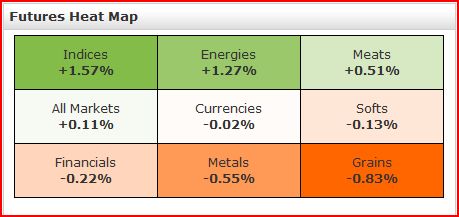

Asset prices are continuing to decouple, slowly but surely, it appears. Today, equities and energy were up big – while the rest of the commodity sectors had a bad case of “The Mondays”:

Why is this potentially significant? Because markets have been moving more or less in tandem for 5 or 6 years now – everything up, dollar down – interrupted by a nasty bout of dollar up, everything else down.

Key trend turns have often been indicated by one asset class “peeling away” from the rally one-by-one, until none are left standing. Quietly, that’s been happening in this rally, with only US blue chips still hitting new rally highs of late.

We should note that this decoupling may be a positive thing for gold investors – gold’s price performance during last week’s smackdown was very noteworthy.

But until we see evidence to the contrary, I have to reiterate that our preferred medium-term positions are still “long the dollar, and short everything else.”

Recent Comments