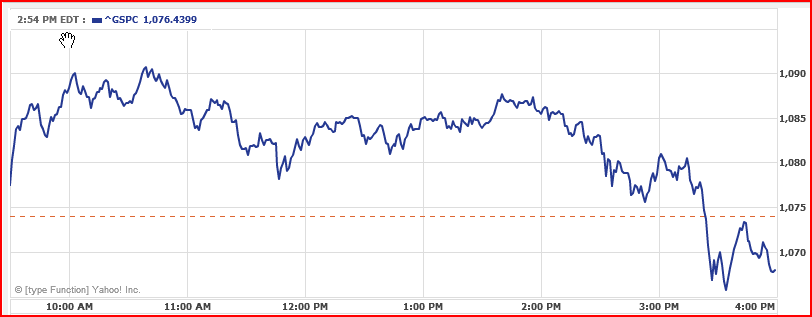

Yesterday afternoon, we closed our short S&P 500 futures position after hours, on the expectation that some sort of bounce was developing in the near term.

If that’s what you call a bounce – it was pretty pathetic!

What a lame-ass bounce!

We’ll see what type of follow through we get tomorrow and Friday. That MAY not be it for this bounce – countertrend moves have a tendency to move in an A-B-C type of pattern, rather than a straight line. So it’s possible that today’s drawback was the “B”, or pullback, part of this retracement. Which would infer that when completed, we’ll see another leg up – constituting the final “C” portion of the pattern.

How’s the VIX looking? I’m glad you asked:

The VIX is alive and well. Fear is back! (Source: Yahoo Finance)

It’s still a “bull market in fear”. A break OUT in the VIX to the upside would likely coincide with a break DOWN in the S&P to the downside. So we’ll watch both indices closely. If and when we get a dual confirmation, that would indicate that the bear is back in charge!

PS: If you’re thinking about taking advantage of this pullback to go “long the VIX”, you’ll want to check out the ETF VXX.

PPS: And the ETF SDS is the double short tracking fund for the S&P 500 – remember if you are LONG SDS, then you are DOUBLE SHORT the S&P.

Just in case you were sleeping too soundly at night, a double short ETF can be the equivalent of slamming a few cups of coffee before you go to bed.

Further reading: How You Can Profit From Rising Volatility

Recent Comments