I can’t tell you how many times I’ve mentioned closed-end funds (CEFs) to investors and been met with blank stares in return.

It’s too bad more people don’t know about these powerful income plays because …

- CEFs let you diversify, not only within stocks but beyond them. Among the 500 or so CEFs out there are funds that own stocks, corporate bonds, municipal bonds, real estate investment trusts (REITs) and more.

- CEFs often trade at discount to net asset value (NAV, or the value of their portfolios). This means we can buy shares of high-quality firms like Apple (AAPL) for less than market value. These deals simply don’t exist with ETFs.

- CEFs offer a large income stream, with an average 8.2% dividend yield across the universe of funds tracked by my CEF Insider service as I write this.

Personally, I think the most powerful thing about CEFs is the Point #2. But I know that investors—including CEF Insider members—tend to favor Point #3. And I get it.

After all, thanks to CEFs’ big income streams, we can re-create a middle-class salary with much less than we’d need with index funds, literally shaving decades off the time we’d need to save enough to stop working.

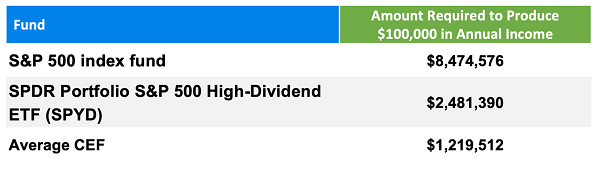

This table shows us that because the average S&P 500 stock yields so little—around 1.2% on average as I write this—we’d need to save an absurd amount, nearly $8.5 million, to get $100,000 in annual income.

You could opt instead for the SPDR Portfolio S&P 500 High Dividend ETF (SPYD), which lowers the savings level to $2.5 million, thanks to its 4% current yield. But thanks to the average CEF’s big yields, CEFs get you there with just half that amount.

We can take this even further. Some CEFs are currently yielding 12%, meaning you’ll get $1,000 per month for every $100,000 you invest. An annual six-figure income means you’d have to save just $833,333.

Plus, there are some funds that can get you this amount of yield while being even more diversified than you’d be with SPY or SPYD.

Let me show you three funds that easily create this kind of yield, while providing diversification across asset classes—something S&P 500 index funds can’t do.

CEF #1: Utilities for Stable Income (and a 12% Yield)

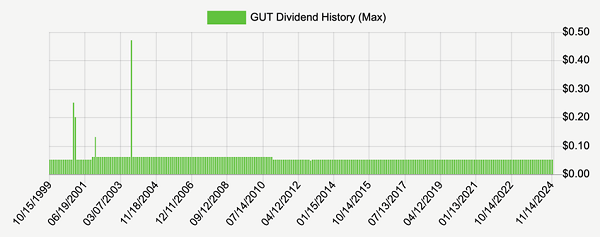

The Gabelli Utility Trust (GUT) has a portfolio of utility companies across the country—giants like Duke Energy (DUK) and Florida-based NextEra Energy (NEE). With GUT, we’re essentially getting a slice of the energy bills paid by residents in cities and counties across the nation.

That’s as predictable a revenue stream as you’ll find, and as a result, GUT has maintained its high payouts—currently yielding an even 12%—since the 1990s.

Stable Income, With Surprise Special Dividends

Source: Income Calendar

Back in the 2000s, GUT paid some special dividends and briefly hiked its payout to six cents a share monthly, up from five cents at its IPO (which is its current payout). But the fund has held back on special dividends to focus on consistency. That’s great for income investors, but it also means GUT has become incredibly popular.

Most CEFs trade at a discount, but GUT trades at a really, really high premium—nearly 53% at the moment! That’s incredibly high for a CEF, and it poses risks if you want to hold GUT for the shorter term, then get out. That’s a problem our second fund doesn’t have.

CEF #2: A 12.3% “Convertible” Yield Selling for 7% Off

Convertible bonds aren’t well-known, but they’re fascinating income plays: You get a high yield, like a bond, but there’s also a conversion privilege. So if the price is right, you can convert your bonds into stock and get capital gains if the stock rises.

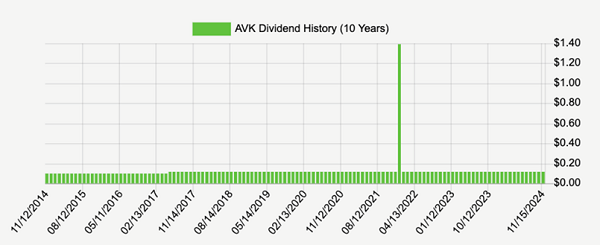

One fund that collects these bonds and converts when it’s ideal is the Advent Convertible and Income Fund (AVK), currently yielding 12.3% and paying out every month. That spike you see in the chart below is a special dividend paid out in late 2021.

AVK’s Consistent Payout

Source: Income Calendar

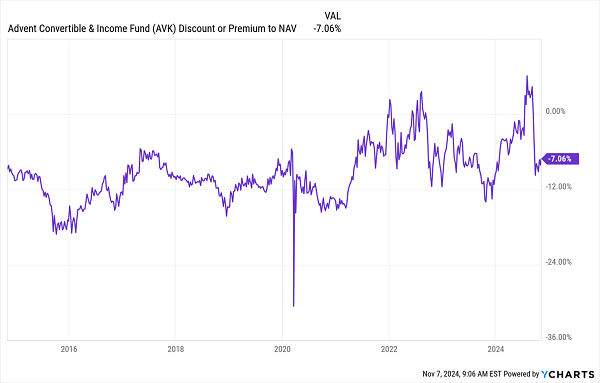

But despite that high yield and consistent payout, AVK trades at a 7.1% discount, which is a sea change from the 6% premium it saw earlier this year:

AVK Is Cheap, With Potential to Bounce Higher

Investors do this to CEFs every once in a while, and it’s happened three times with AVK in the last three years. Higher interest rates have boosted demand for debt from investors, and AVK has benefited with more investment income that management has used to maintain its monthly payout after hiking it back in 2017.

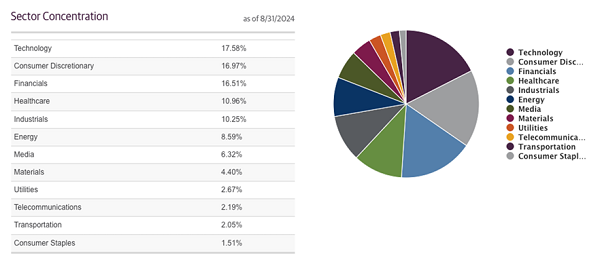

High, steady payouts and a discount? Need I say more? In case I do, check out AVK’s widely diversified portfolio:

Source: Guggenheim Investments

This fund holds bonds and stocks in Bank of America (BAC), Hewlett Packard Enterprise (HPE), Western Digital Corp. (WDC), Uber Technologies (UBER) and other high-quality companies that have no problem paying their bills on time. And those bills accrue to AVK, which passes on those interest payments to investors.

CEF #3: An 11.3%-Yielding Bond Juggernaut

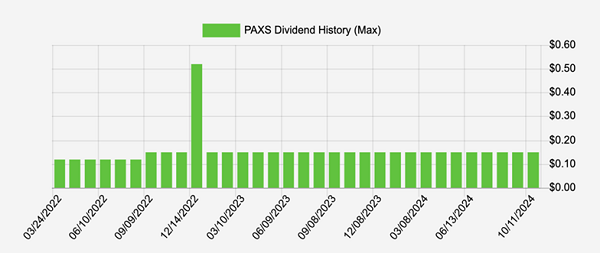

Finally we’re going to pick up the 11.3%-yielding (not a typo!) PAXS, which holds a diversified portfolio of 325 high-yield corporate bonds. As the name states, this is a PIMCO fund. PIMCO is a well-respected name in CEFs, as the firm is known for its active management and its ability to effectively navigate interest-rate changes and seek out undervalued bonds.

A Steady—and Monthly—Income Stream

Source: Income Calendar

PAXS has only been around since January 2022, which was lousy timing for the fund to hit the market, given the hit that bonds took as interest rates rose that year. But it’s still returned around 12% in that time. Its dividend has also risen, with a special payout in late 2022, as you can see in the chart above.

While PAXS trades at a 2.7% premium to NAV, that’s not unusual for PIMCO funds, which often trade at bigger premiums due to PIMCO’s strong record. And this one has traded at premiums as high as 9% in recent months, a good sign for future gains.

The final word? Beyond this trio, there are many more CEFs trading at discounts and with similar yields, meaning you can combine a 12% yield with capital gains. That might help you save years, or even decades, off your planned retirement date.

These 4 CEFs Pay $9,800 on Every $100K (Their Holdings Will Surprise You)

As I said off the top, the best way to think of CEFs is as a tool for buying into a whole range of assets at a big discount, and with a big dividend yield. The 3 CEFs above, with their utility stocks, convertible bonds and corporate bonds, are great examples.

Let me add another category here that might surprise you: AI stocks.

That’s right, through the 4 CEFs I’m pounding the table on now, you can reap big gains and income as artificial intelligence continues to embed itself in our lives. I’m talking about mammoth 9.8% payouts here.

And thanks to these funds’ deep discounts, we’re buying these AI kingpins—companies like NVIDIA (NVDA), Microsoft (MSFT) and Broadcom (AVGO), as well as smaller, fast-growing firms—at prices that haven’t been seen in months!

This is a terrific time to buy these 4 CEFs, and I can’t wait to give you all the details. Click here and I’ll spill the beans on these 4 bargain-priced, 9.8%-paying AI funds and give you a free Special Report revealing their names and tickers.

Recent Comments