Let’s buy the dip on high-growth dividend payers as we head into 2022. Basic investors are fearful, which means it’s time for us contrarians to get greedy.

Thanks to the year-end pullback in stocks, we have an opportunity to double our dividend money even faster than usual. Usually, these moonshot plays aren’t so cheap. But we have a “mini” bear market in small caps and other areas of the market to thank for these bargains.

In a moment we’ll discuss 22 dividend growth stocks that are poised to double in just a few years. These companies have been growing their payouts so fast that, at this pace, they’ll double their payouts in just a few years.

This means that their stock prices are likewise set to double in just a few years. Buying stocks like these is the surest, safest way to “get rich” in the stock market because share prices tend to rise with dividends over time.

How can a dividend grower make so many people rich so fast? Here’s an example. I recently pointed out that hospital landlord Medical Properties Trust (MPW) is poised to deliver 9.4% to 10.4% returns per year, every year, for the foreseeable future.

But the stock only pays 5.4% as I write this. So where did I come up with the extra coin?

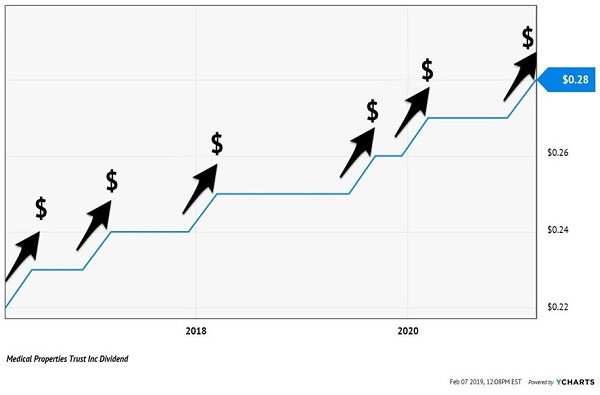

Well, MPW raises its dividend every year. In fact, the company has hiked its payout six times in the last five years. It is skillfully playing a game of “Hospital Monopoly” where it adds assets regularly. These new hospitals boost the firm’s cash flow and then management, in turn, hikes the dividend:

MPW Raised Dividends Six Times in Five Years

Going forward, I have MPW penciled in for another “penny per share” raise next year. And the year after that. And so on.

These pennies add up. They represent 4% to 5% annual gains on the stock’s payout. Which means that by 2025, shares will pay $1.28 per share, a sweet jump from today’s $1.12.

When 2025 comes around, and we wonder where the first half of the decade went, MPW’s yield will have grown to 6%+ thanks to these annual gains. But it’s unlikely we’ll be able to bank 6%+ on new money. This “yield on cost” will be a deal that can only be snagged by forward-looking investors who bought shares today.

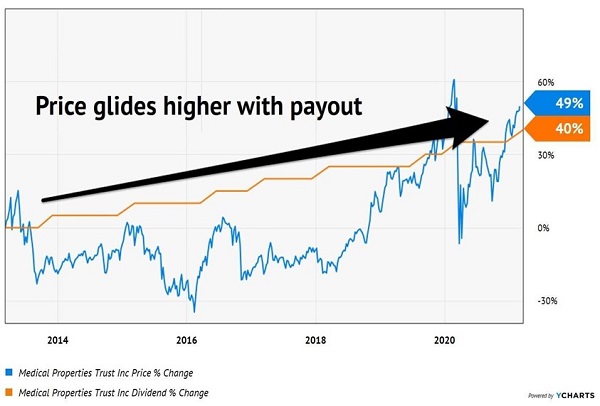

Over time, MPW’s share price tends to rise along with its payout. My longtime Contrarian Income Report subscribers know this well from when we originally purchased this dividend powerhouse in 2015. Let’s rewind even longer to 2013—a full eight years—which is when MPW began boosting its payout.

Over time, its dividend staircase has been a guiding light for its stock. The price can spike higher or lower, but over time it simply follows the dividend:

Dividend Growth Means Price Appreciation

(Please note that the price line above means price only, not total return, which includes the dividends you are paid and is, of course, higher.)

The reason I don’t think we’ll see a 6%+ dividend yield deal on MPW in 2025 is that, over the long haul, this stock’s price tracks its payout. By then, new investors will probably see a yield of 5% or less, because income investors will continue to realize they should ditch their lame 2%-paying blue chips and hop aboard this hospital landlord.

Which means anyone who owns shares right now is poised to enjoy 4% to 5% annual price gains per year. Shares should cruise north of $25 by 2025, thanks to these dividend increases that will attract new income investors.

Want to make more than 9.4% to 10.4% per year? We have two choices:

- Find a double-digit yield that is not only secure, but also growing. (Difficult.)

- Find a dividend that is growing by double digits (Doable.)

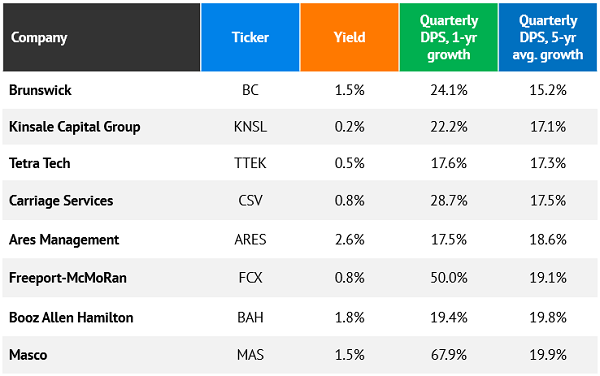

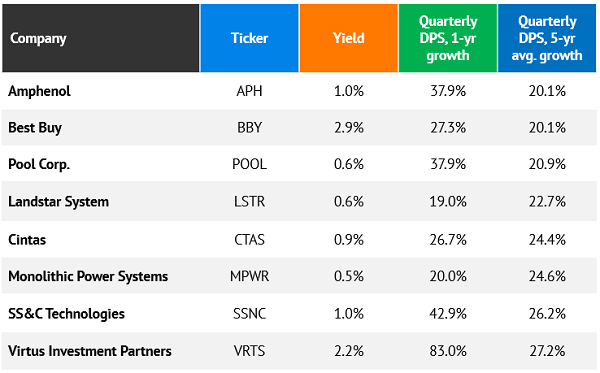

Here are 22 stocks that make the cut, boasting 15% annual dividend growth rates over the past five years, and that raised their payouts by at least 15% in the past year. I’ve also grouped them into three years based on just how aggressive they’ve been with the rate hikes in recent history:

Tier 1

Stocks with anywhere between 15%-20% average annual dividend growth comprise our first tier. And with a couple of exceptions, these represent organic, repeatable income-growth stories that are worth a closer look.

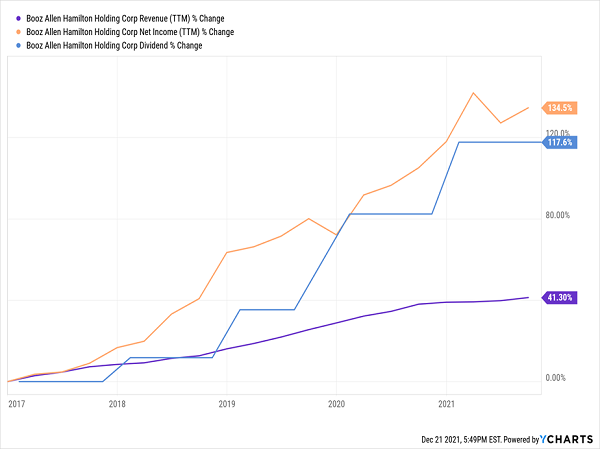

Take Washington, D.C.-area consulting mainstay Booz Allen Hamilton (BAH), for instance. Its 19.4% dividend hike in 2021 is right on par with its five-year average, reflecting years of smooth, steady top- and bottom-line growth. You can thank its strong ties to the government and military for that.

BAH: Refreshing Business Consistency, Even During the Pandemic

Boding well for future dividend expansion is a modest payout ratio of 33%. You’ll rarely see a company double its distribution overnight with that kind of coverage—but double-digit hikes are easily achievable, especially if Booz Allen keeps its profits rising apace.

Tier 2

Our second tier—stocks with 20%-30% average annual income growth—is similar to Tier 1 in that many of the dividend histories here look consistent, and that the stocks can be expected to keep up a brisk payout tempo.

Better still: Some stocks appear to be even earlier in their dividend arc.

SS&C Technologies (SSNC) is a prime example. This $20 billion company is a leader in several niche businesses: It’s the world’s largest hedge fund and private equity administrator, and the world’s largest mutual fund transfer agency. It also has its tendrils in a number of other financial functions, and even deals in healthcare information tech.

Revenues more than tripled between 2016 and 2020, from just under $1.5 billion to $4.7 billion. Net income roughly quintupled in that same period, to $625 million.

In a funny way, that almost makes its 220% dividend growth since 2016 look a little on the sluggish side. But present and prospective investors can have a lot of confidence in the current payout, as well as the potential for future raises. SSNC only dishes out about 22% of its profits as dividends.

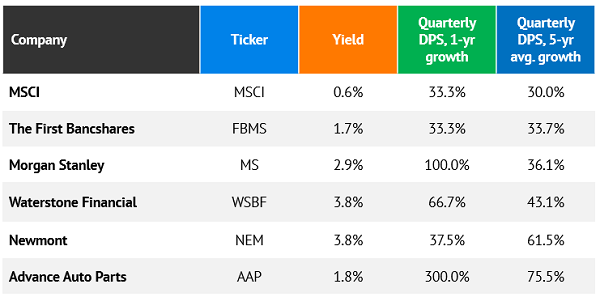

Tier 3

Unsurprisingly, our third tier—five-year annual dividend growth of 30% or more—includes companies that delivered some of 2021’s biggest payout hikes.

Morgan Stanley (MS) made waves by doubling its dividend as part of a wave of financial-sector income announcements this summer. Advance Auto Parts (AAP) made that look like a token increase, juicing its payout by 4x in spring to $1.00 per share.

Both stocks are still paying out less than a quarter of their profits to shareholders as dividends, suggesting oodles more room to keep the good times rolling in the next few years. But in both cases, the sudden dividend jolts were a big departure from their increase histories—especially AAP, which had announced a 317% hike in early 2020 to 25 cents quarterly, but which prior to that had been stuck at 6 cents per share since the early aughts.

Make 15% Every Year—Even During Recessions!

I’ve added each and every one of these 22 stocks to my near-term watch list and marked them for deeper analysis as we cross into 2022.

What I can’t tell you is how many of these 22 stocks will make the cut.

What I can tell you is that I’m already targeting seven dividend-growth dynamos, each of which are flashing all the telltale signs of stocks that are primed to double in just a few years.

It’s a bold claim, I know. But I expect each of these seven stocks to deliver a minimum of 15% in returns each year because they ace the so-called “shareholder trifecta,” where a stock pays us in three different ways:

- With a dividend today.

- A payout raise tomorrow (which lifts the share price accordingly).

- And by repurchasing shares (less float means more mileage per share on dividends and raises).

These “Hidden Yields” stocks can provide us with a recession-proof retirement. They can even make us as rich as we’d hoped to be in our younger days!

These dividends should pop, pop, pop—and when they do, their share prices will quickly follow. In other words, the best time to buy them is right now—before they soar, not after!

Bull or bear, I don’t care. These seven recession-proof dividend stocks are primed to deliver 15% returns per year, every year. Click now to get their names, tickers, buy-in prices and analysis explaining why their dividends are about to explode higher!

Recent Comments