Here at Contrarian Outlook, our beat is income, and we’re often asked for analysis on high-yield ETFs. Today, we’ll look at three funds paying up to 11% (yes, that’s no typo).

I appreciate the ETF popularity. They’re cheap. They’re tax-efficient. They’re well-marketed. They’ve got cutesy tickers.

But income investors who blindly buy into the hype, unfortunately, are not getting the most dividend for their dollar.

The real dividend deals are found in ETFs’ lesser-known cousins, closed-end funds (CEFs), which often dish even bigger payouts (and a monthly cadence, to boot). CEFs can also trade at discounts to their net asset values, because they fly under Wall Street’s radar.

Way under the radar.

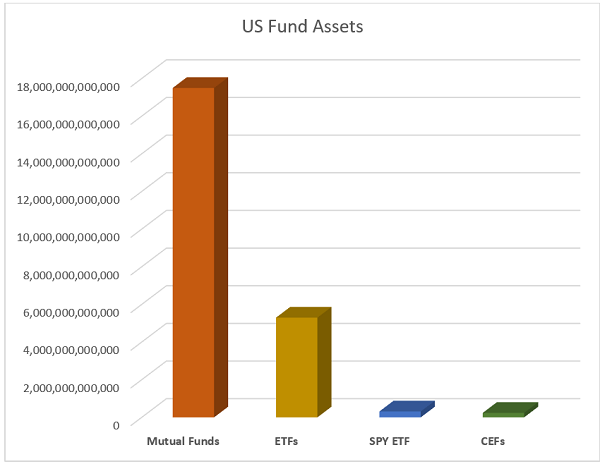

ETFs have been rapidly clawing assets away from mutual funds for years. The latest data from Bloomberg Intelligence shows that US ETFs have scooped up $427 billion in inflows through late 2020, while mutual funds have bled out $469 billion. Don’t feel too bad for mutual fund providers, though—ETFs are still a distant second-place.

Nearly invisible by comparison are CEFs, at just $240 billion. In fact, they struggle to find the medal podium! For comparison’s sake, the largest ETF—the SPDR S&P 500 ETF Trust (SPY)—has more assets than the entire CEF industry, at $317 billion currently:

That’s a shame, because countless retirees are missing out on a truly special investment vehicle.

These actively managed products have a lot of tools at their disposal that their ETF and mutual fund brethren simply don’t. As a result, CEFs can regularly deliver high-single-digit and even double-digit yields—unheard of income in mutual funds and a rarity among ETFs.

Let’s explore three unique high-yielding ETFs averaging 9.6% with boatloads in assets. As you’ll see, these big ETFs are “over-owned” thanks to the marketing machines behind them.

Energy Select Sector SPDR Fund (XLE)

Dividend Yield: 9.9%

What’s not to like about a 9.9% yield? We’re skeptical here because this fund is likely to give back some—or all—of this dividend in price losses.

It’s virtually unheard of for a basic sector ETF to yield anything more than 5%. But lo’ and behold we have the Energy Select Sector SPDR Fund (XLE) doling out nearly 10% at a time when most stocks look expensive.

The XLE is one of the mammoth sector ETFs under the State Street Global Advisors banner. It has been around since the late ‘90s, and it has gobbled up nearly $14 billion in assets since then.

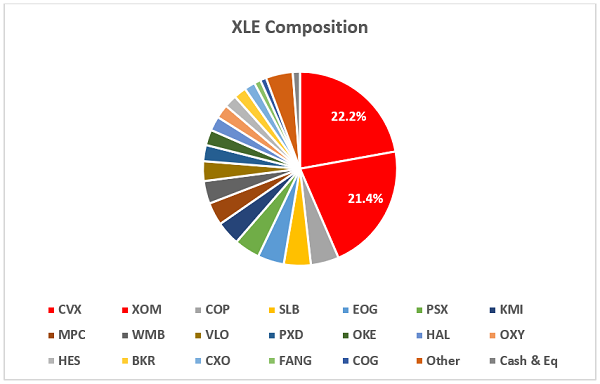

It’s an S&P 500 sector fund, which means it holds all the energy stocks in the index. That’s 25 right now. Unfortunately, this is an overstatement in terms of diversification, as half of XLE is tied up in just two stocks:

An Extremely Overweight ETF

To be precise, more than 43% of the fund is invested in just two stocks: Chevron (CVX) and Exxon Mobil (XOM). So why not just own Chevron and Exxon Mobil and save yourself the fund’s expense fee, however small?

But the biggest crime is that the 12-month yield—typically a reliable gauge for most ETFs—is way off the mark. According to SPDR, “During the ETFs’ fiscal and tax year-end audits (September 30), certain gains incurred related to corporate actions on underlying portfolio holdings were re-characterized to ordinary income for U.S. tax purposes.” If you back out that one-time payment, XLE isn’t yielding 10%. It’s closer to 5%.

And this 5% yield is a bet on oil prices. While I do anticipate higher prices in the goo down the road, this isn’t a trade I would put on just yet. And make no mistake about it, XLE is so oil-price dependent that it will never be a “buy and hold” retirement investment. This ETF is nothing more than a trade, and an untimely one at the moment.

Global X NASDAQ 100 Covered Call ETF

Dividend Yield: 11.0%

An 11% yield delivered monthly from the Nasdaq-100? Are we dreaming?

The Global X NASDAQ 100 Covered Call ETF (QYLD) is the tech yield I’m talking about. If the fund sounds familiar, that’s because it used to be the Horizons NASDAQ 100 Covered Call ETF when we last discussed it a couple of years ago. Back then, it simply bought the index and sold covered calls against it. As I said at the time, “It would reap larger premiums by selling covered calls on individual stocks rather than the index itself.”

Between then and now, Global X took the fund over and changed the methodology to track an index that involves trading calls on the Nasdaq-100’s components rather than the Nasdaq-100 itself.

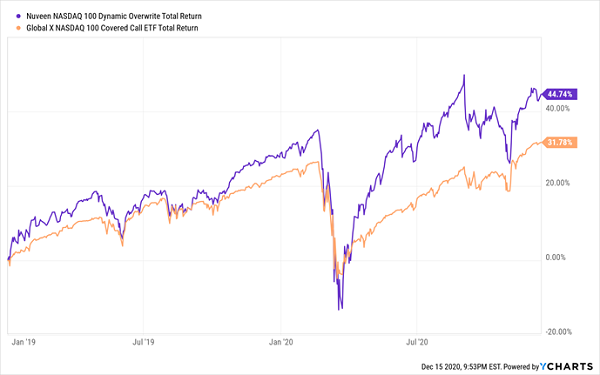

But it still can’t hang with active management. QYLD’s CEF competitor, Nuveen’s Nasdaq 100 Dynamic Overwrite Fund (QQQX) executes a similar strategy, but does a better job with it. QQQX charges 0.9% in annual fees versus QYLD’s 0.6%, but it’s worth it. Here are the total returns for each fund (including dividends) net of fees:

QQQX Outpaced QYLD 45% to 32% Since 2019

As a buy-and-hold retirement holding, we’re better off with QQQX. But there’s a time and a place to initiate a new position in this tech-heavy CEF. In 2017, my Contrarian Income Report readers will fondly recall a fast 42% from QQQX. Back then, the fund was trading at a discount to its NAV and tech valuations were not at nosebleed levels. Today, QQQX is trading closer to its par (or fair) value, and tech is pricey.

We’ll continue to watch QQQX for a better entry point. And, we’ll likely continue to ignore QYLD forever.

Invesco CEF Income Composite ETF (PCEF)

Dividend Yield: 7.8%

The Invesco CEF Income Composite ETF (PCEF) is the closest thing you’ll get to an outright admission from the ETF industry that they can’t do everything. Perhaps they have been reading our columns to this point! The fund tracks an index of CEFs that deal in investment-grade bonds, junk bonds and options-writing.

Top holdings at the moment include funds like Eaton Vance Tax-Managed Global Diversified Equity Income Fund (EXG), BlackRock Enhanced Equity Dividend Trust (BDJ) and Pimco Dynamic Credit and Mortgage Income Fund (PCI). And unsurprisingly, that translates into a nearly 8% yield on PCEF—also paid monthly.

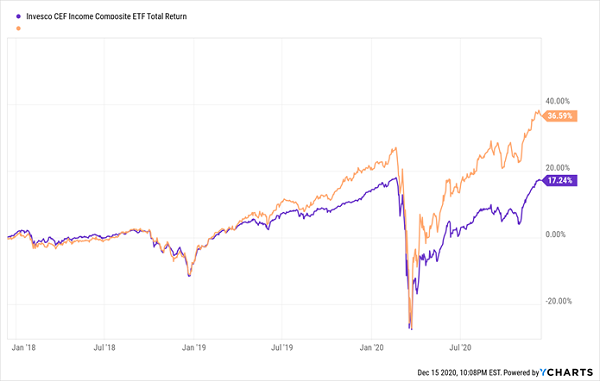

But, like any “fund of funds,” you’re stacking fees on top of fees. PCEF’s total expense ratio is 2.55%, and 0.50% of that is Invesco taking its cut on top of what the CEFs already charge. This overcharge is pointless considering that we can just cherry-pick its favorite CEF holdings directly and cut out the middleman.

Timelier CEF Buys: My “Crisis-Ready” 9% Monthly Payer Portfolio

We’re better off building your own “A-team” of CEFs. I’ve already done the research on this, and a group of these monthly dividend payers are compelling buys right now.

My 9% Monthly Payer Portfolio—a group of my favorite monthly payers—is delivering upwards of $3,750 a month in regular income checks! It even includes one of PCEF’s holdings—a dynamo bond fund that PCEF’s other components are watering down!

2X the Returns Than This Overcomplicated ETF

This kind of monthly dividend income provides you with an edge most other retirees can only dream of: Living in retirement off of your investments while actually building your nest egg!

With my 9% Monthly Payer Portfolio, not only can you enjoy a comfortable retirement without ever needing to eat away at your savings—you can collect your income checks just as frequently as your mailman delivers your regular bills!

These stocks and funds make up an “all-weather” portfolio that doesn’t need a perfect economic environment to churn out all-star income. But they’re not just dividend payers—they’re total return machines that have delivered (and can continue to generate) market-beating gains, allowing you to maintain and even build your nest egg even after you’re kissed your cubicle goodbye!

Best of all: These high-income picks are nestled perfectly within my “buy-in” range.

I’ve personally hand-picked and safety-checked this unique portfolio, from every angle, for maximum safety. That includes a can’t-miss 7%-yielding preferred-stock fund that is actually increasing its cash distributions.

It’s a combination of stocks and funds that are so cheap that they could easily hold their own, even if political tumult and a virus “second wave” put the market’s recent rally on ice—but if the rally does pick up steam, watch out above!

Either way, we’ll be soaking up 9% average yields the whole time!

These picks deliver truly life-changing dividends: In fact, if you drop $500K into this powerful portfolio right now, you’ll kick-start a $45,000 income stream.

That’s $3,750 a month in regular income checks!

Now is the time to get in, while you can still do so at a bargain. Click here to get everything you need—names, tickers, complete dividend histories and more—instantly.

Recent Comments