There are two words I’d bet cross your mind every time you buy a stock: “2008 repeat.”

As in: “I can’t afford one!”

I hear it regularly from Contrarian Income Report readers. It’s obvious why: we’re all 11 years older, and we can’t mess around—we need “correction-proof” growth and big dividends (I’m talking 6% yields and up) today!

By “correction-proof,” I mean stocks that swat away a crash, no matter if it’s October 2008, May 2018 or the pullback we saw just last month.

Sounds like a tall order, I know. But it’s not impossible.

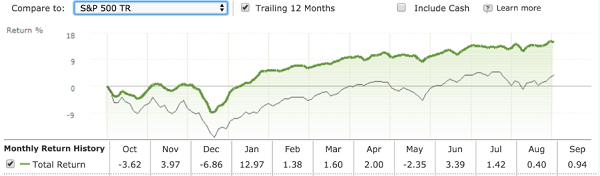

Today I’m going to show you how I regularly find these stout plays, and how they’ve driven a steady 11.4% annualized return (mostly in safe dividend cash) for Contrarian Income Report members since we launched the service in 2015.

Moreover, our Contrarian Income Report portfolio sailed through the late 2018 meltdown, not falling nearly as far as the market while crushing regular stocks overall in the last 12 months:

Our Safe-Dividend Strategy in Action

Source: Morningstar

Further on, I’ll reveal two “undercover” picks that should top your list now. They pay 6.5% dividends and coasted above last month’s meltdown.

Before we get to that, let’s brush aside the hype and look at what the raw data (the only guide we follow in Contrarian Income Report) says about another 2008.

2008 Redux? Here’s My Take

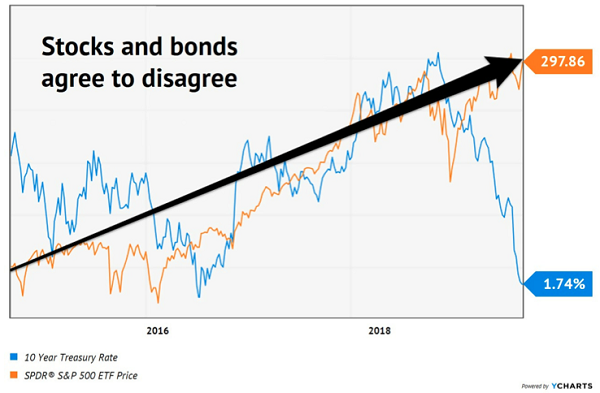

Start with the yield on the 10-year Treasury, which has tanked, meaning investors have bid the price of the long bond up and its yield down—a classic fear indicator—though rates have bounced back a bit in the last few days:

“Long Bond” Sees a Pullback Ahead

Even the corporate bean-counters are worried, with the latest Duke University/CFO Global Business Outlook showing 53% see a recession by the end of the third quarter of 2020. Stretch that to the end of 2020 and the number leaps to 67%.

But here’s where the plot twists: the bond market has been wrong before, and as recently as 2016:

And consider this: if we were about to hit the wall, I’d expect the Shanghai Composite Index to be in the dumps, with China in the crosshairs of the trade war. But Chinese stocks are actually up this year, and by 21%, more than the S&P 500.

Does China Know Something We Don’t?

Source: Google Finance

Look, I’m not saying we should discount a recession, but in the short-term, these worries do seem overblown.

That’s an opportunity, especially if we grab out-of-favor 6.5%+ yielders. These stocks are critical today, because they set you up for big dividends and gains now—and protect you when a pullback does show up.

Because high, safe dividends are the “rubber duckies” of the investing world—they may take on a little water in the short run, but as the weeks go by, they always bounce back.

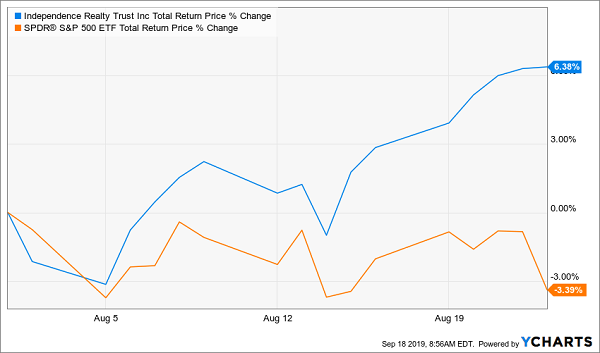

That’s what happened with Independence Realty Trust (IRT), an apartment REIT I flagged as a “correction-proof” buy in my May 29 article. The trust yielded 6.6% then and tripled its dividend in early 2018.

Independence quietly focuses on “secondary” Midwest and Southern markets with strong population and employment trends, like Austin, Indianapolis and Raleigh/Durham. That’s helped it build a sparkling 94.1% occupancy rate.

In other words, IRT has just the kind of well-supported income stream investors and money managers run to in a panic like August’s trade tantrum. Look what happened in that wipeout, when IRT’s 6%+ payout finally made its way onto the radar:

IRT’s “Dividend Lifeboat” Sets Sail

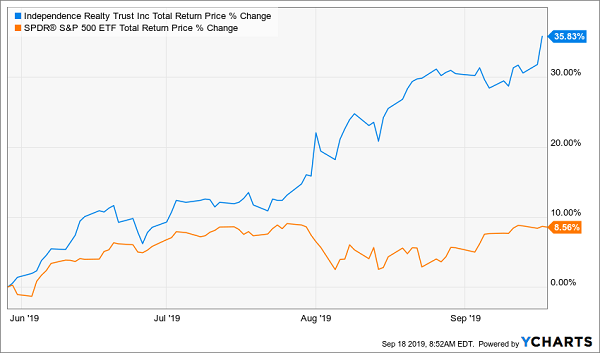

Stretch that timeline out a bit and you can really see the gains a snubbed high-yielder like IRT offers: in the four months since my article came out, the stock returned 36%, four times more than the market!

Big Gains for Safety-Conscious Buyers

That brings me to the two 6%+ “correction-proof” plays that should be on your list today. And no, IRT isn’t one of them—at least not if you buy it “direct,” that is.

“Correction-Proof” Play No. 1 “Restores” IRT’s 6.5% Dividend

The trouble with buying IRT now is that its price has been bid up, driving its yield down (currently 5.2%), and we need more income than that to fund our retirement and hedge against the next downturn with a safe cash stream.

But don’t worry, we’re going to “rewind the tape” and grab IRT at a 6.5% dividend and a 19.8% discount, too!

That deal comes via the RMR Real Estate Income Fund (RIF). RIF is a closed-end fund (CEF) that trades at a 19.8% discount to the value of its portfolio (called a discount to NAV in CEF-speak), which boasts top REITs, including IRT:

Source: RMR Real Estate Income Fund Q2 2019 Fact Sheet

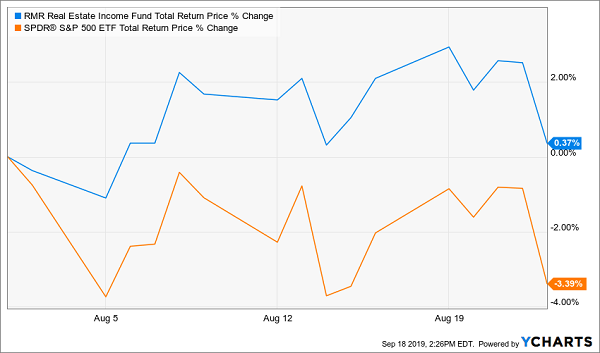

If you’re looking for a correction-proof dividend, look no further! RIF floated through the August pullback:

RIF Owners Ignore the Correction, Pocket 6.5% Dividends

Now let’s wrap up with …

“Correction-Proof” Play No. 2: A Cheap 7% Dividend That’s Doubled

For our final play, we’re going to stick with CEFs but switch investments—from REITs to rock-steady utilities and infrastructure plays.

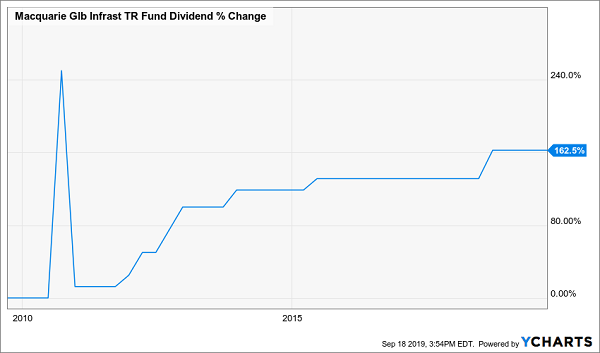

We’re going to do it with the Macquarie Global Infrastructure Total Return Fund (MGU), a CEF trading at a 10.3% discount while throwing off a 7% dividend that’s growing—up 163% in the last decade alone!

A 7% Dividend That Doubles? That’s What You Get With MGU

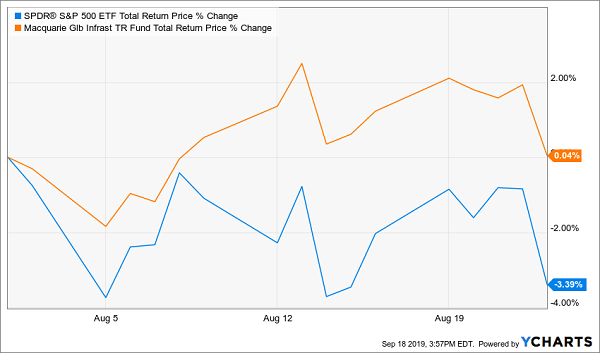

No wonder MGU sailed through August’s trade tantrum—despite the “global” in its name!

Another “Correction-Proof” Pick Steps Up

If you’ve missed the latest run-up in pipelines and utilities, consider MGU your second chance to buy. But you’ll want to make your move now, before its 10.3% discount vanishes.

The Secret to Boosting Your Retirement Income 4X (2008 or No)

My “Perfect Income Portfolio” sets you free from ever having to worry about a recession. That’s because it returns 4X more income than regular investors make.

And you won’t ever have to withdraw a single cent from your portfolio!

So if you never have to sell, who cares when the next crash hits? You can simply live on dividends alone, come what may.

Here’s what else you get from this incredible collection of investments:

- Consistent, predictable payouts—even if there’s a crisis, crash or pullback.

- Safe, steady income of tens of thousands per year in CASH—not just “paper gains.” And you can do it on a reasonable nest egg, not the million bucks (and more) Wall Street says you need.

- Easy setup, minimum time commitment—so you’re not glued to your screen all day and can actually enjoy life.

I know—sounds like I’m promising a lot, right?

It does.

But my system, which I’ll share with you when you click right here—is proven to deliver all of the above and more.

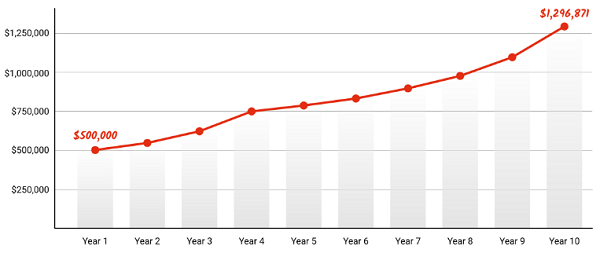

Look at what would have happened to, say, a $500K nest egg—half of what the so-called “experts” say you need to hang them up—if you’d invested it in my “Perfect Income Portfolio” 10 years ago:

That’s almost $800,000 in gains—even if you never added another penny to your portfolio!

I’m ready to show you everything you need to get started right now, including how to take the 2% dividends you’re likely earning and turning them into 6%, 8%, even 10% per year in cold, hard, spendable income.

I’ll also give you my favorite investments on which to build your “Perfect Income Portfolio”—names, tickers, buy-up-to prices and all of my research on each of these “steady Eddie” income generators.

All yours. Right now.

Don’t miss out: click right here to get full details on my brand new “Perfect Income Portfolio” and start building your own “correction-proof” future today.

Recent Comments