Legendary investor Barton Biggs is back in the headlines – he’s buying Japan right now, and says this panic selling is “a gross overreaction.”

Mr. Biggs says he wasn’t tempted to do any buying on Friday or Monday, but by Tuesday morning he jumped in, arguing that the Japanese economy will prove more resilient than many believe.

“They’ll sell Treasurys and rebuild, they can finance it because it’s a country of savers,” he says. “They’ll have to rebuild Japan and the rebuilding will give a boost to the economy.

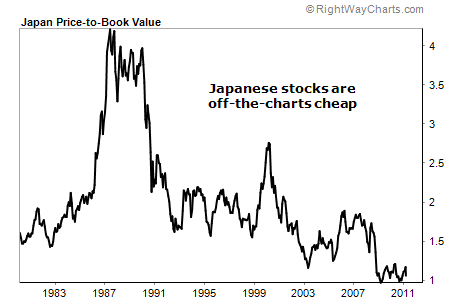

Just how cheap are Japanese stocks right now? Really cheap – especially small caps – according to Steve Sjuggerud:

Small stocks in Japan are the cheapest stocks in the world – by far.

They’re even cheaper now… Over two days, Japan’s TOPIX (a broad stock market index) fell more than it ever has since its inception in 1949.

People are selling first and asking questions later. Japanese stocks as a whole are trading at just 1.06 times book value. (Compare that to the Dow, which goes for 2.75 times book.)

Small-cap Japanese stocks are trading at just 0.7 times book value – or a 30% discount to book value – and 0.34 times sales. This is off-the-charts cheap.

For more on this theme, here is Steve’s recent piece about the upside potential of Japanese small cap stocks. He recommends the WisdomTree SmallCap Japan Dividend Fund (DFJ) for those looking to play this idea.

DFJ was cheap, and in an uptrend – until the panic selling began. (Source: StockCharts.com)

DFJ was cheap, and in an uptrend – until the panic selling began. (Source: StockCharts.com)

Recent Comments