We’ve got plenty of high-quality dividends on the table as we roll into 2023. Some of the best? Closed-end funds (CEFs) yielding north of 7.5%. Three specific names and tickers are coming up for you below.

I mention quality because if 2022 has showed us anything, it’s that quality matters: crypto and profitless tech got clobbered this year, and that was no one-off. With interest rates rising, these gambles—I say “gambles” because buying these was always more like a trip to the slot machines than investing—are likely down for the count.

You can see this in the performance of the NASDAQ 100, which is down some 28% year to date, as well-run, high-cash-flow companies like Apple (AAPL) and Microsoft (MSFT) were dragged down by basket cases like Meta Platforms (META) and its money-bleeding investments in the metaverse. And don’t get me started on crypto, which makes the NASDAQ’s return look stellar by comparison!

Even flipping to the 30 large caps in the Dow Jones Industrial Average would’ve been better: these firms are only down 6.4% this year, as of this writing. That, of course, isn’t much to cheer for, but it’s a far better sight than the losses suffered by investors who were turned off by “boring” investments like the Dow stocks.

Three High-Quality CEFs Yielding 7.5%+

This is where closed-end funds (CEFs) come in: thanks to this year’s pullback, many of these high-yielding funds are now offering us a “double discount,” with the CEFs themselves trading at discounts to net asset value (NAV) as their underlying portfolios have been oversold, as well. Here are three to consider:

Bargain CEF No. 1: A 9%-Yielding “Preferred” Fund That Crushes Its Benchmarks

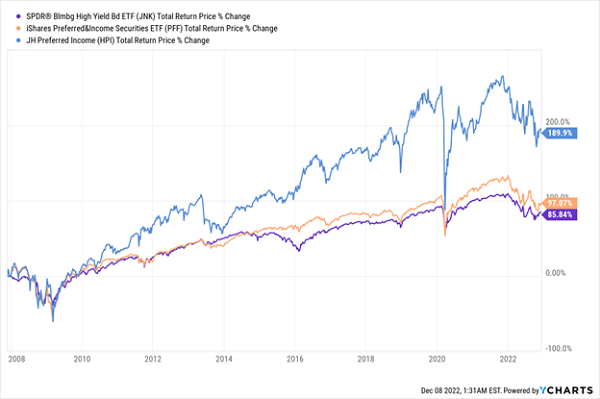

The first CEF I want to show you is the John Hancock Preferred Income Fund (HPI), payer of a 9% yield. While this fund doesn’t sport a deep discount to NAV, trading around par now, it regularly trades at a premium, including premiums of 7% or more in the last year alone, so we’ve got upside potential here. And there’s a reason for those occasional wide premiums: HPI’s strong track record, especially when compared to the benchmark ETFs for corporate bonds (in purple) and preferred shares (in orange), which are the two best yardsticks for this fund.

HPI Crushes the ETF Competition

As you can see, HPI has delivered strong returns—to the tune of 8.1% annualized—since its inception before the Great Recession.

Part of this success is thanks to the fund’s focus on preferreds, a less-volatile but still high-yielding alternative to common stocks, under which firms commit to a fixed yield for a fixed time. That makes preferreds a good choice for income in these uncertain times.

Bargain CEF No. 2: A Municipal-Bond CEF With a Tax-Free 7.5% Yield

Municipal bonds, which states and cities issue to fund infrastructure projects, are a great cornerstone for your portfolio, especially because the income you get from most “munis” is tax-free. So too are the dividends on many muni-bond CEFs, like the 7.5% payout on the RiverNorth Managed-Duration Municipal Income Fund (RMM).

What’s more, this one trades at a 7.1% discount, which means management only has to get a 7% yield from its portfolio to maintain the payout (because the yield is calculated based on NAV, not the discounted market price). Getting a return that size has gotten easier as municipal-bond rates have risen with the Fed’s rate hikes in 2022.

That puts RMM’s 7.1% discount on notice, making now a good time to buy in. Moreover, the fund’s yield is nearly four times the 1.9% payout on the benchmark iShares National Municipal Bond ETF (MUB) and nearly double the 4.7% yield on the largest municipal-bond CEF, the Nuveen AMT-Free Quality Municipal Income Fund (NEA).

This “yield gap” is likely to draw more muni investors to RMM, especially when they consider the huge effective yield they’ll be pocketing when they add their tax savings to that 7.5% payout. When those income investors make their move, expect RMM’s discount to evaporate.

Bargain CEF No. 3: A Stock Fund With a Reliable 8.3% Payout

??Finally, let’s move on to the stock market, which these days boasts many high-margin businesses trading at valuations near March 2020 levels. Even so, we’ll likely see more volatility next year, so it’s prudent to go with a CEF that offers something of a hedge, in the form of a stable income stream and a portfolio of steady, cash-rich blue chips.

The Virtus Dividend Interest & Premium Strategy Fund (NFJ) fits that particular bill, with an 8.3% yield and a 3.6% discount that makes its payout even more sustainable: NFJ needs to earn 7.2% on average per year, which it’s done every year of the last decade except 2014, 2015 and 2018—all years when interest rates were rising.

Source: Virtus

Still, NFJ soared after those years, with an 11% return in 2016 after the weakness in 2015 and 2016 and a 21.3% return in 2019.

So it follows that NFG’s potential looks strong in 2023, after 2022’s bear market. The fund also bolsters its income with high-quality corporate bonds and by selling covered calls on its portfolio (These options give investors the right to buy the fund’s stocks at a fixed point in the future, at a fixed price. It keeps the cash it charges for these options no matter what happens, which is another reason why its payout looks safe.).

5 “Lifetime Profit” CEFs Yielding 9.9% (Buy Now, Hold Forever)

Most folks don’t realize it, but CEFs have an incredible safety record—especially when you focus on funds that have been around for the long haul.

Get this: only 12% of CEFs that are a decade old (or older) have lost money in the last 10 years! And if you ignore foreign and emerging-market funds (which almost always trail their American cousins), that number shrinks to just 6%.

That shows you exactly why billionaires love CEFs: these funds are the perfect “bedrock” for any portfolio, providing essential stability while you collect their outsized dividends.

I’ve got 5 CEFs I want to share with you now that you could easily buy today and tuck away forever. They yield 9.9% on average and trade at such deep discounts that I expect 20%+ price upside from them in the next 12 months!

Now is the time to buy them, while they’re still bargains. Don’t miss out. Click here and I’ll give you the names, tickers, current yields and discounts on all 5 of these “lifetime profit” CEFs in an exclusive Investor Report.

Recent Comments