Now that Federal Reserve Chairman Jay Powell has pivoted towards his “other mandate,” we should take a cue from my six-year-old, who yells from the back seat:

“FedEx!”

For years she has been enamored with the FedEx Corp (FDX) logo. Neither her sister nor her parents are sure why, but the affinity is real. See a truck on the road, yell “FedEx!” loudly to score the point.

I didn’t have the heart to tell her that FedEx disappointed investors with a sanguine outlook a couple of weeks ago. The stock corrected lower, as usually does after earnings.

(Seriously, the best time to buy FedEx lately has been right after the company talks to Wall Street and the suits sell their shares. They rally in between earnings calls.)

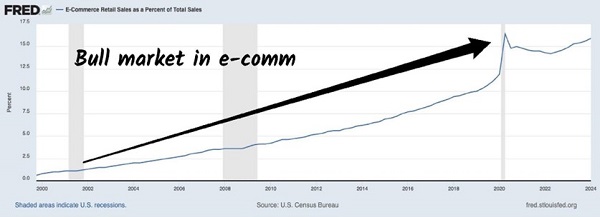

FedEx is the type of stock I always watch, waiting for a pullback. It directly benefits from a megatrend, a bull market in e-commerce sales. E-commerce as a percentage of retail sales gained for two decades and then spiked in 2020. After a brief respite, e-comm sales are heading to new all-time highs:

E-Commerce Sales Grow

FedEx is increasingly fulfilling e-comm shipments. My in-house FedEx fan recently received her brand-new rainbow basketball via her favorite courier via my order from DICK’s Sporting Goods (DKS):

![]()

Instead, FedEx got the call and this beautiful roundball—sans air—was shoved into a shoebox.

FedEx may be delivering even more rainbow basketballs shoved into shoeboxes thanks to an accommodative Fed. Chair Jay Powell spent the last two years focusing solely on the Fed’s key mandate: stable prices. Now, he needs to make an about-face and hit the second mandate—labor. So long, inflation concerns and hello, accommodation!

With lower rates and quiet QE on the menu, it is time to ask ourselves “what if” the economy surprises everyone and the Fed stimulus fuels growth. After all, the economy has been growing since April 2020. Rates are down 50 “bips” with more to come. What if we see neither a hard or soft landing but rather no landing at all?

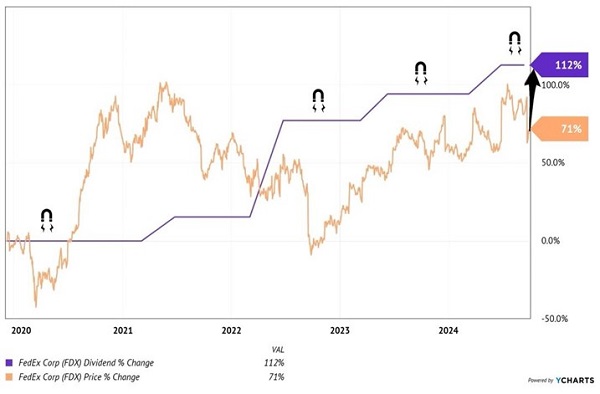

In this scenario. FedEx benefits. In fact its stock price has 40% upside from here just to catch up with its ever-rising dividend:

FedEx: 112% Dividend Growth, Price to Follow

And our Fed isn’t the only dovish central bank! Last week the People’s Bank of China (PBoC) announced a sweeping set of stimulus measures. The PBoC lowered interest rates (including mortgage rates) and announced “stock market support” plans to help companies buy back their own shares and to allow investors to borrow against their portfolios.

Yee haw, China! Shares of Chinese firms spiked last week and copper miners popped with them.

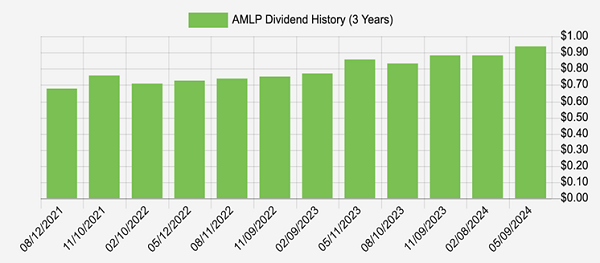

Energy prices have, thus far, remained subdued. But this flood of global liquidity is obviously supportive of dividend king Alerian MLP ETF (AMLP). When energy prices jump, the pipeline stocks that AMLP owns boost their dividends. Just look:

Source: Income Calendar

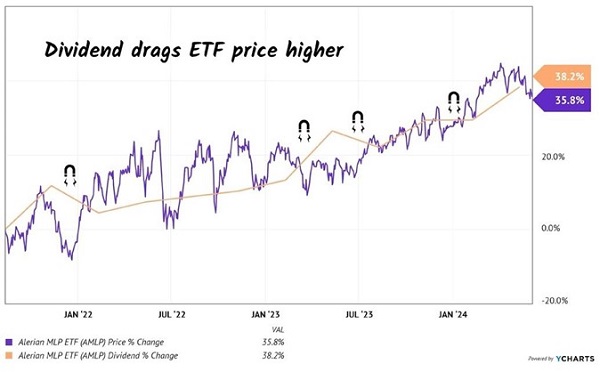

AMLP’s rising payout pulls its price up. Check out this dividend magnet:

Dividend Raises = Price Gains

Top holding MPLX (MPLX) yields “just” 7.7%, and be careful come tax time! If you own MPLX by itself, it will send you a complicated K-1 tax form.

However! If you cleverly own the stock through AMLP, no K-1! Just a normal 1099 showing your sweet dividends received. Which dish an elite 8% as I write today, supported by central banks everywhere.

With the money printers of the world pivoting, it is time for us contrarians to make some moves in our retirement portfolios. Please, don’t fixate on 2019 income investments in this Post-COVID financial world—we need huge, reliable dividends that will benefit from all of these friendly central banks.

Recent Comments