A “great reset” is underway in our economy. We were reminded of that yet again last Friday, when select stocks sailed through an otherwise brutal half-holiday on Wall Street.

Financial talking heads bemoaned the losers. But who cares about these dinosaurs? We contrarians should pay attention to the winners—and their stocks—because that’s where fortunes will be made.

I’ve seen this trend unfolding firsthand. My second software company, which focused on marketing for e-commerce stores, launched a Shopify (SHOP) app in 2013. At the time, Shopify was a fledgling platform that helped retailers sell their wares online.

We were a startup ourselves, newly minted a year prior. To the outside world we described ourselves as a “spinoff” from my first software company, to give the feeling of stability. In practice, we were three dreamers working for free to get our company off the ground.

The Shopify app—and platform—proved to be our launching pad. At the time we had about 40 clients and we were scratching our heads wondering how we’d ever get to 100.

Five years later, we had over 4,000 clients. Much of that 100X growth was achieved by riding the coattails of Shopify. Our e-commerce presence was a big reason SureSwift Capital took interest and recently acquired our company.

Even in 2018, Shopify was still relatively under the radar. That was my third year attending their annual partner conference, and each time the number of partners making their living off from Shopify’s ecosystem seemed to double. The Canadian company was feeding many developer mouths by that point.

Here we software nerds are in 2018, at the Shopify Unite partner conference, celebrating our growth by storming the main stage during a lunch break:

Shopify’s stock price was minting many fortunes. Business was booming because brick-and-mortar businesses realized they needed an online presence. Amazon (AMZN) just wouldn’t do because it is really one big website controlled by Jeff Bezos.

Enter Shopify, which lets businesses create their own nice-looking websites with shopping carts attached. Finally, old school retailers could compete with the likes of Amazon by raking in online sales. And “new school” startups had a way to throw together a virtual store quickly and cheaply—often even cheaper by selling goods made and shipped by others!

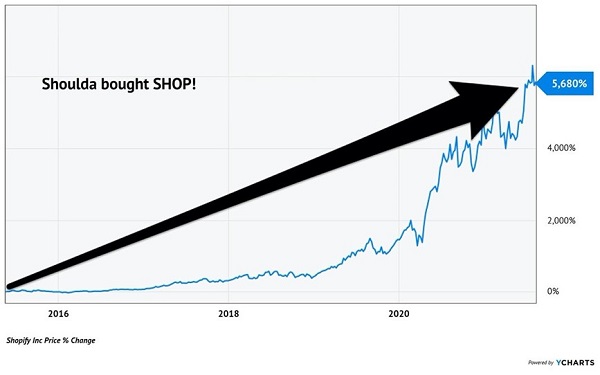

Rather than storming the stage during the lunch break, my colleagues and I should have been hunkered down on our phones buying shares of SHOP. The stock had already rallied quite a bit since its 2015 public offering, but the real moonshot was yet to come when lockdowns in 2020 added fuel to the e-commerce fire:

Shopify Soared Through the “Great Reset”

Well, we can’t turn back the clock and buy SHOP in 2015. Or early 2020. But we can turn our attention to the next batch of moonshots.

The Great Reset is the fastest shuffling of the deck in American economic history. While some business models are becoming obsolete, others (like Shopify) are booming.

We, as contrarians, should focus our attention on the companies that are going to directly benefit from The Great Reset. This will, fortunately for us, include several well-positioned dividend stocks that are likely to double in price.

Look, a big reason that Shopify became successful is that it provides a platform. Businesses can build their dream websites and online checkout experiences on top of the tools that Shopify provides. They naturally extend Shopify’s platform when they do that—and pay the company handsomely!

We contrarians like to call these “pick and shovel” companies. The phrase “pick and shovel” dates to the gold rush of the 1840s, when hordes flocked to California to get rich mining for the metal. The guys who made the real money didn’t mine anything. They were the entrepreneurs who sold the “picks and shovels” as well as booze, “entertainment,” and lodging to the hapless speculators.

Here’s an example of a pick-and-shovel play that is benefiting from The Great Reset. Everyone knows that 5G cell networks are rolling out. But the obvious stocks that will capitalize on these trends, such as the “FAANG+M” technology stocks, are usually too expensive to offer interesting upside. But we have one that is quite reasonably priced.

American Tower (AMT) has been a bargain way to play 5G. This company is a cell phone tower landlord that provides the infrastructure for cell phone traffic. This requires a lot of capital to get started, but once AMT builds its towers, it can scale quite easily.

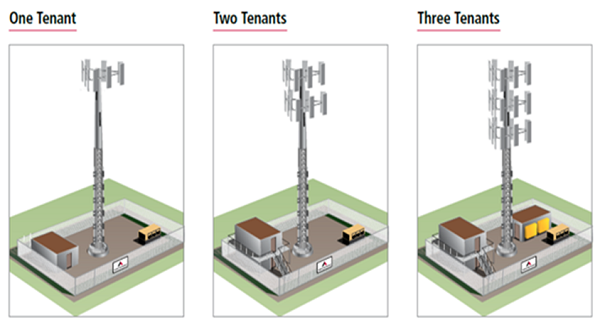

Check out the illustration below to see what it takes for a tower to support one or two additional tenants: it’s as simple as bolting on some additional equipment!

Source: American Tower

The return on investment (ROI) AMT generates from a “one tenant tower” is just 3%. However, this jumps with each additional tenant, with ROI increasing to 13% for two tenants and an awesome 24% for three tenants!

These embedded ROI gains are the camouflaged catalyst that continues to boost AMT’s dividend every single quarter.

Since we added shares to our Hidden Yields portfolio in November 2018, we’ve enjoyed 12 dividend increases that have taken our dividend 51% higher. (Our yield on cost is 3.2% and climbing. New investors pocket only 2%.)

While our pocketed payouts have been good, our price gains have been great. Our total returns are now 68% on the position.

AMT has rallied past our target price of $250 and is Hold. For timelier buys, we should focus on dividend growth stocks that are poised to pop, just like AMT and SHOP were a few years ago.

These are my seven favorite dividend stocks for 2022. Don’t wait until January to buy them! They are screaming buys right now, and I don’t expect them to stay cheap for long.

Recent Comments