“Deglobalization” is the dividend trade of the 2020s. And we’re going to tap it for safe dividend growers with real assets and real cash flow.

I’ll drop two tickers in a second.

Signs that our interconnected world is coming unglued are everywhere. Supply chains are still a mess. Europe is getting set to ban (or slap a price cap on) Russian oil. Speaking of Putin, his immoral invasion of Ukraine is, er, not going well. He’s even going cap in hand to North Korea for spare parts for his ramshackle military!

Meanwhile, Chinese President Xi gazes across the Taiwan Strait, while shuttering his own economy (and vital trading ports) in pursuit of his insane zero-COVID policy.

“Buying Local” Is a Smart Dividend Strategy for the 2020s

Sure, things aren’t exactly great here in the US, but consumers are still spending and inflation looks like it’s peaked—unlike in the UK, where inflation could hit 18% in 2023!

My call? On the other side of this mess, America will lead as the world enters a new era. Bet on it.

That’s why we want to hunt for dividend growers here in the US, or at least in friendly countries. We also demand strong balance sheets, rising earnings and cash flow and fast payout growth, the latter of which has, as we’ll see, the knock-on effect of driving share prices higher.

Last week, we looked at two oil dividends that tick all these boxes: they’re focused on America or “friendshored” in aligned countries—Canada in one case. Let’s build on that with two more picks generating cash so quickly they can’t raise their dividends fast enough.

WEC Energy Is on Its Way to Paying 7% (or More) in Dividends Every Year

Utilities are a no-brainer buy in uncertain times. It’s easy to see why: 2022 is a mess, and we’ll likely see a recession in 2023. Utilities don’t care: people have to pay their power bills either way.

WEC is the ultimate in “onshored” firms, with 4.6 million electricity and gas customers in Wisconsin, Illinois, Michigan and Minnesota. The stock trades at 24-times forward earnings, just above its five-year average of 22.6. But we don’t care, for a couple of reasons:

1) WEC is showing “relative strength.” This simply refers to the idea that strong stocks tend to stay strong. We’re not looking for low P/Es here, just stocks with momentum. And as you can see below, WEC has that—it’s popped 9% so far this year, when just about everything else has been in the red. With more volatility guaranteed and WEC and other utilities being time-tested safe havens, I expect the stock to book more gains as we roll through the end of 2022 and into ’23:

WEC Lights Up in a Dark Year

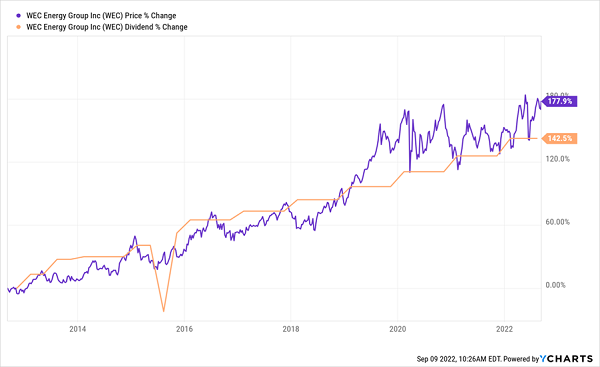

2) WEC’s Dividend Magnet is powered up: The stock yields 2.7% now, but as we’ll see below, a ho-hum yield like that can grow into something special when you hold for the long haul:

Dividend Hikes Translate Into Share-Price Gains

(Don’t worry about that dip in 2015—the payout was pro-rated due to WEC’s acquisition of Integrys Energy; it wasn’t cut!) As you can see, the dividend has soared 143% in the last decade, and the price followed right along, a pattern I like to call the Dividend Magnet—we’ve seen it happen again and again (and again).

Thanks to that fast payout growth, folks who bought in 2012 are yielding a rich 7.6% on their original buy today! This is, hands down, the safest way to get a dividend that big.

Further payout growth is a lock: WEC announced a 7.4% hike for the first quarter of 2022, powered by its strong business: since the end of September 2020, trailing-12-month revenue has jumped 12% as the economic reopening drove electricity demand. Meantime, WEC’s last 12 months of payouts are just 65% of its earnings—at the low end of its target range of 65% to 70%.

So we’re left with a firm that’s thriving in the dumpster-fire year that is 2022, with a surging dividend that’s setting us up for a safe 7%+ payout down the road. That’s an attractive combo no matter what lies ahead.

Life Storage: A 4.7%-Yielding “Domestic” Dividend That’s on a Tear

If you’re looking to buy home-grown stocks with soaring cash flow, self-storage is where you want to be. Sure, it’s “boring,” but few of these firms operate internationally, and the business model is as low-maintenance as they come—management basically has to keep the rooms dusted and hand out the keys!

Self-storage also tends to attract business in good times (as consumers buy more stuff) and bad (as consumers downsize and need a place to store their stuff!).

Real estate investment trust (REIT) Life Storage (LSI), with 1,100 self-storage facilities across 36 states, has done particularly well, booking a 37.5% gain in adjusted funds from operations (FFO, the key cash-flow metric for REITs) in the second quarter.

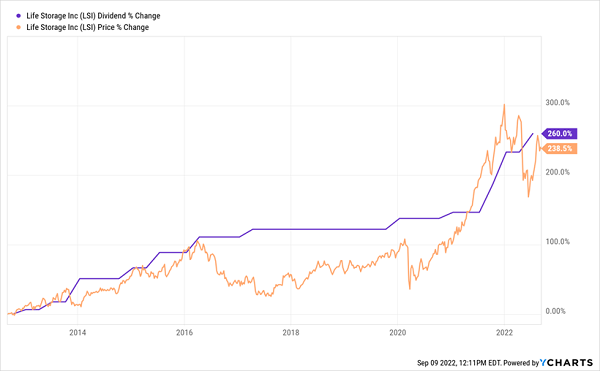

CEO Joe Saffire loves to hike the payout, which yields a healthy 4.7% and has soared 62% in just the last three years. As we saw with WEC, the company’s dividend has paced the stock steadily upward in the last decade:

LSI’s Dividend Magnet Has a Strong Pull

This dividend is primed for more growth, with management forecasting $6.27 to $6.30 in FFO for all of 2022, the midpoint of which is up 24% from 2021. And we get an extra level of safety from LSI’s manageable (for a REIT) payout ratio of 83% of FFO.

That payout is further backstopped by LSI’s 94% occupancy rate. What’s more, once they’re in, people tend to store their stuff for a long time: according to self-storage website Neighbor.com, 48% of self-storage renters keep their unit for two years or more.

All of this makes LSI a good “onshored” buy as we move from economic expansion to (potential) recession and then, inevitably, back to growth.

Life Storage and WEC Are Part of a “Great American Reset” That’s Just Starting …

It started with lockdowns. Then came supply chain chaos. Rampant inflation. The Ukraine invasion.

All of it is prying apart our interconnected world. China’s saber rattling over Taiwan doesn’t help

WEC and LSI are great stocks to own as global trade comes unglued. After all, I’m still bullish on America, where these two companies do all of their business. The US leads the world in growth and is far ahead of European basket cases in getting inflation under control, for example.

What we’re going through now is all part of what I call the “Great Reset,” and I’ve got seven MORE stocks that are notching big gains, and dividend hikes, thanks to this unprecedented shift. I’ve put all of my research on them in a Special Report I call, simply, “The Great American Reset.”

- One of these dividend machines is an American steelmaker that profits as inflation drives up steel prices!

- Another is a food stock that generates more cash as people dine at home—which more folks are doing now, due to inflation, and will do in even greater numbers if we see a recession, as expected, in ’23.

- Yet another is a defense contractor that’s booking higher sales as the US boosts its defense budget to cope with an endless number of global challenges.

All seven of these stocks are ridiculously undervalued as investors have been too blinded by their fear of the Fed to pick up on their exciting profit stories. But that won’t last.

Recent Comments