insider.

I look forward to showing you the very best CEFs, for big yields and upside, over the next 60 days. Don’t miss out!

Recent Comments