At my CEF Insider service, a fund’s discount to net asset value (NAV, or the value of its underlying portfolio) is one of the first things we look at when deciding whether to issue a buy call.

That’s because it can tip us off to a bargain-priced CEF, just like price-to-earnings (P/E) ratios do for regular stocks. But as with P/E ratios, the discount to NAV is not the be-all and end-all when it comes to making a buy decision.

The Discount to NAV Is Just the First Step in Our Research …

It’s easy to see why some investors put too much weight on the discount to NAV, though. Doing so seems like a no-brainer: If a CEF is trading at a bigger discount to its NAV than it has historically, it’s a bargain, right?

Conversely, if it’s trading at a ridiculous premium, you’re best to steer clear. But relying on just this one indicator can leave you scratching your head when that “bargain” fund continues to lag the market.

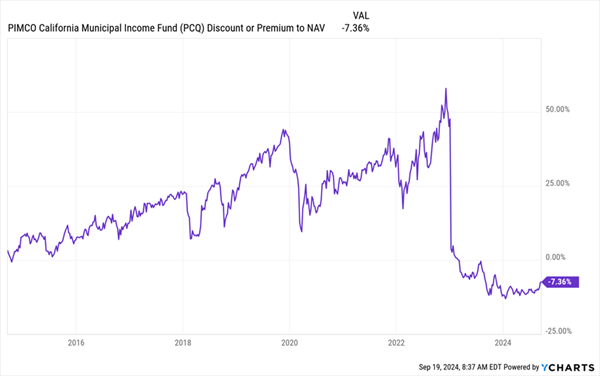

To see this in action, let’s look at the PIMCO California Municipal Income Fund (PCQ). As I write this, PCQ trades at a 7.4% discount to NAV, well below its 10-year average premium of 17.7%, making it seem like a screaming buy.

An Attractive Option on Sale, or a Crashing Dud?

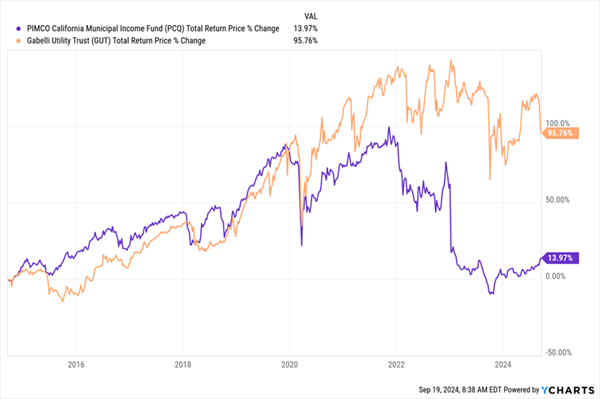

Meanwhile, the Gabelli Utility Trust (GUT) trades at an absurd 73.7% premium to NAV, a number that should make any investor cringe. After all, its 10-year average premium is “only” 49.6%, so why would anyone pay through the nose for this fund?

Here’s Why Investors Are Paying GUT’s Premium

Here’s the kicker: PCQ’s annualized total return (shown in purple above) over the last decade is just 14%, while GUT (in orange) has returned 96%, nearly seven times more.

In other words, that “cheap” discount on PCQ has been masking a fund that’s barely eked out any gains for a decade, while GUT’s massive premium has been paired with actual wealth creation.

… But We Still Need to Be Wary of Premium-Priced Funds

Let me stop right now and make this clear: I do not think you should buy GUT now!

The fund’s 73.7% premium is, like I said, absurd. We want to stick with discounted CEFs. So if we do that, do we find that funds with more generous discounts than they had in the past are always better options?

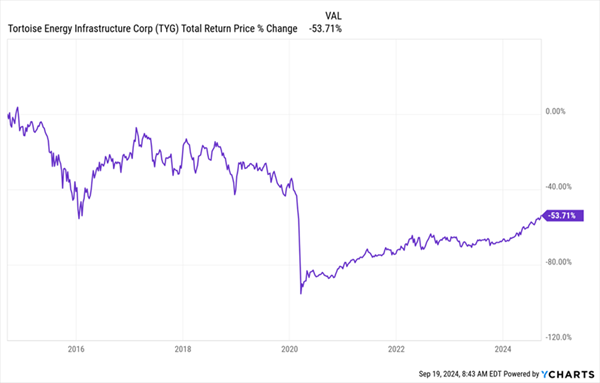

To answer this, let’s look at another CEF, the Tortoise Energy Infrastructure Corporation (TYG). This fund trades at a 12.3% discount to NAV as I write this, which might catch your eye, especially since its 10-year average discount is only 4.5%. On the surface, that’s a wider-than-usual discount, making the fund seem like a potential bargain compared to its historical norm. But here’s where things start to fall apart: TYG has returned negative 54% in the past decade, even with dividends included.

How Relying Too Much on Discounts Can Lead You Astray

A fund delivering a negative return over a decade, no matter how deep the discount, is hardly an enticing investment. And while TYG’s 8.3% dividend yield might seem attractive, for CEFs, which yield around 8% on average, it’s not particularly special.

What’s With the Different Returns?

Clearly, the takeaway here is that while discounts are critical, they’re just one indicator among many when buying CEFs.

We also need to look at a fund’s management team (to make sure they have a strategy capable of closing that discount), its portfolio and the asset class the fund invests in.

GUT is a good example of that last point: Its focus on utilities has been the right setup for the last decade, in which utilities have posted strong returns. That’s what’s been behind GUT’s 96% total return. The last few months, with interest rate cuts in the offing, have been a big help, as utilities tend to rise as rates fall.

Meanwhile, TYG’s focus on energy has been a drain on the fund. PCQ’s dependence on municipal bonds issued by the State of California, where continued worries about balanced budgets and more people moving out of the state, have made that fund less compelling for investors.

All of this shows why relying solely on discounts can be misleading. TYG’s discount might look attractive at first glance, but its long-term performance tells a different story. A deep discount is of little help if the fund isn’t generating decent returns.

But if we can find that sweet spot: a fund with a deeper-than-usual discount, a great portfolio and management team, and a high, steady dividend? That’s where the magic really happens with CEFs.

Buy Alert: These 4 CEFs (Yielding 9.8%) Invest in AI the Right Way

This may surprise you, but we’re finding some of the best CEF bargains—I’m talking about great managers, strong portfolios and, yes, deep discounts—in funds holding AI stocks.

That’s right: AI stocks!

The four AI-focused CEFs I’m urging investors to buy now take a SMART approach to this breakthrough tech, targeting companies that are developing AI the right way.

By that I mean they’re treating it as a productivity enhancer that will make the apps we use every day more efficient over time—not as some ridiculous sci-fi scenario where AI takes over the world!

What’s more, these 4 funds hold not only AI stocks but firms that are first in line to profit as this new productivity wave takes hold. I’m talking about insurers, industrial companies, pharmaceutical producers and more.

The dividends on these 4 funds? They’re fantastic: I’m talking 9.8% payouts here.

This is the right way to invest in AI, and I don’t want you to miss out. Click here and I’ll tell you more about these 4 top-quality AI funds and give you access to a free Special Report revealing their names and tickers.

Recent Comments