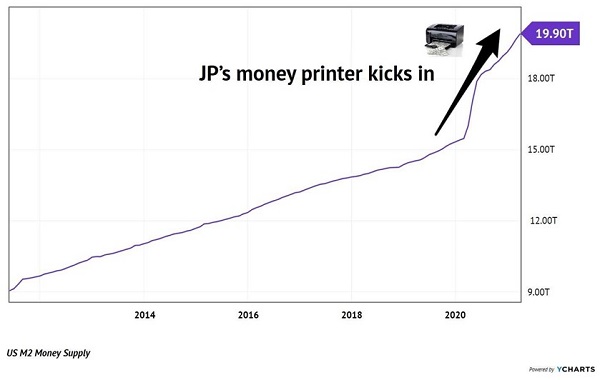

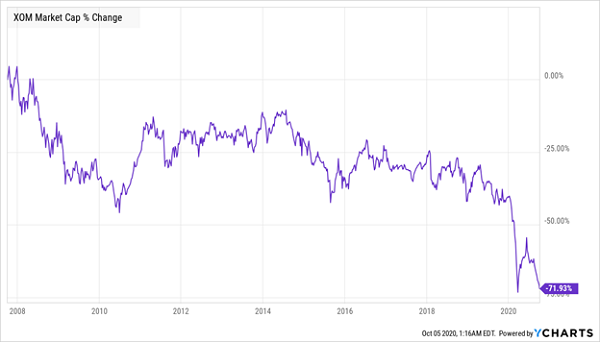

As the stock market returns to Planet Earth, we contrarians will have an opportunity to cherry pick some bargains. This is a good thing for us income seekers. We’ve been thin on dividend deals since the Federal Reserve cranked the printing presses in the spring of 2020.

Last year was slim pickings for income plays. When the Fed’s easy money drives prices of everything higher and higher, our dividend yields go down.

This makes it challenging for us to identify meaningful yields with a bit of upside. After all, we’re in the business of buying low and selling high (not buying high and hoping to ride a price even higher).… Read more

Recent Comments