Most “high bracket” investors love the idea of tax-free muni bonds. But they aren’t sure where to buy them, and often end up using exchange traded funds (ETFs) as their vehicle of choice.

Bad idea.

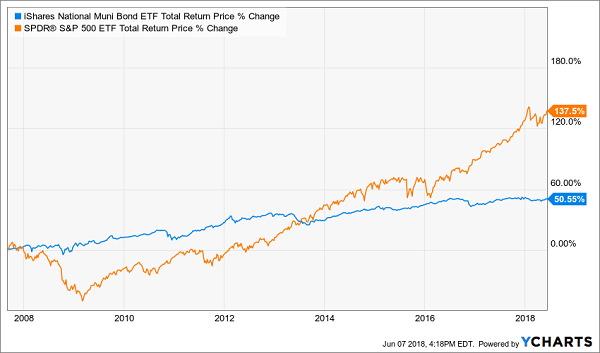

Muni ETFs provide a smooth but unfulfilling ride. The popular iShares National Muni Bond ETF (MUB) for example has rewarded its investors with a drama-free decade. Prescient investors who foresaw the big crash of 2008 and piled into munis saved themselves a year of heartburn and earned $50,000 in Federal tax-free income on every $100,000 they saved from stocks:

MUB is Steady, But Unspectacular

Stocks, as usual, were better over the long run. The S&P 500 returned 138% versus just 51% for MUB.

But neither is a compelling income investment today. The S&P yields just 1.8% and MUB pays (a tax-advantaged) 2.4%. The muni ETF has returned 3.8% per year since inception and is likely to underperform that mark in the years ahead. After all, it pays less and trades for exactly the value of the muni bonds it holds.

We need a better way. And we have one.

Double Our Tax-Free Yield and Long-Term Return

It’s not MUB’s fault it’s so lame. ETFs are marketing products, designed to attract assets from investors. Their strategies are often mindless and their returns reflect it.

Enter CEFs (closed-end funds), the underappreciated darling of savvy income investors. CEFs are better bets for three reasons:

- They are actively managed by pros with a legitimate “edge”,

- Their asset pools are fixed, which means they can (and do) trade at discounts to their net asset values (NAVs), and

- They get access to cheap money, which helps them lever up returns with minimal risk.

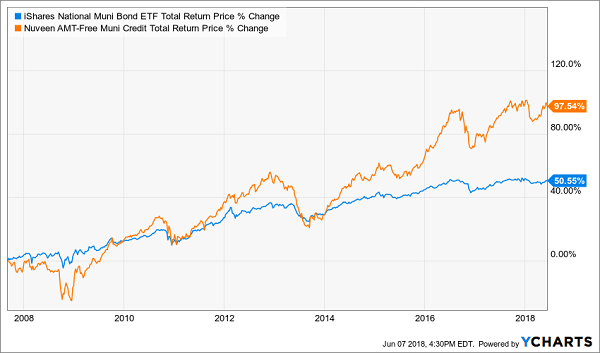

Add up these edges, and we have a superior long-term vehicle for muni returns. For example, since its inception in 2002, the Nuveen Enhanced AMT-Free Municipal Credit Opportunities Fund (NVG) has returned 6.4% yearly to investors (before the tax break!).

It’s no surprise because Nuveen is so connected that it gets the first phone call on muni bond offerings. Portfolio manager Paul Brennan is in the catbird’s seat as he builds a tax-advantaged collection of investments for his shareholders. And Paul earns his paycheck. His Rolodex has doubled up the flashier MUB since the latter was launched by its marketing wonks:

NVG’s Substance Doubled Up MUB’s Flash

I admit that NVG’s superior ride isn’t quite as smooth. Two of its major advantages are responsible for its higher volatility. (I’ll explain in a moment but let me add that this is actually a good trait, because price swings give us calculated contrarians great times to buy.)

Is right now one of them? Let’s consider three important factors.

NVG Trades at a 7% Discount to NAV

We can buy Paul’s muni bonds at a discount today – for 93 cents on the dollar, to be precise (using our 7 cent discount). This covers his management fee and provides us with a nice margin of safety while we collect our federal tax-exempt payouts.

It’s a good deal. Not quite a great one, because there have been times (and will be again) when NVG has traded at double-digit discounts to its NAV. But there have also been times (and will be again) when NVG traded for a narrower discount or even a slight premium.

Given that NVG is a great fund with a great tax benefit for certain individuals, I am fine with us paying a good price for it.

(And when great buying moments like we saw in December 2016 to arise, my subscribers are the first to know! I told my Contrarian Income Report readers to buy NVG then, and it’s delivered 14% pre-tax returns since.)

Gotcha Again, MUB…

Rates Rising: A Problem for Munis?

Headline-following investors believe that rising rates are bad for muni bonds. But munis and long-term rates haven’t always had an inverse relationship. Last decade, they actually co-existed peacefully and tended to move in tandem:

Munis and Rates Haven’t Always Disagreed

This traditional relationship should eventually resume. If the 10-year yield (somehow) rolls towards 5% or 6%, municipalities will have to pay more to fund their projects. But their premiums should be modest, thanks to the tax benefits they provide.

Sure, leverage costs will creep higher for CEFs. But historically, this has been offset by the higher “coupons” our managers are able to collect. We saw this happen during the Fed’s last rate hike cycle from 2004 to 2006:

Fed Rate and Munis: Rising Together in Harmony Then…

And muni history rhymes during this rate hike cycle, too.

… And Now

Double All of Your Dividends With These 8% Retirement Plays

Got more dividends you’d like to double as we did here?

After all, with a simple substitution, we were able to turn a measly muni payout into meaningful money that Uncle Sam won’t touch!

And I have more easy “yield hacks” that’ll help you double your retirement income or better. For example, if you are frustrated with the lame 2% or 3% your current blue chips are paying you, I can show you how to double your income – and do it just as safely.

High yields are important becase they let you “ride out” any price fluctuations. When you live off dividend income alone you never have to actually sell anything.

That’s why I recommend a full “no withdrawal” portfolio of secure 8% payers. There are actually safe funds and stocks that pay this much. They don’t get a lot of coverage in the mainstream financial media because most investors are distracted by big blue chip names. Problem is, this popularity comes at a price – and again you can’t live off dividend income alone if you’re only banking 2% or 3% in yield.

The solution? Stealth plays like closed-end funds, preferred shares and recession-proof REITs. You can build a safe, diversified portfolio from these types of issues that pays 8% – which means you’ll never have to lose sleep over price gyrations again.

Want to learn more – and buy a few high paying shares? Click here and I’ll share everything about my “no withdrawal” strategy, including the names and tickers of the stocks and funds that you can buy for secure 8% yields.

Recent Comments