“I did read that. I thought about you, B.O.”

While other people may be known for their hobbies, or their families, my publisher thought of me when a Vanguard fund re-opened!

I’ve yapped about the Vanguard Dividend Growth Fund (VDIGX) before. I rarely mention (let alone endorse!) mutual funds. But VDIGX is notable for two reasons:

- I plow 100% of my 401(K) contributions into this fund, and

- It’s a pretty good option as far as retirement plans go.

Why this fund? Because in my “Brett Inc.” company plan, I have a set list of Vanguard funds to choose from. This is “set and forget” money so my goal is to maximize long-term returns. The best way to do this, of course, is to buy dividend growth stocks.

My own portfolio dedicated to this approach has earned 17% per year. I’ll share the details with you in a minute. First, let’s give some credit to VDIGX.

As far as 401(K) options go, it is a good one. The fund outperformed the S&P 77% to 68% over the last five years. It really shines in turbulent years like this one, rallying 23% year-to-date.

As we discussed at the outset, VDIGX just re-opened itself to new money for the first time in three years. But unless you also have a Vanguard 401(K), I think you can do better than VDIGX. Much better, actually. Here’s how.

For 17% Returns Per Year, Buy the Fastest Growing Dividends

Dividends drive the stock market. While current yields provide a big part of today’s return, it is the growth of these dividends that determines tomorrow’s return.

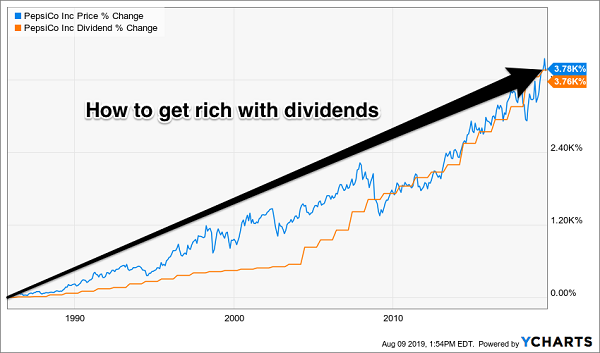

Let’s spy on VDIGX’s holdings to see how this works. Its number five position, PepsiCo (PEP), has made its investors rich thanks to its ability to grow its dividend. Check out the orange staircase below–that’s the payout that PepsiCo hikes every year. Its stock price (blue line below) is attracted to the payout curve like a magnet. Here’s their relationship since the beverage maker began paying a dividend:

Every Pepsi Payout Refreshes the World

PepsiCo’s payout growth has slowed in recent years. (No surprise, it’s already filled the world with sugar water.) Its last dividend raise was only 3%! That’s the junk food equivalent of pedestrian 3% annual price returns.

I wish Don Kilbride, VDIGX’s manager, would trade-in this dog. It’s weighing down my 401(K) returns. PepsiCo’s best years of payout growth are behind it.

Same goes for many Dividend Aristocrats, the stocks that have hiked their dividends for 25 or more consecutive years. They are treated like royalty, so their valuations are always high and their current yields low. It doesn’t make sense to reward past accomplishments since the stock market is a forward–looking vehicle.

The advantage of handpicking your own stocks is that you can look ahead rather than behind. Show me a company poised to grow its dividend by 17% per year (trust me, they exist) and I’ll show you a stock that’s likely to rise by 17% each and every year!

How to Identify Tomorrow’s Big Payout Raises

Forecasting payouts, of course, is work. So let’s start with a shortcut.

The best forward-looking dividend growth tool that I am aware of is Reality Shares’ DIVCON system. It ranks the dividend payers among the 1200 largest US companies across a variety of fundamental factors, including profitability, earnings growth, cash flow and leverage.

DIVCON assigns each stock an easy-to-understand score between 1 and 5. Low score? You’re sitting on an unsafe payout that might be ripe for a cut. High score? You can take that dividend to the bank, and chances are good that the distribution will be bigger within the next year.

If you want to stay put and collect cash, these three highly rated stocks are amongst the dividend payers to consider right now:

Exxon Mobil (XOM)

Dividend Yield: 5.2%

DIVCON Score: 4

Speaking of Dividend Aristocrats, Exxon Mobil (XOM) just renewed its membership card in April when it announced its 37th consecutive annual dividend increase.

It also handled the financial crisis better than many, dipping only about half as much as the broader market from 2007-09.

Exxon Mobil still is the alpha titan of energy. It’s the largest energy stock by market cap. It’s an integrated oil-and-gas giant that handles every step of the process, from exploration to your local Exxon gas station. And because its operations are so widespread, it’s not as sensitive to the rise and fall of oil as many pure-play exploration-and-production companies.

The company also laid out a plan earlier this year to more than double profits by 2025. Wall Street didn’t take it to heart at the time, but then, how many analysts are pricing the stock based on what the company might do in 2025?

Chevron (CVX)

Dividend Yield: 4.1%

DIVCON Score: 4

Chevron (CVX), long energy’s No. 2 to Exxon, is another Dividend Aristocrat—one that has racked up 32 consecutive years of higher payouts thanks to a 6% bump announced in January.

It’s also a fortuitous loser.

Earlier this year, it bid $32 billion to snap up driller Anadarko Petroleum, which accepted … but left Chevron at the altar after Occidental Petroleum (OXY) stepped in with a $38 billion partially financed by Berkshire Hathaway (BRK.B) CEO Warren Buffett.

Chevron refused to blow up its balance sheet just to counter the bid – a decision that Wells Fargo analyst Roger Read called “Winning By Not Overpaying.” It showed discipline, and it conserved cash—in fact, it even earned a $1 billion breakup fee. That healthier balance sheet is among several reasons why DIVCON gives CVX a high score of “4,” meaning the payout remains healthy, and likely to keep ramping up for years to come.

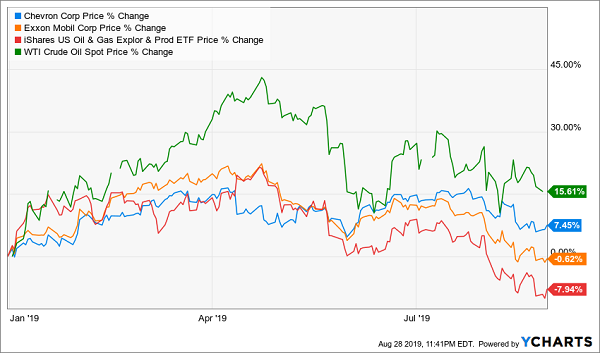

That said, while Chevron and Exxon are both integrated majors whose varying businesses make them less sensitive to commodity prices, they still can suffer when oil does. So while I expect them to hold up better than most in times of market turmoil, energy prices are a wild card to keep watch over.

These Oil Majors Are Resilient, But Not Invincible

Watsco (WSO)

Dividend Yield: 4.1%

DIVCON Score: 4

Here’s a name that doesn’t come up very often.

Watsco (WSO) is the nation’s largest distributor of air conditioning, heating and refrigeration equipment, parts and supplies. It operates under several brands, including Carrier, East Coast Metal Distributors and Baker Distributing Company, among others.

This is an almost criminally boring business. But it’s one that held up extremely well during the Great Recession. It lost less than half as much as the S&P 500 from the index’s peak to trough. And from the start of the bear market through Aug. 28, it rocketed ahead by 455.5%—well more than quadruple the broader market!

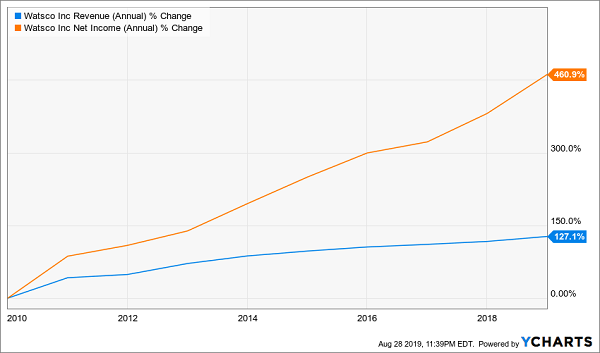

Its operational growth isn’t sizzling, but it’s good, and it’s consistent. Revenues have ticked higher by 3.4% annually on average for the past three years. Profits are logging roughly 12% growth each year since 2015.

Watsco isn’t technically a Dividend Aristocrat, but that’s only because it’s not a member of the S&P 500. Including its 10% payout hike announced in early January, the company has upped the ante on its dividend for 45 consecutive years.

Sure, HVAC isn’t necessarily on par with medicine or canned goods. But in most parts of the U.S., you need heat or air conditioning to make it through at least part of the year. Watsco will hang tough.

Watsco Turns Up the Heat on Its Margins

This “Perfect” Portfolio Will Quadruple Your Retirement Income

These blue-chip stocks are good retirement holdings. I agree with DIVCON: They have safe dividends. In fact, they’re safe companies. They’re safe stocks.

But what if I told you that the old retirement model is broken, and that piling into safe but overcrowded blue chips in 2019 will leave you woefully underfunded?

The vast majority of so-called income experts frequently point to the stocks I just discussed, telling you to invest in a system that will never pay the amount of money you need! In fact, unless you’re sitting on a massive pile of cash (or you’re willing to wait 30, 40, or 50+ years) it’s mathematically impossible for you to retire rich, wealthy and financially free by following their outdated advice.

Times have changed. You need far more income, for far longer, than people needed 20 or 30 years ago.

My “Perfect Income Portfolio” can deliver exactly that. In fact, if your current holdings look like the industry standard, this portfolio can literally double, triple or in some cases quadruple your annual income.

No tricks. No crazy options techniques that will blow up in your face overnight.

Just under-the-radar, against-the-radar income plays that can quickly build your wealth without piling on extra risk.

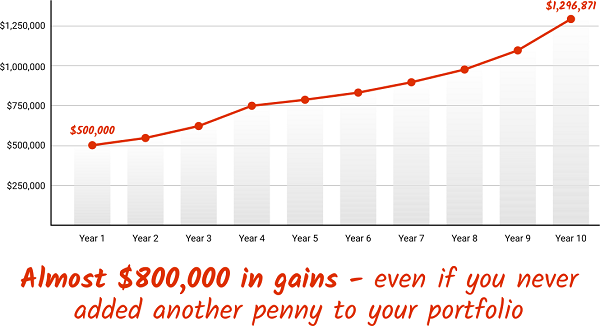

Too good to be true? Look at this strategy’s past 10 years of returns, and you’ll see why I call it the “Perfect Income Portfolio”:

What really makes this group of stocks stand out is that it’s so much more than high headline yield. This portfolio checks off a bundle of vital retirement boxes:

- It gives you a safe, secure, and steady income of $10s of thousand per year in cash—not just ‘paper gains.’

- It pays out more than enough to live on from dividends without drawing down your savings or assets.

- You avoid overly complex, high-risk investments that can wipe out decades of hard-earned money in a matter of weeks or months!

- You’re not involved in any risky options, spread-bets, or day-trading.

- It’s simple to set up and simple to manage. That way you’re not glued to your screen all day. Go out. Enjoy life. Your check’ll be in the mail.

Don’t lie awake anymore worrying about your yo-yo-ing net worth. Instead, let me teach you more about this incredible strategy, including its dominant track record. In fact, I’ll even let you hear it from the mouths of other investors that have reaped market-smashing gains from my research service.

Don’t wait another minute. Learn how to get 2x-4x your current income with this simple, straightforward system. Click here to get a FREE copy of my Perfect Income Portfolio report, including tickers, buy-in prices, dividend yields, full analyses of each pick … and a few other bonuses!

Recent Comments