I run into far too many investors who think the best way to build their bond income is to buy through an ETF.

It makes sense. After all, buying corporate bonds “direct” means playing in the murky over-the-counter market, or forking over a hefty brokerage commission.

What’s more, the media—with help from ETF providers’ marketing departments—has most folks believing an “automated” ETF always beats a human manager.

So it follows that more people are buying ETFs like the Bloomberg Barclays SPDR High-Yield Bond ETF (JNK). With one click, you’re getting a portfolio of corporate bonds throwing off a nice 5.6% dividend yield—and charging just 0.4% of assets.

I’ll have more to say about JNK (and three more loser ETFs) as we move through today’s column. I’ll also show you three high-yield closed-end funds (CEFs) with yields up to 8% that are far better buys.

Let’s start by dispelling the common “wisdom” that ETFs always outperform.

ETF Outperformance: Not as Advertised

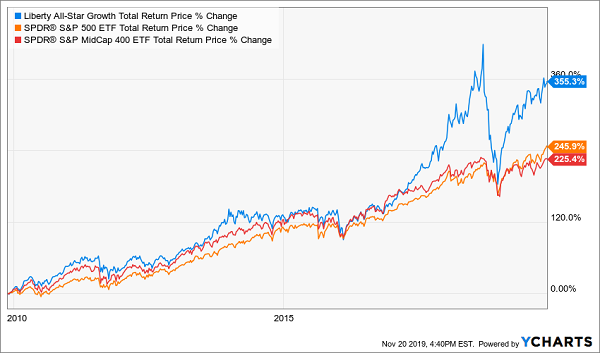

You don’t have to look far to find CEFs that beat ETFs. Consider the Liberty All-Star Growth Fund (ASG), which holds large cap stocks like Visa (V), Microsoft (MSFT) and Yum! Brands (YUM), as well as a selection of US-based midcaps.

ASG has crushed the SPDR S&P 500 ETF (SPY) and the SPDR S&P MidCap ETF (MDY) in the last decade:

CEFs: 1, ETFs: 0

Let’s stop here for a moment, because there’s something you need to know about this chart: unlike the charts you get on screeners like Yahoo Finance, this one includes dividends.

That’s critical, because CEFs’ payouts are massive, averaging around 7%. ASG, for its part, pays an 8% dividend that’s doubled since 2009. With that payout set aside, the CEF looks like a loser—and reinforces the myth that ETFs are the way to go.

CEF Price Charts Deceive

By the way, getting more of your return in cash is another CEF advantage, because your dividends can cover your bills in a downturn, while SPY holders would have to sell—at fire-sale prices—to generate extra cash, due to SPY’s pathetic 1.8% payout.

So if you’re looking to add midcaps and large caps to your portfolio, skip SPY and MDY—go with ASG instead.

With Bonds, CEFs Are a No-Brainer

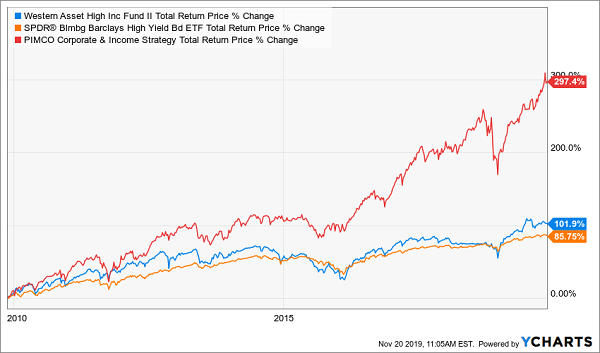

In bonds, too, human CEF managers regularly outrun the computers. Which brings me back to JNK, which has been outrun by the Western Asset High Income Fund II (HIX)—in blue below—and the PIMCO Corporate & Income Strategy Fund (PCN), in red, in the last decade:

CEFs: 2, ETFs: 0

Why?

Because HIX and PCN are run by Legg Mason and PIMCO, which manage $747 billion and $1.76 trillion of assets, respectively. That kind of cash gets you the kind of first-mover advantage you and I can only dream about: when companies issue new bonds, you can bet the first calls go to the likes of PIMCO and Legg Mason.

And just like with ASG, you’re getting most of your return in cash from these two, with HIX yielding a hefty 8.5% and PCN yielding 7.1%.

So which of these two bond CEFs is the better buy? I’d lean toward HIX, for both the higher payout and its 8.5% discount to net asset value (NAV, or the value of the bonds it holds).

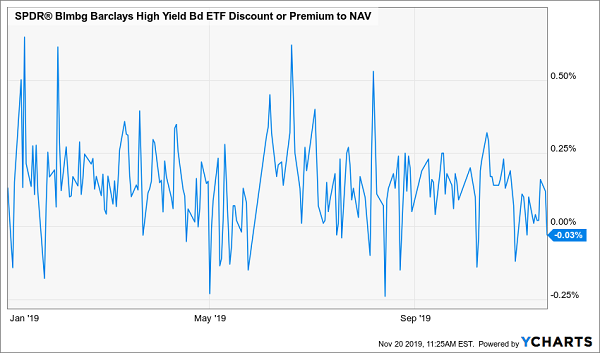

These discounts are another benefit of CEFs, because unlike with ETFs, their share counts are more or less fixed after their IPOs. This means their prices can (and regularly do) rise or fall in relation to NAV.

ETFs? They’re always priced to perfection:

JNK: No Deal Here

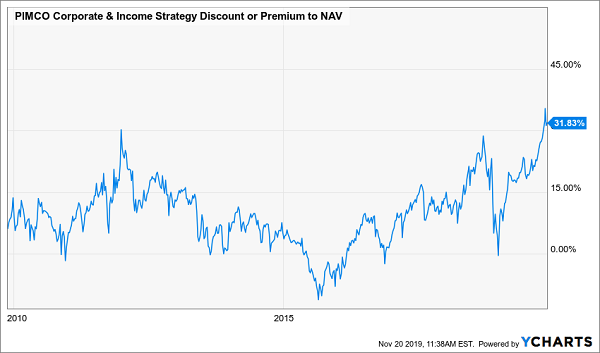

Which brings me to my No. 1 rule of CEF investing: demand a discount. This is why I recommend avoiding PCN: it’s trading at a 32% premium to NAV! That’s near a 10-year high and ripe for a dive when investors realize they’re paying a ridiculous $1.32 for every dollar of PCN’s assets.

PCN’s Premium: Look Out Below

The Biggest ETF Myth? Low Fees = Better Returns

Finally, let’s talk about fees, the main argument most folks make in favor of ETFs. It’s also a great setup for our last “loser” ETF—and a better CEF to replace it.

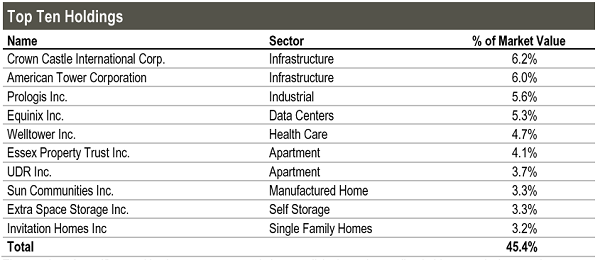

The ETF is the Vanguard Real Estate ETF (VNQ), which charges just 0.12% of assets and tracks real estate investment trusts (REITs). Top holdings include Public Storage (PSA), cell-tower owners American Tower (AMT) and Crown Castle International (CCI) and senior-care operator Welltower (WELL).

VNQ yields 3.1%, much higher than SPY’s 1.8%.

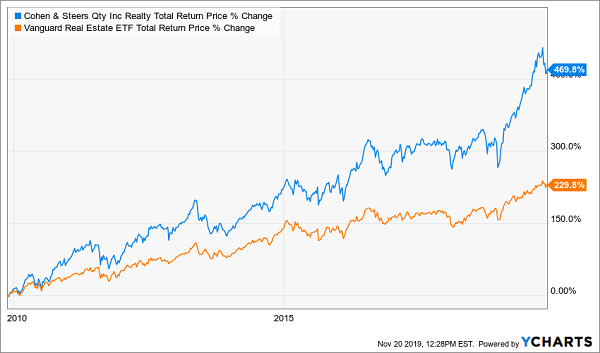

But if you focused on fees alone, you’d have skipped the Cohen & Steers Quality Income Realty Fund (RQI), which charges 2.2%—18 times more than VNQ! And you’re getting many of the same stocks, too:

Source: Cohen & Steers

Those sound like two strong arguments for picking VNQ anyway, right?

No way.

That’s because all returns I’ve shown you are net of fees. (And those fees are taken out of the fund’s NAV, so it’s not like you’re getting a bill in the mail anyway.) In other words, RQI delivered two times that of VNQ while charging 18 times the fees!

The Cost of Fee-Focused Investing

I’m guessing you wouldn’t mind paying higher fees for a return like that. And yes, just like with HIX and ASG, you’d have gotten most of this return in cash, thanks to RQI’s dividend, which yields 6.6% today.

This “Perfect” Income Portfolio Can Boost Your Dividends 2X (Instantly)

If you’re hunting for steady, 10%+ yearly returns, I’ve got the solution: my just-released “Perfect Income Portfolio.” I’ll give you all the details right here.

I know the word “perfect” might sound outlandish, but what I’m about to show you is my life’s work. I’ve calibrated this system over years of testing to do one thing: hand you a reliable 10%+ annualized return in good markets and bad.

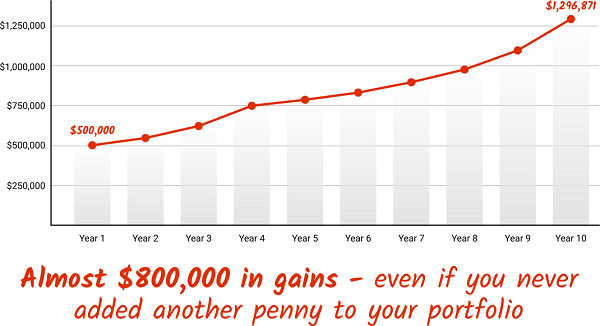

I’ve got the proof: here’s what would have happened to your money if you’d followed this strategy over the last decade:

What’s more, this stout collection of investments hands you most of your return in safe dividend cash!

If you’re stuck “grinding it out” on the paltry dividends the S&P 500 pays, this portfolio is the answer: I’m confident it will let you double, triple—even quadruple—your income stream.

Imagine Banking a Reliable 10%+ Return—Year in and Year Out

I’ve devised this portfolio to be simple to set up—it consists of 3 often-ignored investment vehicles.

When you read my full report (it’ll take you 4 minutes, tops), I’ll walk you through these 3 corners of the market. Then I’ll make sure you have the names and tickers you need to set up your own Perfect Income Portfolio today.

I could charge thousands for access to this portfolio, but I’m giving you the keys to the kingdom now.

Don’t miss out. Discover my Perfect Income Portfolio for yourself and learn how you can grow your income 2X, 3X and even 4X—starting today.

Recent Comments