Wondering why state governments, after decades of increased spending, are just now “all broke at once?” This chart, courtesy of The Globe and Mail, says it all:

The bottom line is that until tax revenue growth climbs again, the states are going to be hard pressed to stay solvent. They can’t cut expenses fast enough to keep up with falling revenues.

And ironically (perhaps poetically so?) – the crappier the economy is, the greater the strain on the social safety nets that state governments provide. So they get slammed from both sides.

It hearkens back to Maggie Thatcher’s famous quote: “The problem with socialism is that you eventually run out of other people’s money.” It appears that this is also the problem with social safety nets – the states have finally run out of money.

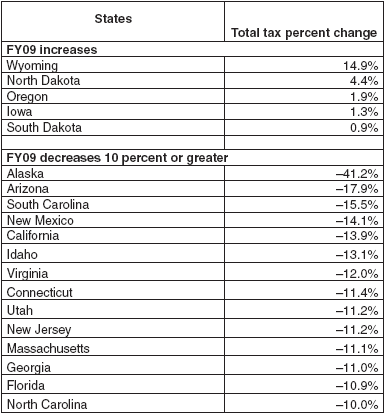

Can the tax decline rates be reversed? It looks pretty unlikely when we look at state tax collections from 2009. Only 5 states posted increases in tax collections. Meanwhile, 14 states posted double-digit declines!

Here in the People’s Republic of California, us Komrades are looking at a projected $19 billion shortfall this year, and a $37 billion projected shortfall next year. (Source: The Globe and Mail) Which makes you think the matter of defaulting, or getting bailed out by the Federal Government, is now merely a matter of “when”, not “if”. It’s the Final Countdown.

Hat tip to my alert Komrade Carson for sending the Globe and Mail link along.

Recent Comments