First-level investors are at it again, crowing that now is a great time to give the vaunted Dividend Aristocrats another look.

(You’ve probably heard of these darlings of the income world: they’re the 53 stocks that have hiked their dividends for 25 straight years or more.)

Desperate for a Deal

So why is now supposedly a great time to buy these payout poster boys?

Because according to a recent Barron’s article, the ProShares S&P 500 Dividend Aristocrats ETF (NOBL), the passive fund that holds all 53 of these stocks, is trading at 18.1 times forecast earnings for this fiscal year. That’s below the average of 18.8 over the last three years.

You can tell the market’s in nosebleed territory when a 3.7% discount is touted as a great bargain!

There’s more, though. Because NOBL is lagging the S&P 500 this year, tempting some folks to think there’s good value here:

Aristocrats Lag; Time to Buy?

My view?

Jumping into the Aristocrats based on these 2 arguments alone won’t get you much upside. And if you follow the popular view that a payout that’s risen for 25 years straight is enough to make a stock safe, you’re putting yourself in danger.

That’s because today’s surging dividend could be tomorrow’s surprise cut. And when management commits that sin, shareholders pay the price.

(In a moment, I’ll show you 3 better options—ranked worst to first—than NOBL or picking Aristocrats yourself. Plus, each one pays sky-high yields up to 10.5%.)

Aristocrats Are Held to a Higher Standard

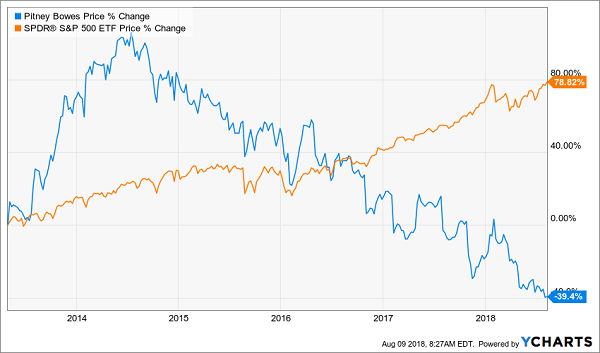

To see how a failed Aristocrat can cost you, consider Pitney Bowes (PBI), which slashed its payout in half a little over five years ago after just barely eking into the club with 26 years of hikes.

Since then, the stock has not only wiped out half of shareholders’ dividend income, it’s taken out 40% of its value, too—while the market marched 79% higher.

PBI Adds Insult to Injury

That’s not the only way Aristocrats can bleed your cash. Because some, like AT&T, deliver such weak hikes (I’m talking a penny a year here) they barely top inflation.

And as I said in my July 14 article, “10 Dividend Stocks That Will Double Your Money,” a fast-rising dividend is the No. 1 driver of share prices. That’s because there’s nothing like a surging payout to send the herd stampeding into a stock.

But a flaccid payout like AT&T’s does nothing to lift its stock. In fact, Ma Bell’s shares have dropped 9% in the last five years, despite management’s lame payout hikes:

AT&T Falls Through the Dividend Floor

Luckily, there’s a way to grab high—and rising—dividend payouts at real discounts.

8%+ Dividends—and Upside—From Stocks You Know Well

I’m talking about closed-end funds (CEFs), a unique type of fund with an overlooked quirk we can tap for 20%+ price upside and high, safe dividends upwards of 8%.

That quirk is the discount to net asset value (NAV). It means that CEFs often trade at wide markdowns to the value of the investments in their portfolios.

This is free money! And by purchasing CEFs when their discounts are really off the wall, we’ll set ourselves up for fast profits as that markdown narrows, sending the fund’s share price soaring.

To show you what I mean, let me move on to the 3 CEFs I want to show you today, starting with my third-favorite pick of the lot.

CEF Pick No. 3: A 10.4% Dividend Fit for a Patriot

The Liberty All-Star Equity Fund (USA) boasts a 5-person management team that adds a dash of growth to its value focus—and this shows in USA’s results: the fund has nearly doubled the market’s return this year:

Clobbering an Already-Hot Market

Better yet, this gain was almost all in cash, thanks to USA’s blockbuster 10.4% dividend. To put that another way, $200,000 in this fund would get you a tidy $1,733 in cash!

That massive income stream comes from a portfolio built on big-cap stocks like Amazon.com (AMZN), PayPal (PYPL) and Salesforce.com (CRM). In other words, if you hold any of these names (as many folks do), you could easily swap them for USA now, get more diversification and start tapping that 10.4% payout.

The reason why I’ve got USA in third spot is that it’s not as cheap as my other two picks, trading at a 4.4% discount to NAV. That doesn’t leave us with much upside from our closing discount window, but fear not: USA will still ride higher as soaring S&P 500 earnings drive its portfolio value up.

The kicker? That massive 10.4% dividend will keep paying your bills (and then some) while you wait.

CEF Pick No. 2: A Monthly 8% Dividend at a 7.4% Discount

I told you last week about the incredible opportunity in real estate investment trusts (REITs) due to the myth that rising rates hurt these investments. I also showed you 3 REITs that are great buys now.

The only hitch?

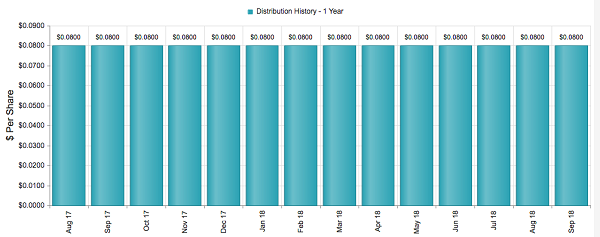

The biggest payer of that bunch, STAG Industrial (STAG), “only” yields 5.1%. We can do better with the Cohen & Steers Quality Income Realty Fund (RQI), which drops a rock-steady 7.9% dividend paid monthly:

Another Month, Another Cash Payout

Source: CEFConnect.com

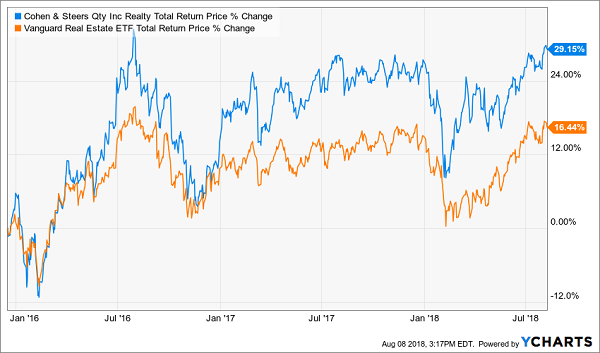

And look at the drubbing the 3-person team at the top (with 74 years of combined experience) has laid on the “dumb” Vanguard Real Estate ETF (VNQ) since the Fed kicked off this rising-rate cycle in December 2015:

Interest Rate Drag? What Interest Rate Drag?

But is management getting any respect for this smackdown? Nope.

As I write, RQI trades at an absurd 7.4% discount to NAV—and that markdown was as narrow as 0.9% just last March! There’s no reason for that—it just shows you how inefficient the tiny CEF market is.

But that markdown will march back to that level soon, handing us easy 13% price upside, just from that window closing alone!

CEF No. 1: A “Secret” 10% Yield

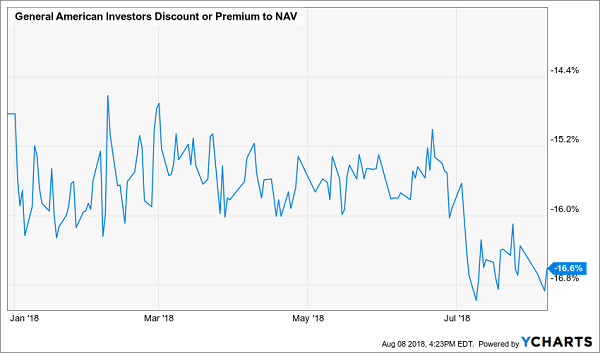

My top pick of our threesome is the General American Investors Fund (GAM), a CEF that’s also shown up on the radar of our CEF specialist, Michael Foster, in the last couple months.

It might seem like a strange choice at first because of its low yield: just 1.4%. But we need to look closer.

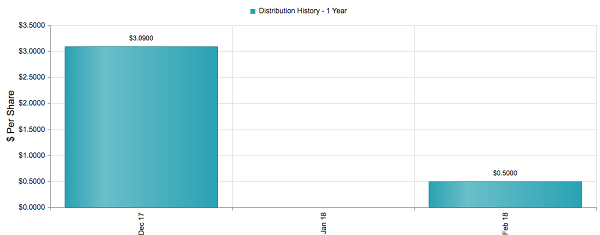

While it is true that this fund’s last regular payout ($0.50 a share paid yearly) does indeed yield 1.4%, what everyone forgets is that management pumps out a special dividend every year. When you factor in GAM’s last regular payout and the special dividend, the fund’s trailing-12-month yield jumps to 10%!

“Regular” Payout Just Part of the Story

Source: CEFConnect.com

That’s because management likes to keep its cash free to invest in fast-growers like Gilead Sciences (GILD) and Alphabet (GOOGL). It then hands us the profits at the end of the year in greenbacks. But this strategy has been totally overlooked by the market, giving us a shot at this fund for a silly 17% discount.

Misunderstood Dividend Lets Us Buy Cheap

Here’s something else everyone forgets: GAM’s discount helps boost its dividend. Because while investors focus on the yield on market price (currently 10%), the really important number is yield on NAV, or what the fund pays out on its portfolio, including that yearly special dividend.

And the fund’s yield on NAV is 8.3%, a fairly easy return for management to nab in the market (and give to us as a plus-sized payout in December). That makes now the time to buy.

… And Here’s An Additional $40,000 a Year Paid Monthly

The suits at Merrill Lynch say you need $738,400 to retire well.

They’re dead wrong. You’ll actually need a lot less than that.

The proof? My “8% Monthly Payer Portfolio,” which gives you a simple way to bankroll your golden years on 32% less.

That’s right: I’m talking about a fully paid for retirement for around $500k! As the name suggests, I’ve carefully constructed my 8% Monthly Payer Portfolio to hand you a rock-solid $40,000 a year (or steady $3,333 a month) on a $500k nest egg.

And you’ll probably need even less than that!

That’s certainly been the case with the grandmother who invested $387,000 in my portfolio. Eight months later, she’d withdrawn $3,000 a month to pay her bills, and her balance had actually grown to $397,000!

That’s the power of this unsung collection of investments, and I’m ready to share everything I have on each one of them with you now. Simply CLICK HERE and I’ll give you the full story, including exactly how to buy in and start tapping this outsized 8% income stream today.

Recent Comments