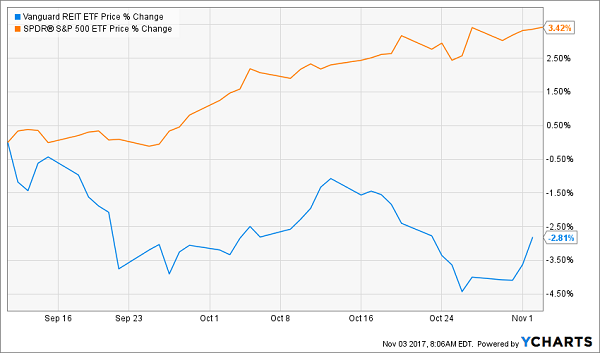

“First-level” investors – those who buy and sell on headlines – mistakenly believe that real estate investment trust (REIT) profits will suffer if rates rise.

Sure, in the short run, the “rates up, REITs down” theory puts on quite the show. When the 10-Year Treasury’s yield rises, REITs usually fall. And when its yield drops, REITs usually rally. This inverse relationship tends to hold up over multiple days, weeks and even months:

A Short-Run Seesaw Between REITs and T-Bill Yields

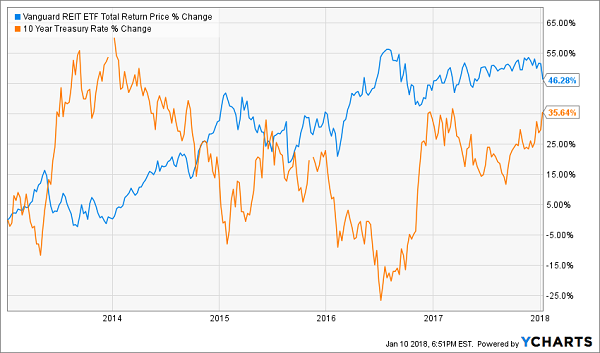

However the “long view” shows that many of these short-term moves are merely noise. It is possible for REITs and higher rates to coexist in profitable harmony:

But Long-Run REITs and High Rates Can Co-Exist

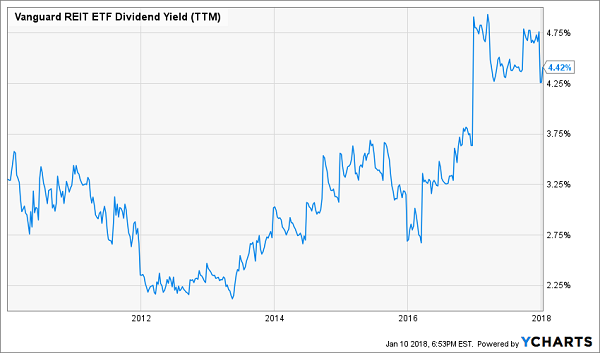

Investors who are bailing on REITs are missing out, because they are currently paying their highest yields this decade:

Highest REIT Yields Since the Financial Crisis

Most income hounds get it wrong.…

Read more

Recent Comments