A handful of closed-end funds (CEFs) are boasting what are (at first) tantalizing dividend payouts. I’m talking 15%, 20% and even 40% annualized yields here.

Skeptical? You should be.

Today we’re going to delve into the two highest-paying funds in the CEF world and look at what’s driving their sky-high payouts. Each tells us a lot about what to avoid when buying CEFs for our portfolios.

High-Yield CEF #1: 22% Payout Masks a Dreadful Dividend History

The Cornerstone Strategic Value Fund (CLM) regularly yields more than 15%, even when average CEF yields are historically low. Now that all CEF yields are higher, due to an overall pullback in these funds’ market prices, CLM’s payout is a monster 22%.

But is it a safe 22%?

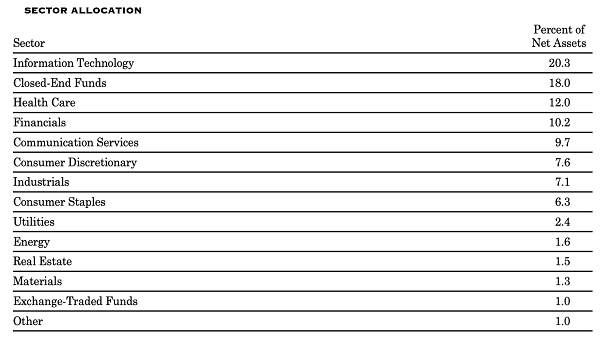

CLM does take a conservative approach: with a diversified portfolio spread across all sectors, the fund won’t get you undue exposure to a high-risk business like energy (which is a tiny fraction of CLM’s holdings).

Source: SEC

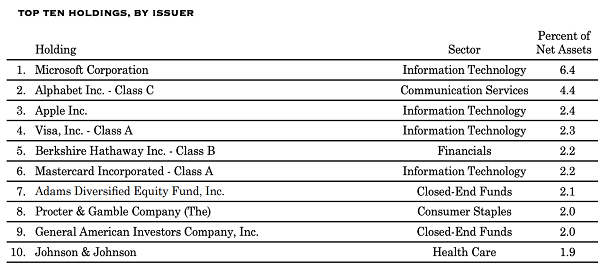

What’s more, the stocks CLM selects are particularly appealing: familiar names like Microsoft (MSFT), Alphabet (GOOGL), Apple (AAPL) and Visa (V) are top positions. But unlike those low-yielding names, CLM hands you a big chunk of your returns in dividend cash.

Source: SEC

That’s exactly how CLM functions: it buys stocks, sells them when they go up and hands you those profits as dividends. There’s just one problem:

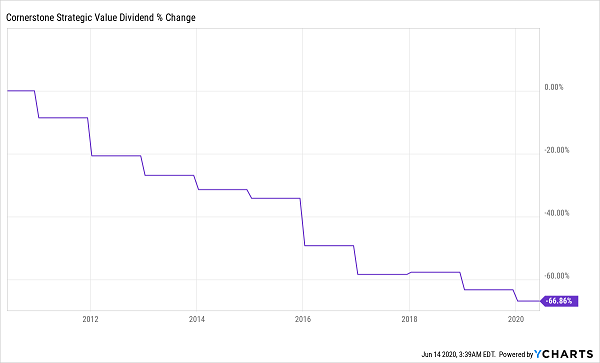

CLM’s Constantly Shrinking Dividend

CLM’s payouts have been cut many times over the long haul, meaning your yield on cost will drop if you hold the fund over time. So, if history were to repeat itself, your 22% yield on a buy today would shrink to 7.3% in 10 years—and it could be much lower!

I think you’ll agree that it’s far better to buy a 7.3% dividend and work your way up to 22%+, rather than the other way around. So don’t fall for CLM’s lofty payout—it will fade away before you know it.

High-Yield CEF #2: A 41% Payout Based on a Broken Business Model

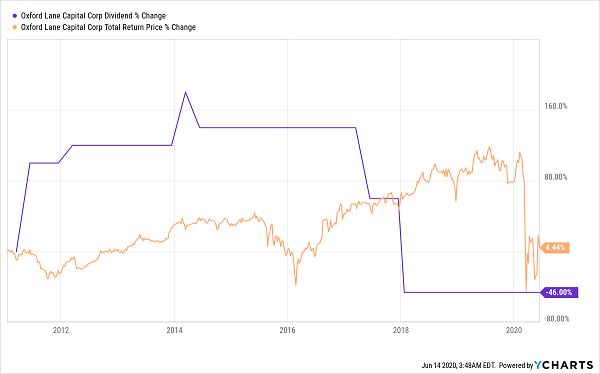

Oxford Lane Capital Corporation (OXLC) yields an unheard-of 41.5% and holds a diversified portfolio of debt securities. But investors who’ve bought in recent years have paid a heavy price.

Payouts Plunge, Profits Stagnate

Over the last decade, the fund has returned a meager 4.4% (the S&P 500 is up 185.5% for the same period), while its payouts have fallen 46%.

That would still come out to a 22.4% yield if payouts were slashed by that same amount in the coming decade, but the market OXLC operates in is so volatile that a 46% chop could be a very conservative estimate.

The fund invests in collateralized loan obligations (CLOs), a kind of derivative similar to the mortgage-backed securities that tanked the world economy in 2008. While these assets can do well in good times, they can be very risky in a world recovering from COVID-19, because lockdowns have crushed mid-sized businesses and CLOs depend on these companies’ ability to repay their debts. Many of these firms simply aren’t doing that now.

Despite that, OXLC hasn’t reduced its payouts since this crisis began (other, smaller CLO funds have)—at least not yet. In their last earnings call, management said they will “likely elect to reduce or suspend the company’s distributions” for July, August and September. That hasn’t been made official, but it’s obvious that OXLC is struggling to maintain payouts, and that struggle isn’t over by any stretch. That’s why the shares are still down 50% from the start of 2020, and why they might go even lower.

Buy These 4 “Crisis-Fighter” 9.4% Dividends Now

We’re not just going to cover CEFs you need to avoid today—I’m also going to show you 4 other CEFs you should be buying now, while you can still get them at a great price.

These 4 stout CEFs boast an outsized (and steady) 9.4% average dividend as I write this. Plus, I’m calling for 20%+ price upside in the next 12 months, even if the market only moves up modestly from here!

If stocks fall, we’ll benefit as these funds’ bargain valuations and high dividends draw investors in, helping stabilize their share prices. And we’ll still collect their huge 9.4% dividends!

These 4 funds are my top buys for this crisis, and I can’t wait to show them to you.

And that’s not all: I’ll also set you up with a no-risk 60-day trial to my CEF Insider service, so you can get full access to all of my other high-yielding CEF picks, too! Don’t miss out: get full details on these 4 steady 9.4%-paying funds now—and take CEF Insider for a no-risk test spin—while this offer is still available.

Recent Comments